By Jonathan Low

Competition from Amazon, Apple, TikTok and Microsoft – and to a lesser extent, Spotify and Walmart – has been exacerbated by regulatory pressure.

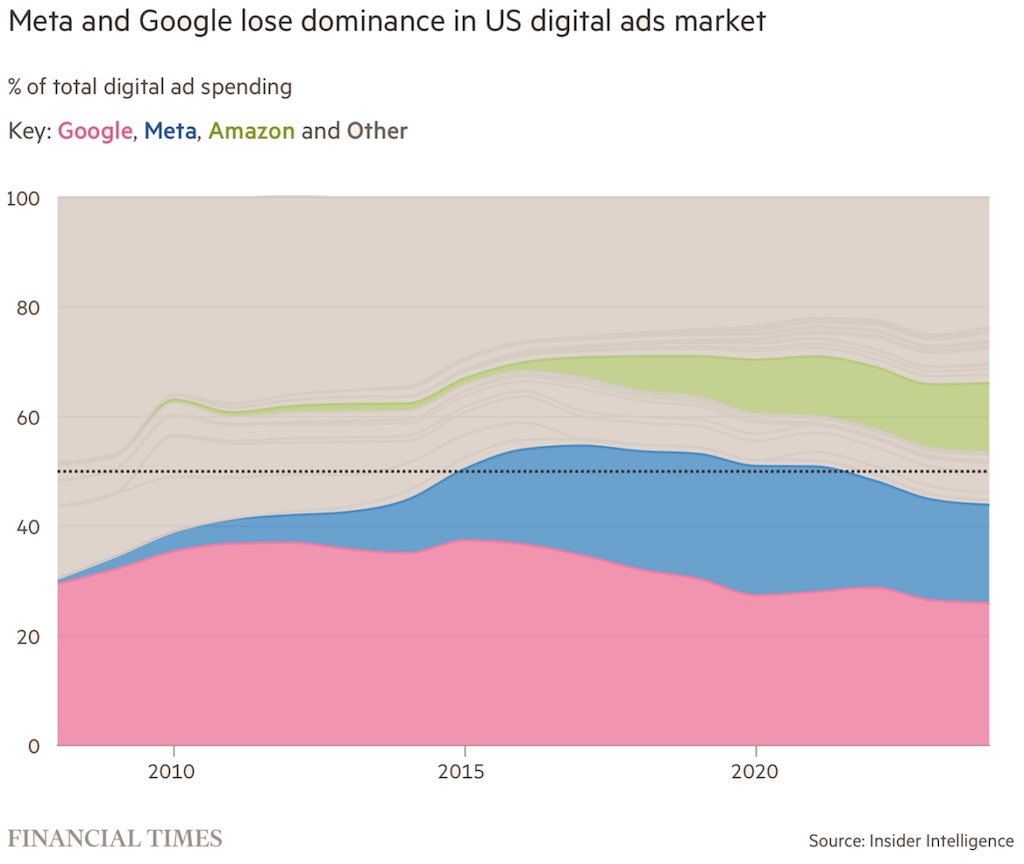

Google and Facebook have lost market share for five years but have lost their majority of digital advertising for the first time since 2014. JL

Patrick McGee reports in the Financial Times:

The share of US ad revenues held by Facebook’s parent Meta and Google owner Alphabet is projected to fall to 48.4% this year, the first time the two groups will not hold a majority share of the market since 2014. This will mark the fifth consecutive annual decline for the duopoly. Meta and Alphabet have lost their dominance over the digital advertising market as the(y are) hit by fast-growing competition from Amazon, TikTok, Microsoft and Apple. Amazon’s ads business will rise by 19%, Apple’s by 26%, Spotify 30%, TikTok 36% and Walmart 42%.

Meta and Alphabet have lost their dominance over the digital advertising market they have ruled for years, as the duopoly is hit by fast-growing competition from rivals Amazon, TikTok, Microsoft and Apple.

The share of US ad revenues held by Facebook’s parent Meta and Google owner Alphabet is projected to fall by 2.5 percentage points to 48.4 percent this year, the first time the two groups will not hold a majority share of the market since 2014, according to research group Insider Intelligence.

This will mark the fifth consecutive annual decline for the duopoly, whose share of the market has fallen from a peak of 54.7 percent in 2017 and is forecast to decline to 43.9 percent by 2024. Worldwide, Meta and Alphabet’s share declined 1 percentage point to 49.5 percent this year.

