GLOBAL HIGHLIGHT

The summer update of MAGNA’s “Global Ad Forecast” predicts media owners net advertising revenues (NAR) will reach $927 billion this year, growing +10.0% over 2023. This is a significant acceleration on the global growth recorded in 2023 (+6.4%). Neutralising the impact of cyclical events in 2023 and 2024, the normalised acceleration is still real but more modest: non-cyclical ad revenues grew by +7.5% in 2023 and will grow by +8.7% in 2024.

A record number of cyclical events are taking place in 2024, including four major sports tournaments (Paris Olympics, UEFA Euro 2024, Copa América hosted by the US, and the ICC T20 Cricket World Cup hosted by the US and the West Indies), and general elections in five major markets (Mexico, India, US, France, and the UK).

The first three elections take place in countries with little or no restrictions to political advertising, therefore moving the needle in terms of advertising sales. Overall, the 2024 cyclical events will provide 1.3% extra growth to global ad revenues this year, 5% extra growth for television, 0.5% extra growth for digital media, and almost 2% extra growth for the US market alone.

MALAYSIA IN FOCUS

Malaysia’s advertising economy continues to transition toward digital formats and away from Pay TV, Newspaper, and Radio. The Olympics in 2024 is expected to boost advertising spending in FTA TV, Radio, and Cinema. However, despite the significant events this year, Print and Pay TV are expected to continue their decline. Furthermore, intense competition from streaming services, and shifting content preferences are being reflected in advertiser budgets.

1Q24 spending was reduced due to geopolitical concerns around the conflict in the Middle East, but growth is expected to pick up throughout the year as the trends of increasing internet usage and influencer marketing offset some of this weakness.

In 2023, Malaysia boasted a GDP of $400 billion, securing its position as the 40th largest economy globally. With a population of 33 million in the same year, Malaysia’s advertising revenues amounted to MYR 8.3 billion ($1.7 billion). Digital media claimed a significant share of advertising budgets, standing at 73% in 2023, a notable surge from 28% in 2015.

Television retained a share of 10% in 2023, down from 19% in 2015, while print declined to 7% from 33% in the same period. Radio and out-of-home advertising each accounted for 4% and 5% of budgets, respectively.

Leading the industry verticals, the government and public sector, personal care and household goods, and retail sectors contributed $60 million, $60 million, and $50 million in revenue, respectively. Procter & Gamble, Suruhanjaya Komunikasi dan Multimedia Malaysia (SKMM/MCMC), and Astro Awani Network emerged as the top advertisers.

MALAYSIA’S ADVERTISING GROWTH

Malaysia experienced a notable growth of +9.6% in advertising revenues in 2023, totaling MYR 8.3 billion ($1.7 billion). This growth positioned Malaysia as the 38th largest advertising market globally. Concurrently, the economy saw a nominal GDP increase of +5.8%, driven by a real GDP growth of +3.7% and a CPI growth of +2.5%.

Digital media owners witnessed a substantial growth of +14.7%, amounting to MYR 6.0 billion ($1.3 billion). Within digital advertising, search advertising surged by +12%, reaching MYR 1.9 billion ($400 million), while social media advertising soared by +19.1%, totaling MYR 3.1 billion ($700 million).

Traditional media owners, on the other hand, experienced a slight decline of -2% in advertising revenues, amounting to MYR 2.3 billion ($500 million). Notably, television advertising revenues decreased by -2.8%, reaching MYR 900 million ($200 million).

Ad revenues per capita in 2023 stood at $53, positioning Malaysia as the 51st highest ranked market globally in per capita revenues.

MALAYSIA IN THE LONG TERM: +4.4%

In 2024, Malaysia anticipates an advertising revenue growth of +8.5%, totaling MYR 9.0 billion ($1.9 billion). This projection will shrink Malaysia’s position as the 40th largest advertising market worldwide. The economic landscape is expected to witness a nominal GDP growth of +9.0%, fueled by a real GDP growth of +4.4% and a CPI growth of +2.8%.

Digital media owners are expected to continue their growth trajectory with a forecasted revenue increase of +11.5%, amounting to MYR 6.7 billion ($1.4 billion). Search advertising and social media advertising are expected to grow by +9.3% and +15.1%, respectively. Conversely, traditional media owners are projected to experience a marginal growth of +0.5% in advertising revenues.

Ad revenues per capita are forecasted to rise to $57 in 2024, positioning Malaysia as the 52nd highest market by ad revenues per capita.

Looking ahead to 2028, Malaysia anticipates a steady annual increase of +4.4% in total advertising revenues. Digital media owners advertising revenues are projected to grow by +7.1% annually, while traditional media owners advertising revenues are expected to decline by -5.4% annually. By 2028, Malaysia is expected to retain its position as the 39th largest advertising market globally.

Digital media is set to dominate advertising budgets, commanding 83% in 2028 compared to 73% in 2023. Television’s share of budgets is expected to decrease to 6% in 2028 from 10% in 2023.

