Advertising spend on Retail Media Networks (RMNs) in Southeast Asia is projected to hit US$4.7 billion by 2030, underscoring the increasing significance of RMNs as a pivotal channel for advertising by marketers in the region.

This is based on the latest study by GrabAds, the advertising arm of Southeast Asian superapp Grab, and Kantar, one of the world’s leading media insights and research for advertising. Globally, RMN ad spend is expected to surge by 73% in the next seven years, surpassing growth rates in search (47%) and social (45%).

Southeast Asia is leading the growth of RMNs globally

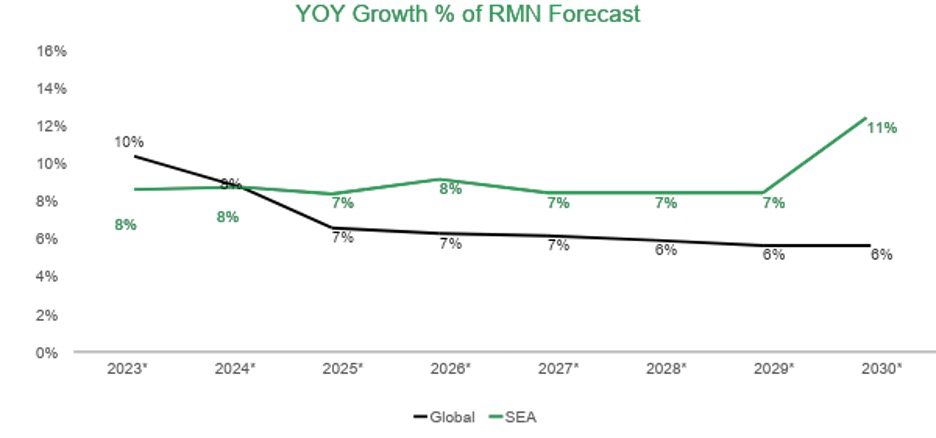

The study also reveals that year-on-year growth of RMN ad spend in Southeast Asia is forecast to be higher or consistent with the growth being seen globally (see Figure 1 above). GrabAds and Kantar believe Southeast Asian marketers will prioritise investments towards RMN channels this year, with year-on-year ad spend growth projected to increase from 8% in 2024 to 11 % in 2030.

This upward trend is unsurprising as RMNs ranked first in ad equity across different media channels in the Kantar Media Reactions 2022 study. Ad equity measures how receptive consumers are to advertising messages, with campaigns proving to be 7 times more effective on channels which have positive ad equity.

“RMNs allow marketers to serve highly relevant ads to consumers by showcasing products and brands that cater to their immediate needs and behaviour across the buying journey. This approach to advertising adds value to consumers rather than disrupting the browsing experience,” said Katie McClintock, Regional Managing Director, Kantar.

“Keeping up with consumer habits and behaviour is the only way for brands to be meaningfully different, and we at Kantar believe that RMNs, with first-party data informed by real consumer transactions, can give brands the tools they need to provide greater value for consumers and build strong brand differentiation.”

Ad spend growth on RMNs in each of the Southeast Asian countries is also projected to grow higher than the global growth index, with Indonesia leading the pack with a forecasted growth of 219% from 2023 to 2030. Indonesia is also projected to have a CAGR of 13.41%, which is 1.9x higher than the projected global rate.

Superapps drive overall RMN growth with the ability to reach the hybrid shopper

The study reveals the four main types of RMNs in Southeast Asia- social media RMNs, which are digital marketplaces within social media platforms; e-commerce RMNs, digital retail marketplaces that offer advertising spaces; large retailer RMNs, which differ from e-commerce RMNs by nature of their physical retail spaces; and superapp RMNs, which consist of an ecosystem of services.

Unlike the other RMN types that cover specific purchase stages, superapp RMNs can reach consumers at all stages of their buying journey, from awareness to purchase. This includes offline and online touchpoints, which are becoming increasingly key as shopping evolves into an omnichannel experience.

Per the study, 79% of Southeast Asian shoppers use both online and offline channels and using both channels improves positive ad receptivity by 5%. This makes superapp RMNs a critical channel to help marketers understand and measure offline-to-online (O2O) behaviours and transactions.

The increasing share of RMNs in marketers’ media mix over the next 7 years is also propelled by the unique market dynamics in Southeast Asia. The GrabAds and Kantar study highlights that 2 out of 3 Southeast Asians find it important to have products and services on demand.

61% also shared that it is very important to have products or services to anticipate their needs, compared to the global figure of 52%. This suggests that Southeast Asian consumers prefer seamless, convenient transactions that fulfil their needs quickly. Superapp RMNs are well-positioned to serve these consumer needs with their O2O full-funnel ecosystem powered by first-party data.

“Tomorrow’s hybrid shopper will look very different from today’s shopper. Marketers are tasked with the arduous task of identifying the right ads to serve at the right time to the right consumers to value-add to the buying or discovery experience,” said Ken Mandel, Regional Managing Director, GrabAds & Brand Insights at Grab.

“RMNs provide a full-funnel sales flywheel to help marketers do just that – first-party transaction data from RMNs inform marketers of users’ real needs and interests, thereby delivering ads that provide a suitable solution for the right occasion, while their full-funnel ecosystem allows marketers to close the loop and track return on investments accurately.

As marketers increasingly invest in this emerging channel, it is crucial to design ad campaigns that leverage RMNs’ unique features, creating immersive experiences that extend beyond the conventional buying journey to also include loyalty and advocacy,” added Ken.

MARKETING Magazine is not responsible for the content of external sites.