Jerry Dischler, head of ads at Google, told the Financial Times that fierce rivalry from new entrants reflects an “extremely dynamic ad market.”

Regulators in the US and Europe have added antitrust scrutiny such as pursuing Google for allegedly promoting its products over rivals.

In December, Facebook owner Meta was served with a complaint from the EU’s watchdogs over concerns that the social network’s classified advert service is unfair to rivals. Tech groups are fighting harder than ever for a share of the $300 billion digital ads market, even as companies worldwide are cutting their ad budgets in response to rising interest rates and high inflation.

Amazon and Apple have expanded their advertising teams. In July, Netflix announced it would partner with Microsoft to build an advertisement-supported tier of its streaming service.

Meta chief executive Mark Zuckerberg has blamed recent revenue falls on Apple’s privacy changes that make it harder to track users and target advertising, as well as the growing popularity of viral videos app TikTok, owned by Chinese parent ByteDance. “Four years ago, you wouldn’t be talking about either [TikTok or Amazon] in advertising,” said Dischler. “So it’s really telling that more and more people are acknowledging that advertising is a great and scalable business model.”

Amazon’s foray into the digital ads world has played a big part in hitting Meta and Google’s dominance. After years of toying in the market, it ramped efforts up in 2015 and has since seen ad revenues skyrocket from less than $1 billion to an estimated $38 billion this year.

“Before I joined, I didn’t even know what Amazon Ads was,” said an Amazon executive who says they now run “a massive team—and I didn’t know this existed before the recruiter called.”

Paul Prior, chief operating officer of Undertone, a digital advertising company, said retail giants led by Amazon woke up to the realization that their extensive data on customers could be the basis for a massive advertising business with higher margins than the sale of goods online.

But Amazon then went a step further, expanding its on-site ads business beyond its own shopping site. “Across the wider digital universe, they use that data set to empower brands and the advertisers to buy better, to spend more effectively and drive return on ad-spend,” said Prior.

Apple has also emerged as a new threat. Its ad revenues have grown from under $2.2 billion in 2018 to more than $7 billion this year. Although that is just 1.2 percent of the global market, it is already more than Snapchat and Pinterest combined, and some estimates suggest Apple could reach $30 billion of ad revenue by 2026.

In September, the FT revealed that the iPhone maker plans to nearly double the workforce in its fast-growing digital advertising business. Its job ads describe ambitions of “redefining advertising” for a “privacy-centric” world.

Zuckerberg has repeatedly hit out at Apple’s “conflict of interest,” criticizing it for charging “monopoly rents” and stifling innovation. Apple’s privacy rules have made it difficult for Meta to tailor ads to people, contributing to its shares falling by about two-thirds over the past 15 months.

Google does not appear to have seen as much impact from Apple’s privacy changes, as it can tailor ads directly to users typing in search terms—giving it valuable “user intent” data that Meta struggles to attain.

But Apple already has its own Google Maps rival, a search function on the iPhone, and it is building a nascent ads business—which analysts say could take on Google in future.

“Apple has a really strong brand that consumers trust and they have the devices that are used by the cream of the consumer crop,” said Josh Koenig, chief strategy officer at Pantheon, a digital marketing platform. “If they can figure out how to turn that into a real valuable network for advertisers, they’ll be able to charge a premium.”

Insider Intelligence has forecast that Google and Meta’s US ad growth in 2023 will be just 3 percent and 5 percent, respectively, while at least eight of its rivals are to experience double-digit gains.

It estimates that Amazon’s ads business will rise by 19 percent, Apple 26 percent, Spotify 30 percent, TikTok 36 percent and Walmart 42 percent. However, many of these groups’ market shares are currently small.

Dischler said Google was working hard on expanding its ads business in both ecommerce—where it is partnering with retailers—as well as in privacy-first advertising, where he argues Google can play a bigger role than Apple.

“I very much don’t see it as a zero-sum game,” said Dischler. “If Uber has an ad network—billboards on cars that previously didn’t have billboards, and is providing advertising opportunities when you’re getting groceries or food through restaurants—then they’re making the pie bigger.”

This article first appeared on The Low Down Blog

MARKETING Magazine is not responsible for the content of external sites.