Dentsu Aegis Network’s latest advertising spend forecasts, based

on data from 59 markets, predicts global growth of 3.9% in 2020, amounting to US$615.4 billion and building on growth of 2.6% in 2019.

With the Tokyo Olympics and Paralympics, UEFA European Football Championships US Presidential elections and APEC Malaysia all taking place in 2020, events will be a significant driver of increased ad spend around the world as advertisers look to capitalise on huge global audiences.

Our forecasts for Asia Pacific shows ad-spend growth of 4.2% with a drill down showing growth in Malaysia of (4.5%), Australia (3.8%), China (5.6%) and Japan (2.0%) with India predicted double digits at (10.9%) – largely driven by digital which is in part powered by booming smartphone adoption.

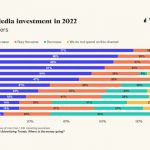

For Malaysia, digital continues to energise ad-spend growth in 2020 and is forecast to grow 17.2%, reaching US$522 million and 37.7% of total spend. Growth remains strong into 2021 putting digital’s share of ad-spend at 41.9% at the start of the new decade.

Within digital, mobile and video are fuelling expansion. Both are forecast strong momentum in 2020 at 23.3% and 42% growth. TV and newspapers take home 16.3% and 25.2% of ad-spend share respectively, with OOH, cinema and radio claiming 9.1%, 3.4% and 7.5% of share.

Digital offers the potential to breathe new life into all traditional formats in the Malaysia market as Voice Assistants, addressable TV and programmatic ads drive global spending in these mediums.

Peter Huijboom, Global CEO Media at Dentsu Aegis Network, said:

“There is a lot to look forward to in 2020. Our forecasts point to a boost in ad spend as we enter a year of important political and sporting events including Tokyo Olympics and Paralympics, UEFA European Football Championships and the US Presidential elections.

Looking at local trends the picture is more mixed with some key markets slowing down while emerging economies are powering up. Marketers in 2020 need to manage these contrasting dynamics; long and short term, global and local, digital and traditional. Ultimately, they need to remain focused on long-term sustainable growth by winning, keeping and growing their best customers.”

Nicky Lim, CEO Dentsu Aegis Network Malaysia, said:

“As I have long foretold, digital continues to rise with significant momentum and will be pivotal to the transformation and future growth of the Malaysian advertising industry. Global trends indicate that investment in Voice Assistants, addressable TV, Data Science and Programmatic ads are fuelling growth across traditional formats like radio, TV and OOH. Embracing digital by flexing and re-shaping these mediums to meet market demand for these types of investments is the path that offers the best chance of exponential yet sustainable growth for the industry as a whole.”

Satya Das, Acting Head Amplifi Malaysia, said: 2020 is projected to be a challenging year with minimal growth expected in the advertising space. We see that year on year, advertising expenditure is becoming increasingly fragmented. However, there are two key sporting events this year with the Tokyo Olympics and the UEFA European Football Championships which will drive ad investment.

Trends from 2019 into 2020 indicate that ad-spend will be directed towards content creation, Performance campaigns, Social media, technology development, market automation data and identifying brand-building opportunities that offer improved market share and brand scores.

We will also see an increased focus on Digital media energised by programmatic and Data science. Media vendors should resist the temptation to offer solutions that drive brands in the short-term and instead invest in and/or refresh services offerings that deliver on

business outcomes for brands.

Media agencies unquestionably need to embrace the new age of marketing automation tools and use them across media platforms for more efficient planning. In other words, using Data science as a solid foundation to underpin an integrated media planning approach will secure successful outcomes.

Key APAC market trends

- China: Ad spend growth for China in 2020 is forecast at 5.6% up from 3.1% in 2019. Digital dominates (67% of share) and growth will continue with double digits of 10.6%. Mobile continues to be a key driver for Digital spend with an expected increase of 18.3%. OOH is forecast to grow 2.3% up from 1.3%. For programmatic advertisers are embracing expanded choice which is reflected in a growth rate estimated at 47.6%.

- Australia: Ad spend is forecast to grow by 3.8% in 2020 driven by strong growth in Digital. Online video continues to be a key driver for Digital spend and is expected to increase by 24.4% in 2020, making up 57% of general display spend. Mobile’s upward trend will continue in 2020 and is expected to grow by 15.1% representing 58.9% of total digital spend with an advertising value of $3.9bn US dollars. The introduction of 5G in 2020 offers greater opportunity for growth in the mobile segment.

- India: After a relatively slow 2019, ad spend in India is predicted 10.9% growth for 2020 – driven by the smart phone revolution and resulting increase in digital advertising. Digital ad-spend is set to grow 27% in 2020. TV takes the largest share of media spend at 38.8% followed by Print at 27.2%. TV continues to be a key medium and is set to grow 9.6% in 2020. Social media emerges as strong driver within Digital ad space with spend set to increase by nearly a third at 29.2%. Increasing smart phone usage sets mobile forecast for rapid growth at 40.6%.

Global media trends

- Global ad spend growth is forecast at 3.9% in 2020, amounting to US$615.4 billion.

- Ad spend is expected to decline in some key markets in 2020 including Germany, Spain and Italy.

- China and India are on different paths, forecast at 5.6% and 10.9% respectively.

- Latin America is growing rapidly driven by digital ad spend.

- Global digital ad spend growth is forecast at 10.5% in 2020, amounting to US$276 billion.

- The decline of traditional advertising mediums continues, with printed newspapers and magazines forecast at -7.1% and -6.3% respectively in 2020.

- TV and radio are expected to make a modest recovery at 0.6% and 1.7% respectively.

- Voice Assistants and addressable TV are breathing new life into traditional media.

- Online video expected to grow at 14.6% in 2020

- Mobile expected to overtake TV ad spend share in 2020.

MARKETING Magazine is not responsible for the content of external sites.