Introduction

2022’s Word of the Year in terms of smart money may very well be on “hybrid” as it encompasses so much of the current multi-front transformation where it goes back to the old forms of communication, energy, shopping and working, yet neither are we fully green, virtual or automated.

Retailers who invested in e-commerce capabilities during the pandemic (2020’s Word of the Year), are resuming to target ever greater ratios of e-commerce sales.

In 2022, the underlying digitization trends have been complicated by ongoing supply chain disruptions (and causes de-globalization), soaring inflation and decelerating retail sales.

China reduced their economic growth estimates for the year due to COVID-19 limitations of strategies and a range of other economic and financial risks.

The U.K., when it comes to e-commerce sales and penetration as well as digital advertising revenue throughout the pandemic, is now facing double-digit inflation and the specter of rising gas and heating costs, with the lowest income households disproportionately affected.

Yet as stated in June’s edition of This Year Next Year, it is not a past conclusion that we are headed for a widespread and deep recession.

The key findings from the analysis are:

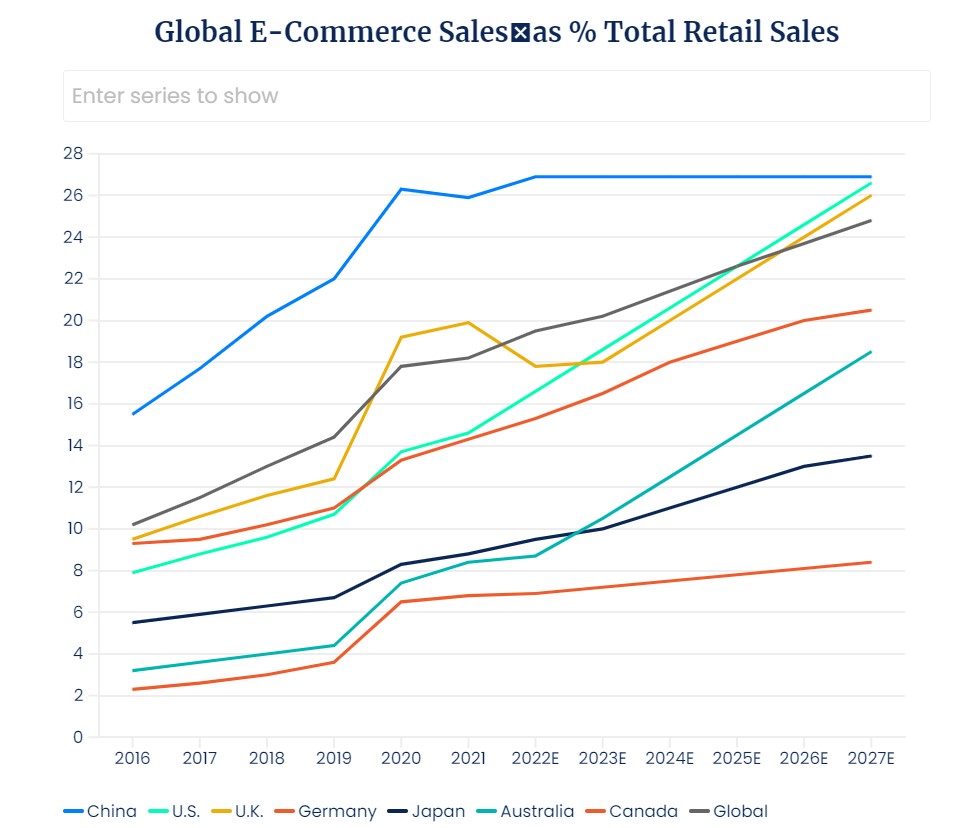

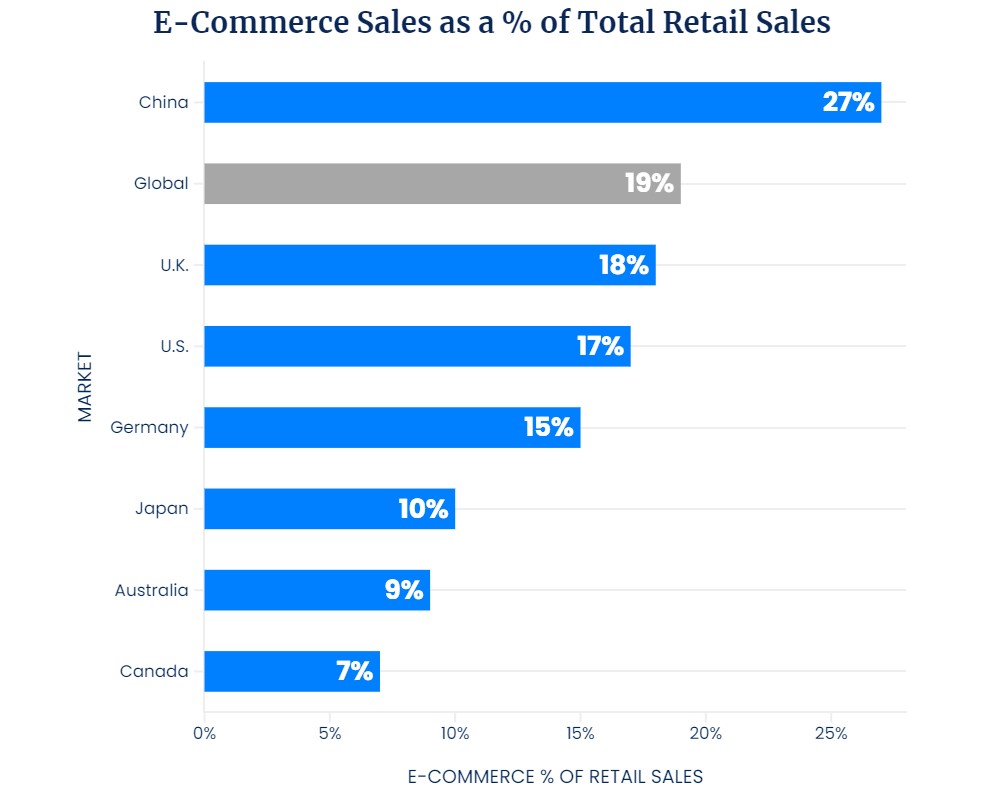

- Global e-commerce is estimated to make up 19% of global retail sales in 2022, growing to 25% by 2027.

- Twenty of the top global e-commerce companies accounted for 67% of global e-commerce sales in 2021.

