The world’s largest media investment company, GroupM, has released their Global Mid-Year Forecast that shows significant growth in advertising revenue despite fears of an impending recession and ongoing geopolitical situations around the world.

The forecast, titled “This Year, Next Year” is authored by GroupM’s President of Business Intelligence Brian Wieser, and the Global Director of Business Intelligence, Kate Scott-Dawkins. The release comes following a press briefing attended by MARKETING Magazine.

We are well aware that e-commerce is finding its place in a world where in-person activities are resuming, all while pandemic-related lockdowns in China and supply chain bottlenecks from there and war-torn Ukraine contributed to a drag on growth in the first half of 2022.

The forecast explains reasons of not foreseeing a perilous economic state ahead, some of which are:

- Low unemployment levels, high household savings, strong new business formation.

- Interest rates are rising, but from historic lows, justifying expectations for a deceleration of economic growth without decline.

- Cuts in spending by some marketers will be offset by gains from others and many of the same factors that drove unprecedented growth for the industry in 2021 will continue in 2022.

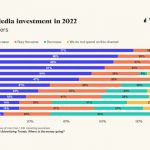

Most marketers are still adding to their media budgets in 2022; a key difference between this year and last year is that the rate at which this is occurring for older marketers is simply slower, and at the same time there are likely fewer new marketers emerging.

Increased consumer price inflation in the markets covered by GroupM is expected to average 6.9% this year, sparking fears of recession. However, as mentioned earlier, GroupM does not foresee a perilous economic state. Despite increased consumer price inflation expecting to average 6.9% this year, it is expected that underlying growth should outpace that of 2019, even if some parts of the world do end up experiencing a recession.

Here’s the overall industry forecast and some numerical highlights:

- 2022 growth: Global growth forecasted at 8.4% (excludes the globally distorting effects of U.S. political advertising), with global ad revenue forecasted at $837.5 billion.

- In many markets, expectations are higher for 2022 now versus our December expectations, although China, the world’s second largest market, is now expected to grow at a much slower pace versus prior forecasts.

- Looking out over the next five years, India is expected to grow by double digit levels, while many markets are now expected for grow by mid-to-high single digits:

France, Germany, Brazil and Canada are expected to grow by high single digits. - The U.S., Australia and the U.K. are more likely to grow by mid-single digits.

- China is expected to grow by low single digits.

- The top five sellers of advertising in 2021, a group including Google, Facebook, Alibaba and Bytedance, generated $408 billion in ad revenue, or 53% of the global total.

Commenting on the growth in Malaysia, Kate Scott-Dawkins told MARKETING Magazine, “We have made some historical revisions in Malaysia to achieve some historical numbers in ad revenue. We are expecting to see some growth there.”

As for the future of Programmatic DOOH in Southeast Asia, GroupM’s Chief Investment Officer for Southeast and North Asia, Anita Munro, told MARKETING Magazine, “Speaking broadly in terms of Out Of Home, it has rebounded in very healthy ways post Covid, and there is a lot of change that we are seeing in the infrastructure behind Out Of Home advertising in the region.”

“We have witnessed the evolution of digital formats, which is the first step towards enabling programmatic services. Coupled with that a lot of technology providers such as Hivestack have been entering the region, allowing us to enable Programmatic DOOH,” Anita added. “It’s still early stages for some of the markets, but the likes of Singapore, Australia and Hong Kong are well developed in Programmatic space, and across the rest of Southeast Asia and especially Malaysia, we believe that it will certainly be an area for growth and opportunity.”

The major areas considered in the mid-year forecast are:

- Digital advertising: Growth is expected in ad revenue for pure-play digital platforms of 12% in 2022, an expected deceleration from 2021’s 30% growth rate.

- Under a broader definition of digital advertising, which includes traditional media’s digital extensions, the industry is estimated to account for $617 billion in 2022, or 73% of its total.

- Television advertising: forecasted to grow 4% in 2022.

- Notably, television is becoming increasingly global in ways it never was before.

- Mostly U.S.-based streaming services continue to invest aggressively in local-language content as they move into foreign markets.

- Connected TV environments, including digital ad inventory from streaming services, will capture shares of existing budgets much more than they will drive new ones into the industry.

- While television remains better than many alternatives for the purposes of satisfying reach and frequency goals, its reduced effectiveness will only encourage marketers to explore alternative strategies.

- OOH advertising: the median market we track is expecting 12% growth, as many of these markets have approached or are soon to exceed their pre-pandemic highs. Outdoor is expected to exceed its 2019 volumes next year, indicating that much of the growth being seen at present can still be characterised as recovery driven.

MARKETING Magazine is not responsible for the content of external sites.