Fan Chen Yip, Chief Investment Officer, MAGNA Malaysia, commented:

“Malaysia is projected to record 8.5% growth in 2024. Whilst this sounds encouraging, we must note that the increase in spends comes solely from digital advertising which includes non-Malaysian advertisers targeting Malaysians online. These include overseas properties, educational institutions, international conferences, and other relevant categories that do not necessarily spur our local economy.

Local media owners have also been massively ramping up their digital assets and offerings to meet this need, and projections of digital forming 83% of total adex in 5 years should serve as further encouragement to continue these investments for more digital opportunities in the horizon.

While global events have affected economies and brand spends around the world, there are positive factors pushing the needle for advertising sales globally, and we hope for a stronger 2H to raise these projections higher, towards 2023’s growth of 9.6%. Additionally, we hope to see a softening of the boycott impact, leading to more normalisation.

Malaysians are also keeping watch on the recent diesel subsidy rationalisation policy and how it may affect inflation and consumers’ purchasing power, perceived or otherwise. At this juncture, it is too early to tell how this may affect the economy, as the ministry looks to allay public fears of price gouging and abuse of fleet cards.”

Vincent Létang, EVP, Global Market Research at MAGNA, and author of the report, said:

“Based on MAGNA’s analysis of media companies financial, advertising revenues were much stronger than expected in the first quarter of 2024. Coupled with some improvement in the macro-economic outlook, this leads us to increase our full-year global advertising growth forecast from +7.2% (December 2023 update) to +10%.

All categories of media owners are faring better than expected so far this year, including traditional media owners and, specifically, television and premium long-form video. The introduction and rapid development of ad-supported streaming in more markets by nearly all streaming players (now including Prime Video) is driving non-linear TV ad sales by +16% this year, and total TV ad sales by +4%.

Non-linear forms of television are finally reaching scale in terms of viewing and advertising monetization.”

KEY FIGURES

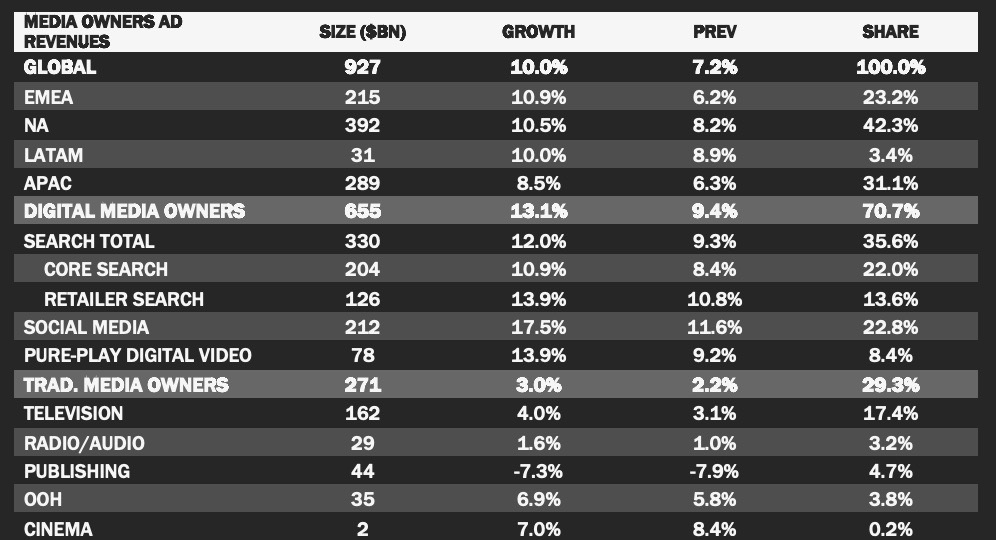

TABLE 1: GLOBAL AD FORECAST FOR 2024

TABLE 2: MALAYSIA KEY INDICATORS

TABLE 3: MALAYSIA GROWTH BY MEDIA

TABLE 4: MALAYSIA MEDIA MIX

MARKETING Magazine is not responsible for the content of external sites.

After 20 years of evolving technology, shifting market trends, and adapting to changing consumer behaviour, the media landscape has nearly reached saturation.

We’ve optimised to the fullest, providing advertisers with abundant choices across technology, platforms, data-driven marketing, CTV, OTT, DOOH, influencer marketing, retail, etc.

Media specialists have diversified, but with more options comes the challenge of maintaining income growth. The industry is expanding, but revenue isn’t keeping pace.

Now, we’re at a TURNING POINT: time to explore and harness new sustainable revenue streams. While GroupM forecasts a 7.8% global ad revenue growth in 2024, challenges like antitrust regulation, AI and copyright issues, and platform bans persist.

Collaboration is key: partnerships that thrive on synergy, shared values, and aligned goals are becoming increasingly essential.

Hence, the Malaysian Media Conference, in its 20th year, has assembled the partners and players under one roof on October 25 for a day of learning, sharing, and exploring.

REGISTER NOW