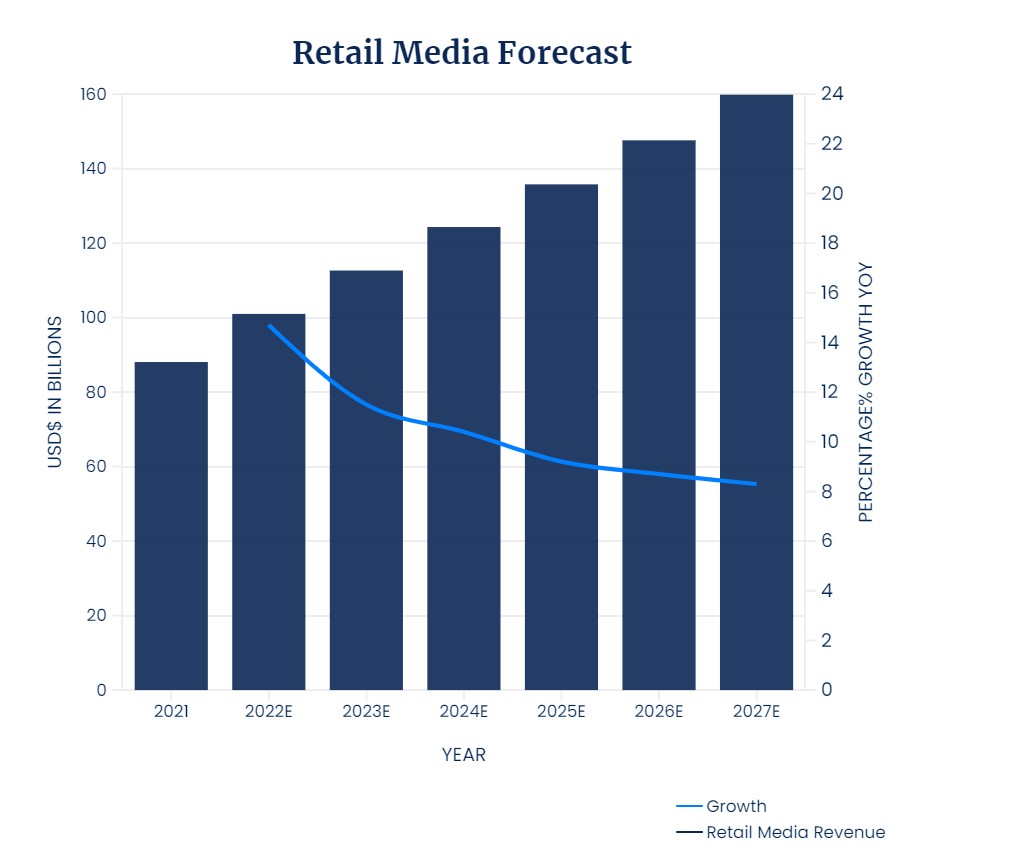

- Media of Global retail is likely to reach $101 billion in 2022 (15% higher than a year ago) and will hit $160 billion in annual revenue in five years’ time.

- The high-water mark for advertising revenue today equates to approximately 5% of GMV, which under the right circumstances could be a reasonable target for others who presently fall somewhere between 0% and 3% today.

- In the next one to three years, retail media will likely see greater competition, more frequent decoupling of data from inventory and greater participation by non-endemic brands.

Retail sales

Retail sales are known as a signal for health to a given economy, but in most years, retail sales account for less than half of what is spent by consumers on services. During the COVID-19 pandemic, however, the ratio of “goods” and “services” shifted.

Most consumers weren’t spending on certain goods and services like they normally do. Instead, people resort to consumer expenditure out of services and into goods.

In the U.S., consumer spending on goods grew more than 20% over 2019 levels for each month from March through December of 2021, whereas, In Australia, goods expenditure has outpaced services expenditure on an indexed basis since March of 2020.

Concurrently, global advertising revenue recorded growth of 24% in 2021, all the more remarkable as the 2020 figure represented only a small decline of 2%.

The outsize growth of retail sales, the shift within that to e-commerce sales and the condensed time frame of those changes likely contributed to greater advertising intensity and advertising revenue as a result. Advertising intensity can be measured as the ratio of advertising expense to company revenue.

This research indicates higher advertising intensity for goods-and product-based companies versus services companies, helping illustrate why 2021 was such a banner year for advertising growth.

Global E-commerce Sales

The subset of e-commerce sales are global retail sales, and while retail sales figures are regularly reported by government agencies, not all markets provide figures for e-commerce sales as expeditiously.

