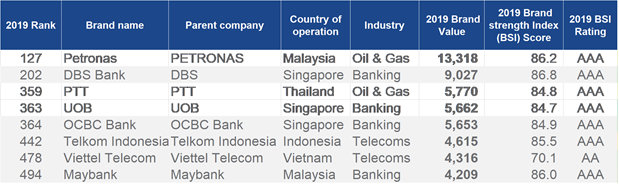

Brand Finance released it global rankings with only eight ASEAN companies making it to the top 500. The top 8 are as follows:-

According to Brand Fiance Asia Pacific managing director, Samir Dixit, there were many factors that made a brand qualify for the top 500.

“The brand value is dependent on a variety of factors including but not limiting to the competitiveness of the brand, the revenues and profits margins it makes, the stickiness it has with the customers, its relative brand strength vs other players in the market (and globally), etc.”

PETRONAS was not only crowned the number one ASEAN brand yet again, it also had a brand value increase of US$1.8 billion over 2018, not an easy feat for an Oil and Gas industry brand given the roller coaster ride the industry goes through.

Samir adds, “PETRONAS is a classic example of your brand driving the business success. Most oil and gas brands operate like commodity products given the controlled pricing and low levels of customer engagement opportunity due to the product. But PETRONAS has redefined how technical superiority though a wining formula in terms of fuel and lubes formulations and their partnership with F1 Mercedes team can be a game changer to even the dullest product categories and commodity type brands.”

Coming in second place was Maybank (a new entrant) and it was also the second Malaysian Brand to enter the Global 500 rankings besides PETRONAS. It is a great achievement and a triple treat for Maybank due to the US$ 1 billion brand value increase, the 4.6% increase in the brand strength score, the fact that they have joined the global 500 rankings.

“Maybank’s brand has been growing from strength to strength over the years and this milestone achievement is a great reward however there also lies the challenge of staying in the Global 500 rankings by managing their brand strength and brand value in a more planned manner.”

DBS, claimed the title of the ASEAN’s strongest brand, previously held by Telekom Indonesia, according to the latest report by Brand Finance, the world’s leading independent brand valuation and strategy consultancy.

The tech savvy regional brand has increased its Brand Strength Index (BSI) score by over five points from 81.2 to 86.8 out of 100 over the past year, pulling ahead of the likes of Dove, Prada, Pepsi, Red-bull, Starbucks, Porsche, Emirates, Adidas, Nestle and many more.

UOB was the ASEAN allrounder with highest ranking growth (128 places) , highest Brand Value %age increase (51.4%) and Second highest BSI improvement (of 12.2%) after PTT, 12.2.%. All these improvements also managed to propel UOB ahead of OCBC in the global ranking making them the second most valuable Bank Brand in ASEAN after DBS.

OCBC also saw significant improvement of scores but conceded its position to UOB by an extremely narrow margin of US$ 9 million. It will be a tall order for UOB to stay ahead of OCBC next year as OCBC had the second highest Brand value improvement (40.5% BV increase) and the third highest BSI improvement (8.8%) across all ASESAN Brands.

Telekom Indonesia was the only brand to have dropped in brand value (US$ 553 million decrease) amongst the 8 ASESAN brands and yet managed to stay in the global 500 rankings.

This however came with the hefty price of a 98 place drop in their rankings and they are now ranked 442 globally.

Viettel group joined the ranks of the global 500 brands for the first time.

The only Vietnamese brand to have managed to do so with a US$ 1 billion increase to the brand value in 2019.

They were also the seventh most valuable ASEAN Brand. Some the their value growth is attributed to their presence outside of Vietnam.

PTT, the major oil and gas player from Thailand was the third most valuable ASEAN brand. PTT had the highest BSI %age score improvement (24.5%) across all ASEAN Brands. This indicates that while their value increase is relatively smaller (US% 850 million) , the brand remains strong and will continue to grow but without being a threat to the #2 ranked DBS.

MARKETING Magazine is not responsible for the content of external sites.