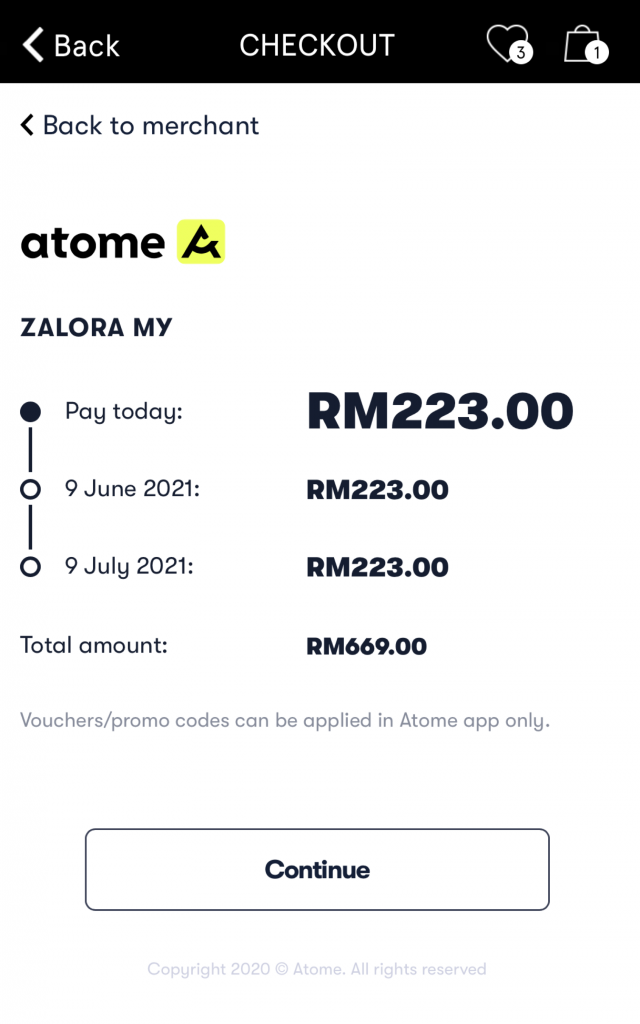

ZALORA is introducing the Buy Now Pay Later (BNPL) flexible payment options across both its mobile app and website through its new regional partnership with Atome.

Starting today, ZALORA customers will have the option to to split their purchases into three, zero-interest payments during the checkout process on ZALORA’s mobile app whereas the website checkout is set to launch by the end of this month.

To use the payment option, users will have to register and select Atome as the payment option which is now available to ZALORA customers in Singapore and Malaysia. According to a statement released by the company, the BNPL payment option will be progressively rolled out to its Hong Kong, Indonesia, Philippines and Taiwan customers in coming months.

“This partnership (with Atome) introduces safe and secure payment choice and flexibility for our customers, especially for our fashion, beauty, lifestyle and luxury fashion categories,” said Chief Operations Officer of ZALORA, Rostin Javadi. “They now have the ability to split their purchase into bite-sized payments that make higher price point items more accessible and available, thereby enhancing the customer shopping and payment experience (and) already, the partnership is off to a great start as we’ve seen 70% growth in the number of our customers using Atome in Singapore and Malaysia since our soft launch in recent weeks.”

A recent feature by Tech Wire Asia stated that BNPL payments have become increasingly popular in Southeast Asia as more shoppers opt for the flexible payment method when shopping.

“Due to (financial uncertainty caused by the pandemic), many fintech companies seized the opportunity to implement buy now pay later (BNPL) solutions, replacing traditional financing options with more convenient, alternative payment methods,” the feature included. “What makes BNPL enticing is that it allows customers to make purchases and pay them off over time in weekly, bi-weekly, or monthly installments (and) these products often come with appealing features including 0% interest, pay-in-installments, and ease of use.”

Globally, BNPL is a booming market that’s set to grow from US$7.3 billion in 2019 to US$33.6 billion in 2027 at a compound annual growth rate (CAGR) of 21.2%, Coherent Market Insights estimates. In this timeframe, Asia Pacific is forecast to be the fastest-growing region owing to increasing Internet users. 40 million new users joined Southeast Asia’s digital economy in 2020 alone, bringing the total number of Internet users in the region to 400 million, according to the e-Conomy SEA Report 2020.

Main image credit: 123rf

MARKETING Magazine is not responsible for the content of external sites.