This model estimates global e-commerce sales of $5.4 trillion dollars this year. By 2027 it is estimated that the e-commerce sales will reach $9.1 trillion.

This figure includes sales of autos and auto parts, as well as gasoline, but excludes food services or catering sales to produce like-for-like comparisons across all tracked markets.

Nowadays, e-commerce, after a surge of investment and adoption during the pandemic, is finding its place in a world where in-person activities are resuming even while pandemic-related lockdowns in China and war-torn Ukraine have contributed to a drag on growth in the first half of 2022.

It is predicted that e-commerce will represent 19% of global retail sales in 2022, up from 18% in 2021 and 2020.

To look at the yearly e-commerce penetration numbers by market is to see the timeline of the pandemic played out in peaks and troughs.

China, where e-commerce sales jumped to more than 26% of all retail sales in 2020 as COVID-19 prompted shutdowns across Wuhan, in 2021 saw penetration fall as the country eased restrictions. The ratio of e-commerce sales is expected to rise again in 2022, to 27%, due to further shutdowns.

The U.K. by comparison, which saw the largest e-commerce adoption spike of our tracked markets in 2020 — 47% growth — spent much of 2021 in various levels of lockdown but has resumed relative normalcy in 2022 and is expected to report a decline in e-commerce penetration to 18% in 2022 (versus 20% in 2021).

E-commerce in the U.S. is forecast to represent 17% of all retail sales this year, a significant increase over the 11% figure in 2019.

Among the major global markets we have highlighted in this report, only three are forecast to see 10% or lower e-commerce penetration in 2022: Australia, Japan and Canada.

Japan, with the oldest population, with 29% of its population age 65 or older as of 2021, a potential drag on adoption. Australia and Canada, while relatively younger, have populations spread across large and not very dense territories.

And Canada, despite being home to Shopify, is forecast to lag behind all other tracked markets in e-commerce penetration through 2027, when it could still see sub-10% of all retail sales.

