Social media advertising has grown dramatically over the last few years since social media audiences began ballooning during and after Covid-19.

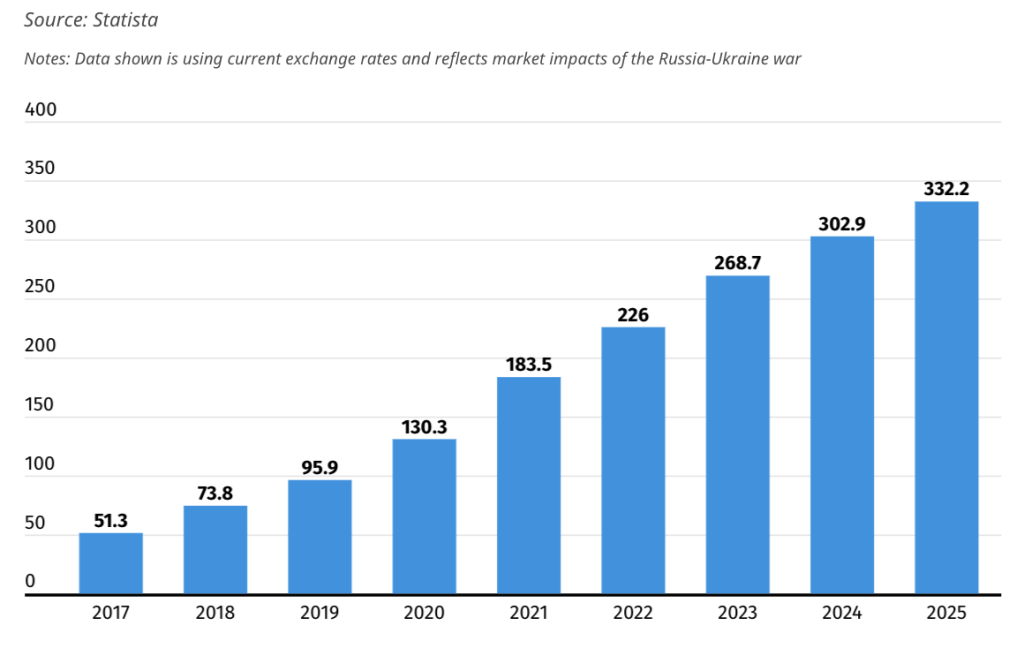

Advertising expenditure on social media has more than doubled since 2020 and is expected to cross US$300bn by 2024 according to data presented by AugustaFreePress.com.

With 4.7 billion users in 2022, social media networks have become the largest marketplace for advertisers and brands searching to promote their businesses.

Ad revenues began to climb when more companies began connecting with their audiences through social media and brands started exploring new advertising possibilities such as live streaming.

A Statista survey showed social media ad revenues increased by 35%, between 2019 and 2020, to US$130 billion worldwide while in 2021 it hit US$185.5bn with projections estimating this to increase by US$42bn to US$226bn by end 2022.

Statistics show companies increasing their social media ad budgets, driving nearly US$77bn in revenue growth over the next two years and expected to reach US$332bn by 2025.

The survey also revealed that average revenue spending per user is expected to grow by 23% over the next two years rising from US$44.2 to US$54.7 while mobile ads will account for 83% of total revenue – up from 82% this year.

China will become the leading social media ad market.

Globally the US leads in social media ad spending with statistics showing it generating US$80.6bn or one third of total ad spending this year followed closely by China with US$79.7bn.

Statista predicts that China will overtake the US and become the leading social media ad market with US$96bn in total ad spending by next year and by 2024 reach almost US$110bn against US$105bn for the US.

A social networks analysis for 2022 shows the social media ad market is dominated by Meta Platforms with a 45% share followed by Bytedance at 25% while Snapchat, LinkedIn and Tencent have a 5% share each.

MARKETING Magazine is not responsible for the content of external sites.