30% sales drop in Q2, 2020.

This year has been the worst period for retailers in Malaysia since 1987, as the market turned into a bloodbath since mid- March with the Movement Control Order (MCO).

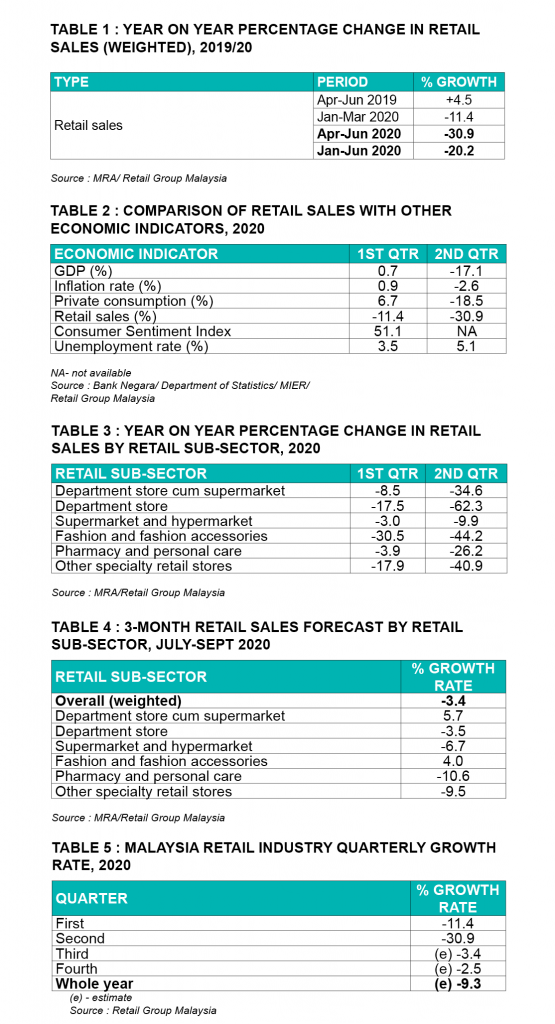

For the second quarter of 2020, Malaysia’s retail industry suffered a negative growth rate of 30.9% in retail sales, as compared to the same period in 2019 (Table 1).

This latest retail sale performance is probably the worst quarterly result in the history of the Malaysian retail industry.

For the first 6 months of this year, the retail sale growth rate was -20.2%, as compared to the same period a year ago.

Comparison with other economic indicators

For the second quarter of 2020, Malaysia national economy recorded a negative growth rate of 17.1% (Table 2, at constant prices), as compared to -30.9% for retail sales (at current prices).

…. Despite opening during the entire lockdown period, the Supermarket and Hypermarket sub-sector reported a negative growth rate of -9.9% during the second 3-month…

This was the first quarterly economic contraction for Malaysia since the global financial crisis in 2008.

On the other hand, prices of foods and beverages rose moderately every month during this period.

Private consumption reversed its growth momentum with -18.5% during the second quarter of 2020. The strict movement restrictions affected consumers’ spending during this period.

Unemployment rate during the second quarter of 2020 climbed to 5.1%.

Retail Sub-Sectors Sales Comparison

Except Supermarket and Hypermarket sub-sector, all other retail sub-sectors reported double-digit negative quarterly results.

Department Store cum Supermarket sub-sector recorded a disappointing growth rate of -34.6% during the second 3 months of this year.

Businesses of Department Store sub-sector contracted by 62.3% during the second quarter of 2020. This was the worst performing sub-sector during this latest quarter.

Despite opening during the entire lockdown period, the Supermarket and Hypermarket sub-sector reported a negative growth rate of -9.9% during the second 3-month period of 2020.

Fashion and Fashion Accessories sub-sector experienced a decline in business with a growth rate of -44.2% during the second quarter of 2020, as compared to the same period a year ago.

….Consumers are expected to tighten their spending during the last 3 months of this year when their monthly loan repayment re-started…

3 Months Forecast

The business outlooks of members of retailers’ association in the next 3 months are mixed. They estimate an average growth rate of -3.4% during the third quarter of 2020 (Table 4).

The department store cum supermarket operators hope their businesses will turn around with positive growth rate of 5.7% for the third quarter of this year. The department store operators are expecting their businesses to drop by 3.5% for the third 3-month period of this year.

Supermarket and hypermarket operators in the third quarter of 2020, anticipate a contraction of 6.7% in retail growth rate.

Retailers in the fashion and fashion accessories sector expect their businesses to recover with a growth rate of 4.0% during the third quarter of 2020.

Retailers in the Pharmacy and Personal Care sub-sector do not expect their businesses to recover in the next 3 months. Their businesses will decline by 10.6% during the third quarter of 2020.

REST OF 2020

The 6-month moratorium will end on 30 September 2020. Consumers are expected to tighten their spending during the last 3 months of this year when their monthly loan repayment re-started.

Retail Group Malaysia (RGM) has revised the fourth quarter growth rate downwards from -1.5% (estimated in July 2020) to -2.5% (Table 5).

With consideration of the latest growth revisions and market conditions, Retail Group Malaysia (RGM) has revised the retail sale growth rate for whole year from -8.7% (estimated in July 2020) to -9.3%.

*This report is based on interviews with members of the Malaysia Retailers Association (MRA) on their retail sales performances for the second quarter and rest of 2020. For more information, write to [email protected].

DOWNLOAD FULL REPORT HERE

———————————————————————————————————————————————–

The 14th Malaysian Media Conference (MMC) is happening on 25 September at the Sime Darby Convention Center and is proud to announce its list of speakers compromising the most influential leaders in Malaysia’s media landscape. Have you registered to join MMC 2020?

MARKETING Magazine is not responsible for the content of external sites.