It is important to note that the line is becoming increasingly blurred between physical sales and e-commerce sales, especially following the COVID-era explosion of retail offerings such as buy online pickup in store (BOPIS), click-and-collect or in-store contactless mobile phone payments.

E-commerce Company Rankings

This Year Next Year, where we build our analysis on the health of media sellers, for this forecast we have examined the largest e-commerce retailers globally. To keep the analysis focused, we have included retailers selling owned inventory as well as marketplaces.

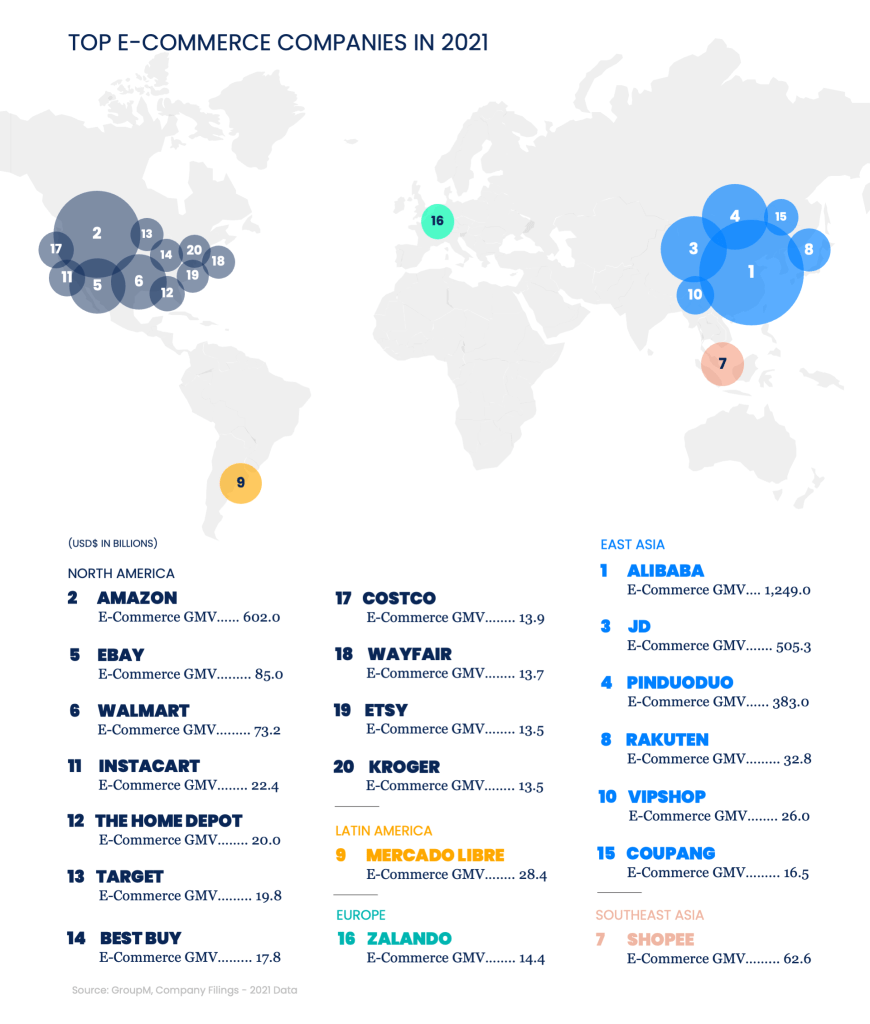

Chinese retailers make up three of the top five retailers by global e-commerce gross merchandise value (GMV) with Amazon and eBay rounding out the other two spots (though Shopify would replace eBay at #5 if included).

Alibaba is the undisputed leader and counts more than double the e-commerce GMV of the number two, Amazon. Alibaba has dominated the mobile commerce and payments ecosystem with Alipay (along with Tencent competitor WeChat).

Alibaba, along with Pinduoduo, eBay and Mercado Libre act primarily as marketplaces, meaning that they facilitate matching consumers with sellers and earn revenue as a percentage of the sale price, or via additional offered services such as logistics, warehousing and advertising.

Sales from third-party sellers have rapidly grown as a percentage of Amazon’s GMV, and our estimates put that ratio at 65% in 2021.

For our E-Commerce Top 20, the median GMV growth rate in 2020 was an impressive 60% year-over-year. And there remained plenty of headroom for a median growth rate of 21% in 2021.

