Digital media firms are struggling, many have missed their revenue targets, reduced their workforces and have been trying to generate revenue from e-commerce.

BuzzFeed made $260 million against a goal of $350 million, while Vice Media fell a $100 million short of its revenue goals for 2017.

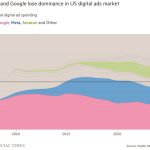

This state of affairs despite accelerating US digital ad spend is to a large extent due to Google and Facebook taking the lion’s share of digital marketing dollars.

How to challenge the duopoly?

To gain more bargaining power with the duopoly, BuzzFeed CEO Jonah Peretti recently said in an interview to The New York Times that he was open to merging with digital media companies like Vice Media, Group Nine, Refinery29, and Vox.

If BuzzFeed and five of the other biggest companies were combined into a bigger digital media company, you would probably be able to get paid more money.

According to Peretti, if BuzzFeed merges with competing digital media publishers, the combined entity can potentially attract ad spend that might otherwise go to the duopoly.

He reasons that as a combined entity they will be commanding more eyeballs.

Further, BuzzFeed and its competitors control their content, whereas Facebook, Twitter, and Youtube—with their reliance on user-generated content—have been struggling with the proliferation of misinformation and propaganda.

This has also made brands anxious about their ads appearing next to questionable content; something that is unlikely to happen on a platform that has tight control over its content.

Mergers are quite common in other media industries, including TV and print for companies looking to scale.

Merged corporate giants like Discovery Inc. and Viacom have negotiating power over distributors like Comcast or Optimum.

But publishers, even as a combined entity, would not be able to counter the extraordinary power wielded by the duopoly.

BuzzFeed and its competitors depend on Google and Facebook for distribution.

But the duopoly does not really need them as they are open platforms having access to nearly infinite content sources.

According to eMarketer, Google and Facebook dominate online media with a combined market share of 58% of US digital ad spend.

Trying to come together to aggregate scale and improve ad-share terms with Facebook and Google is thinking along the wrong trajectory.

The publishers are never going to have the scale to compete with the duopoly.

They will just slow their demise, and not generate any new cash flow. What they need to do is to re-think their business models on what Facebook and Google can’t do.

The duopoly has an Achilles’ heel

According to Jessica E. Lessin, one of Business Insider’s “100 Most Influential Tech Women,” and the Founder & Editor-in-Chief of technology website, The Information, it’s a mistake to think that building scale will give digital publishers advantage against two giants with thousands of software engineers and advanced technologies like artificial intelligence.

She advises publishers to double down on what they are excellent at and what the tech giants are struggling with, and that is unique and exclusive content.

Peretti and Lessin appear to be on the same page on this as he said to the NYT, “Having some bigger companies that actually care about the quality of the content feels like something that’s very valuable.”

What’s next?

BuzzFeed has been trying to diversify its revenue sources; over the past year, it started selling kitchen tools at Walmart, accepting banner ads on its web pages and recently announced a membership model providing exclusive access to newsletters and behind-the-scenes against a monthly fee.

MARKETING Magazine is not responsible for the content of external sites.