By Sandeep Joseph

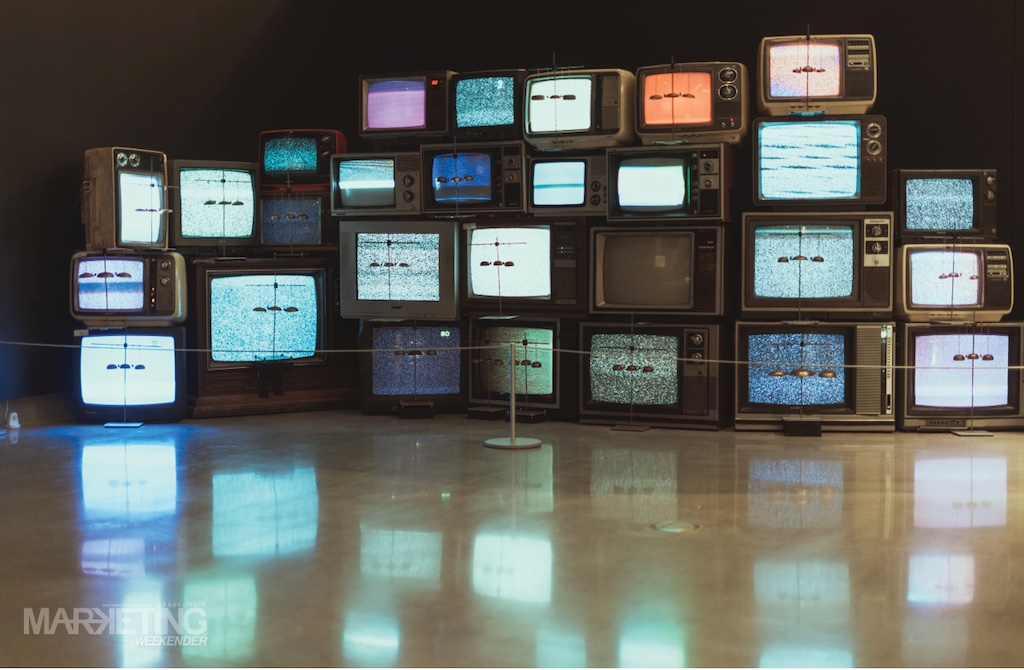

Digital is everywhere.

We’re glued to our phones all hours of day and night.

We’re sitting in meeting rooms typing to each other.

We’re staring intently at OTT and Waze with equal measures of frustration.

And media agencies tell us Digital forms 60% of all ad spends.

In Malaysia, today.

Take a commercial break now.

So, if you work in the television industry, should you be worried?

Is the TV industry on life support, or is there a viable way forward?

Let’s look at some of the data on hand:

TV ad spends for 2022 were lower than 2021.

Looking at the top 10 advertisers is illuminating. Unilever spent RM 768 million on TV in 2021, but in 2022 their spend was down to RM 438 million, a jaw-dropping fall of 42%. Nestle spends on TV fell by 7%. P&G significantly went the other way: their spend grew 38% YOY, mostly on Astro. (Worldwide they have reinvested in traditional, feeling that too much digital bottom funnel comms doesn’t drive results.)

Across the entire gamut of Malaysian advertisers, for 2022, Free to Air ad spends remained more or less constant (down by RM 13 million on a base of RM 3.503 billion) while Pay TV (Astro) ad spends were down by 7% (from RM 6.53 billion to RM 6.13 billion).

And if we look at the trend from the first 2 months of 2023, the projection would be, that ad spends would be at least 7% lower for TV as a whole.

7% doesn’t seem life-changing. But if you factor in that this is ad spend estimates by Nielsen and Kantar, based on media rate cards, and not real ad ringgit spent, then the situation starts becoming, prima facie, more grim. TV ad spends may actually be down 20% or more, in real terms.

In such a scenario, what does the future hold for TV?

Cord-cutting will continue: Consumers will continue to cut the Pay TV cord, though robust sports programming and reality TV shows might help slow the churn. The number of subscribers per month for Astro is falling, though new offerings, packages and programmes are helping to slow the slide.

Expect more innovation: Netflix and Disney via Astro is just the start. Expect more innovation from the legacy players in the future. The digital interface of Astro’s Ultrabox is world-class, and you could argue it makes for a more interesting navigation experience than Netflix has, currently.

Hooking in viewers who are accessing content and commerce via their connected TV is definitely the future.

Marketing one to one: TV increasingly does not represent a nuclear family all viewing the same content at the same time. Mom could be watching a show on TV, while her son could be following football via Astro on the Go. Addressable TV advertising, which allows advertisers to target individuals on every device based on demographics and interests, will be blurring the boundaries between digital and TV as we used to know it.

Will it help bring back the dollars of ad spend migrating to digital platforms? Probably not all the dollars will come back, because there are many digital platforms with engaging content, and your TV will become just one more. But it will play a role in retaining the (diminished) yet still relevant presence of pay TV in media plans.

Local content rules: Wherever the ad dollars go, one truth remains: Content is still king. The recent success of Project High Council shows that content brings audiences.

Astro has also taken a big bet on local Malaysian football, and broadcasting it with better production values: this should see positive results. Media Prima, sees sales of over 50 million from selling its shows and content overseas. Expect this to grow.

Data matters more than ever: The role of data science in finding new audiences and insights is critical for content development. As ad dollars slow, bets on content development necessarily will be impacted.

Even Netflix is becoming more judicious with content budgets: TV stations will necessarily become more miserly in deciding what to greenlight and what to KIV. Data scientists who analyse viewership patterns and insights will help find the answer.

Is TV dying?

I am reminded of what Michael Corleone said in the Godfather Part II, of his principal enemy: “Hyman Roth has been dying from the same heart attack for the last twenty years.”

TV will remain the future, it just may be diminished and different from what we knew it to be, 15 years ago.

Sandeep Joseph is the CEO and co-founder of Ampersand Advisory, a strategic media and data-driven consultancy. The company’s mission is “business results now!” and it has won numerous local and international awards.

The views expressed here are the author’s own: you can debate with him at [email protected]

MARKETING Magazine is not responsible for the content of external sites.