It is also expected that demand for some product categories, including electronics, fitness equipment, household goods and furniture, to soften after stimulus payments (in some countries) and new home-based work and life led to pandemic buying sprees.

The benefits of e-commerce growth over the last six years have become more concentrated among our Top 20, which represented just 49% of global e-commerce sales in 2016 but accounted for 67% of those sales in 2021.

Excluding the Chinese retailers from this analysis, we can see that concentration is still increasing, but hasn’t reached nearly the same level with our top 16 ex-China companies representing 32% of e-commerce sales in 2021, up from 24% in 2016.

Defining Retail Media

Retail media is known as any advertising revenue accruing to a retail-based company, including marketplaces.

Also, considered a test and learning environment not so long ago, has more recently become a growing line item on many marketer budgets.

There remain significant disparities in capability depth, data quality and partnerships across global markets and within retail channels, but the promise of retailer first-party data, albeit residing in yet another walled garden, is tantalizing — enabling purchase-based targeting and closed loop measurement.

GroupM estimates that global advertising revenue for retail-based companies was $88 billion in 2021 and will reach $101 billion this year. This amounts to 18% of global digital advertising and 11% of total advertising.

As a percentage of global e-commerce GMV, this amounts to 1.8%. They expect retail media advertising to increase roughly 60% by 2027.

Only some of the companies in their composite disclose advertising revenue, and of those that do, most only recently began disclosing a figure.

GroupM estimates Amazon as being at the far end of the spectrum when it comes to advertising revenue as a percentage of e-commerce GMV.

While Amazon doesn’t disclose how much of their total advertising revenue comes from commerce-related activity (as compared to advertising revenue from sports programming, for example), we would characterize the vast majority of that revenue to be directly attributable to e-commerce or informed by the company’s first-party retail data, and equal to roughly 5% of e-commerce GMV.

This 5% high-water mark for advertising revenue could be a reasonable target for others (who presently fall somewhere between 0% and 3% today), it depends on the retailer’s ability to build out their media product offerings globally to create competition among significant numbers of manufacturers to reach prospects, and further developing a platform to sell impressions to non-endemic marketers.

Proliferation of Retail Media Networks

Retailers nowadays consider advertising businesses, and as e-commerce penetration shot up through 2020 and 2021, there were frequent announcements of new retail media networks, including from non-retailers — Doordash, Uber and Meituan are all building out their media offerings.

Scalability, differentiation and staying power, particularly in the context of the broader economic situation, will be the battle ground for many of the newer networks and their supporting technologies.

Expansion of Use Cases

During early retail media programs, the majority of advertising inventory lived on a retailer’s owned-and-operated platforms, however “off-site” opportunities have opened up additional inventory and budgets.

Going forward, some retailers are experimenting with the separation of their data and ad inventory entirely, a move that offers brands additional flexibility as partners, but also risks commoditization.

Retailers that are better able to trace sales, for example those with highly adopted loyalty programs, are likely in a stronger position.

Separating out retail data from inventory could also lead to non-endemic brands advertising in greater numbers, provided that the premium being paid to activate on retail data is supported by an equal or greater increase in performance.

Future of Retail Media

Fueling the nearly 60% growth of retail media over the next five years are a number of factors — the expansion of use cases and growth of non-endemic brands mentioned above, as well as potential shifts from outside of traditional sales and marketing budgets, incorporating incremental spend from other media channels.

Geographic Trends

China

In 2022, it is estimated China’s e-commerce market will grow by 5.6%, slower than last year’s growth of 10%.

For the year, estimated that total retail will amount to CN¥40 trillion, with e-commerce accounting for 27% of this figure.

Over the next five years, growth will track in line with retail sales growth, meaning that e-commerce penetration will remain relatively flat through 2027 versus the 19% growth from 2016 through 2021.

By 2027 retail sales will amount to CN¥52 trillion with 27% of retail occurring via e-commerce channels.

Top 3 Online Shopping Platform Ads

- 35% Live Streams

- 35% Messages to Platforms

- 34% Push Notifications from Apps

Top 3 Product Categories bought Online in past 12 Months

- 62% Groceries

- 56% Household

- 53% Beauty & Personal Care

Since the beginning of the year there have been recurring outbreaks of COVID-19 across China, with several major cities seriously affected that has taken a toll on offline consumption and consumer expectations, leading to a marked decline in household consumption since March.

Although the initial impact of this year’s outbreaks on the total retail sales of consumer goods is relatively slight compared to 2020, with the establishment of testing centers and policies aimed at buoying consumption, consumers continue to scrutinize purchases spread of these outbreaks, and with e-commerce adoption peaking, competition among the players has opened on several fronts:

Breadth of Merchants and Geographic Coverage

At a time when the economy is being affected by the coronavirus and is entering a period of weak growth, Chinese consumers are more likely to shift their focus to essential products in the short term.

They are more sensitive to the prices of non-essential goods and are likely to cut down unnecessary spending.

Domestic circulation has been advanced to improve rural e-commerce logistics and promote agricultural products to drive entrepreneurship and employment among farmers. In 2021, more than 80% of the country’s rural areas were accessible to express delivery.

Entertainment as a Component of E-commerce

Compared to traditional catalog-based e-commerce, emerging e-commerce trends increasingly emphasize entertainment.

Content production has become more refined, and there are higher requirements for live streamers and livestreaming operations with cultural connotations.

Rapid Delivery or Quick E-commerce

While we have excluded food delivery services from our analysis, it is important to note that this is an expanding market in China with established giants Meituan (offering Flash Purchase of necessities or groceries) and Alibaba’s ele.me both involved in instant retail to deliver necessities or groceries.

Traditional e-commerce platforms are also developing competitive offerings. JD.com launched hourly purchases with Dada Express; Alibaba launched Maoxiang, a direct retail model with upgraded supply chain logistics; and Meituan teamed up with convenience stores to deploy 24-hour delivery and delivery within 30-minutes (Jisudain Chinese).

U.S.

In 2022, it is estimated that the U.S. e-commerce market will grow by 25%. For the year, estimated that total retail will amount to $7.2 trillion, with e-commerce accounting for 17% of this figure.

In the next five years, growth will occur at a 14% CAGR, and by 2027 e-commerce sales will amount to $2.3 trillion, or 27% of all retail sales (by our definition, which includes autos and gas, but excludes food services).

In the U.S. (as in some other markets) retail sales are growing more quickly than e-commerce sales through the second quarter of 2022 as inflation raises the prices of food and gas especially, goods that are purchased offline by most consumers.

Although it remains a relatively small share of the sector’s total, it is best that retail media should reach $33 billion in 2022 after rising from next to nothing several years ago.

E-commerce Trends Q2 2022 Versus Q2 2021

- +27% building materials, garden equipment, etc.

- -9% electronics & appliance

- +8% health & personal care

U.K.

In 2022, it is estimated that the U.K. e-commerce market will decline by 3.6%, which is a reversal from last year’s growth of 15% and average five-year CAGR of 20%.

For the year, estimated that total retail will amount to £738 billion, with e-commerce accounting for 18% of this figure.

E-commerce growth will decelerate to 13% on a compound basis over the next five years, and by 2027 the total retail sales figure will amount to £909billion with 26% of retail occurring via e-commerce channels.

In the U.K., we estimate e-commerce sales represented 17% of total retail sales during June 2022, which has slowed from 18% in June 2021.

The U.K. faces a number of challenges including rising inflation affecting consumer spending and global supply chain issues that will continue to impact the U.K. e-commerce market.

In such challenging economic times, large incumbents may fare better than non-essential retail e-commerce players like Misguided, which has recently faced bankruptcy.

Germany

In 2022, it is estimated that Germany’s e-commerce market will grow by 14%, slightly faster than last year’s growth of 12% and above the three-year pre-pandemic average of 10%.

For the year, estimated that total retail will amount to €925 billion, with e-commerce accounting for 15% of this figure.

Growth will likely continue similar to pre-pandemic levels, and by 2027 the figure could amount to €1.1 trillion with 21% of retail occurring via e-commerce channels. E-food is the fastest growing category, and it sees the highest growth in average order value. Furniture and health & beauty are the next fastest growing e-commerce categories, according to HDE.

Japan

In 2022, it is estimated that Japan’s e-commerce market will grow by 12%, above last year’s growth of 8.9% and the three-year pre-pandemic CAGR of 8.1%.

For the year, it is estimated that total retail will amount to JP¥156 trillion, with e-commerce accounting for 9.5% of this figure.

Growth is likely to remain above pre-pandemic levels, and by 2027 retail sales will amount to JP¥169 trillion with 14% of retail occurring via e-commerce channels.

Amazon and Rakuten are the largest established players, competing with each other across the top product categories: household goods, groceries and electronics, which all saw exceptional growth during the pandemic.

While there is high overlap of usage across both platforms, Rakuten has sought to differentiate via its superior points system, shopping events and product availability.

This has influenced Rakuten’s skew toward an older, housewife audience, whereas Amazon skews toward younger, working professional males.

There has been substantial growth measured in the last five years driven by high internet penetration and an increasing reliance on e-commerce due to the COVID-19 pandemic — with a majority of consumers still preferring to shop online rather than in store.

Alternative payment solutions such as PayPay, LINE Pay and Amazon Pay are also increasingly being used.

Canada

In 2022, it is estimated that Canada’s e-commerce market will grow by 10.1%, below last year’s growth of 17.3% and well below the three-year pre-pandemic CAGR of 22%.

For the year, total retail sales will likely reach C$737 billion, with e-commerce accounting for 6.9% of this figure. By 2027 retail sales are likely to be C$901 billion with 8.4% occurring via e-commerce channels.

E-commerce sales continue to show a steady rate of increase moving into the second half of 2022, after double-digit growth in 2021.

Canadian consumers are embracing electronic commerce amid disruption in traditional retail channels.

There have been more than 27 million e-commerce users in Canada this year, accounting for 75% of the Canadian population; that number is expected to grow to 78% in 2025, according to the International Trade Administration (ITA).

E-commerce Consumer Insights

- 75% of Canadians use e-commerce

- 55% made purchases on mobile devices

- 47% of those 18-34 purchase 1x per week

Retail e-commerce sales in Canada are forecast to total C$51 billion in 2022, more than double the C$23 billion recorded 2019.

While unable to sustain the precipitous growth seen over the heights of the pandemic — a common trend across the advertising industry as well — retailers continue to invest in digital platforms to reach consumers dispersed over a vast land mass while also responding to competition from digital-natives like Amazon Canada.

As of January 2022, 55% of Canadians made online retail purchases with their mobile devices, and this trend is growing.

Consumers aged 18-34 lead the trend, with 47% of these shoppers purchasing retail items via digital devices at least once a week, per the ITA.

Canadians tend to prefer supporting Canada-based online retailers, such as Loblaws, but American companies like Amazon and Walmart continue to lead the space.

Australia

In 2022, it is estimated that Australia’s e-commerce market will grow by 8.4%, below last year’s growth of 24% as well as the pre-pandemic three-year CAGR of 15%.

For the year, estimated that total retail will amount to A$504billion with e-commerce accounting for 8.7% of this figure.

By 2027 retail sales could amount to A$602billion with 19% of retail occurring via e-commerce channels.

Retail has continued to see growth nearly double the headline inflation rate, with demand remaining resilient even as consumer confidence falls sharply.

E-commerce growth has shifted from a secular expansion driven by lockdowns to a value-proposition and loyalty-led growth. Digital commerce in Australia has seen 400,000 fewer monthly active shoppers, impacting discretionary purchases and mega sales sites, however stickier platforms and propositions have seen continued growth, including up to 50% year-over-year growth in grocery, according to company filings.

Half of digital commerce sales volume is coming from only 13% of households, so the ability to attract, retain and grow sales through high customer lifetime value cohorts is proving key to long-term sustainable growth.

We expect growth in the second half of 2022 in Australia to decelerate as we cycle out of lockdowns and revert to traditional seasonal peaks and valleys. Food and beverage delivery, a top-three category, saw a material slowing of demand in June while still delivering the fastest growth of any vertical.

But the overall ad market for e-commerce continues to expand, with more products becoming available across a growing number of platforms.

EBay has continued to innovate and show resilience following a period of deceleration, retaining its top position in the local digital commerce traffic.

Amazon continues to outperform, with traffic up 20% versus the prior year, according to SimilarWeb.

Grocery and fashion categories are still seeing significant growth, with Coles and Woolworths both reporting approximately 50% year-over-year growth in calendar Q1.

Click-and-collect remains a key pillar supporting this increase, with published data showing a consistent 14% of sales, even as household penetration sits at just under 10% for this vertical, according to Australia Post.

Source: GroupM

MARKETING Magazine is not responsible for the content of external sites.