The fastest rising brands in the BrandZ ranking were from the technology sector this year while automotive and mass personal care brands lagged behind.

A wide variety of brands with diverse marketing approaches are rising up in this year’s global BrandZ ranking of the top 100 brands by Kantar, showing that any sector or category is ripe for disruption.

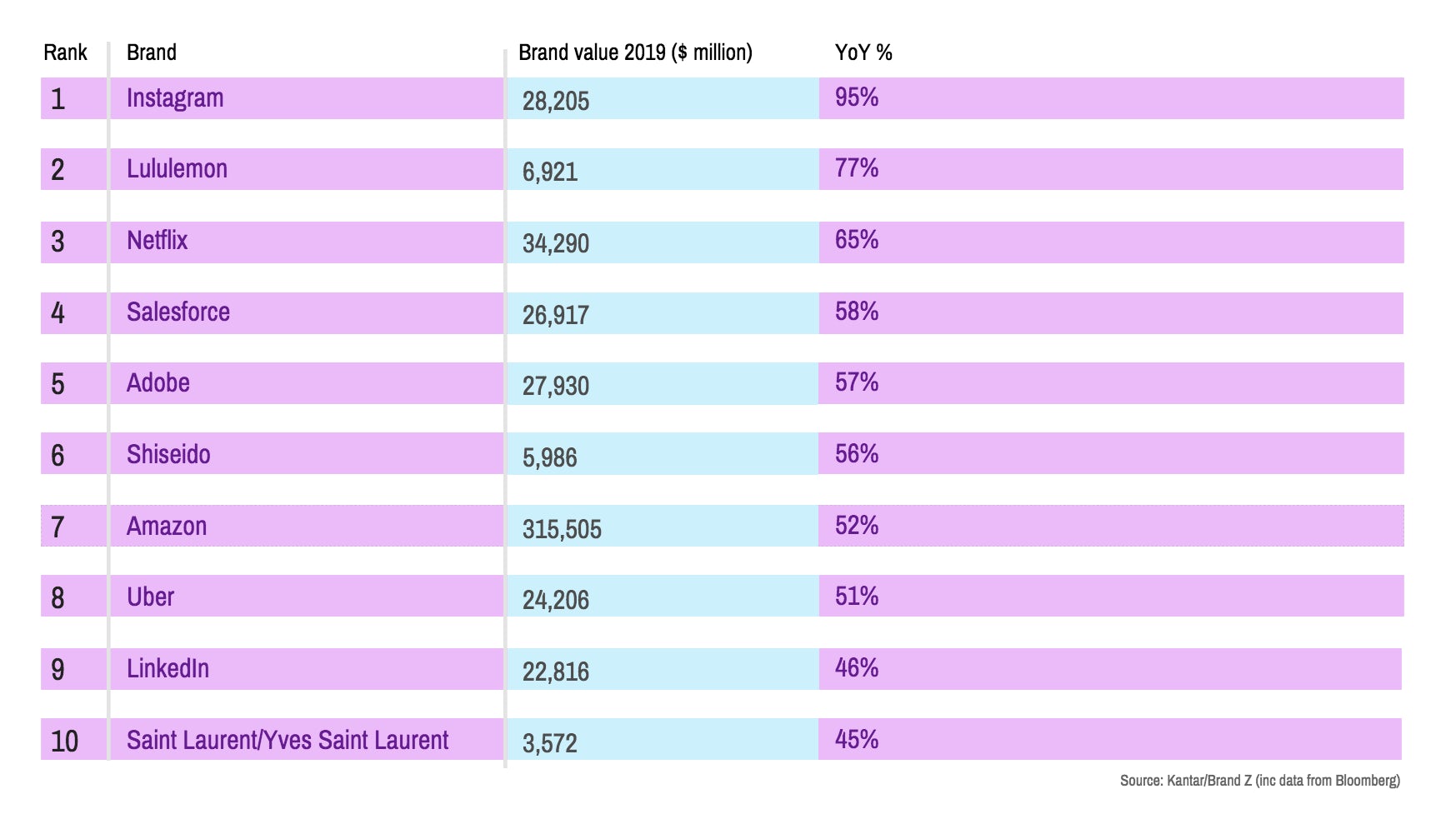

Facebook-owned Instagram is this year’s fastest riser, climbing 47 places after a 95% increase in brand value takes it to USD$2.82bn.

The second-fastest riser is Lululemon (77%) followed by Netflix (65%), Salesforce (58%), Adobe (57%) and Shiseido (56%).

All of these brands have grown at a faster rate than this year’s leader Amazon, which increased its value by 52%. Other fast risers include Uber (51%), LinkedIn (46%), YSL (45%) and restaurant chain Chipotle (40%).

“Some [brands] are still establishing themselves, growing by reaching previously unexposed audiences, such as Instagram. Some are reminding consumers of what they stand for like Chipotle, or refreshing their positioning and perceptions like YSL,” explains Graham Staplehurst, BrandZ’s global strategy director.

“Others are extending and innovating into new sectors, as we are seeing with Uber expanding into home food delivery with Uber Eats and even underwater ride hailing ScUber on the Great Barrier Reef.”

He adds: “Many of the fastest growing brands are tapping into evolving consumer ecosystems, or are creating their own, like newcomers Meituan (78th) and Didi Chuxing (71st) in China. They are brands that keep themselves relevant to consumers and easy to choose and use.”

Due to an increased focus on lifestyle and wellbeing, luxury brands are having somewhat of a renaissance and are the fastest growing category this year (29%). Alongside YSL, top performances come from Dior (29%), Louis Vuitton (15%), Gucci (13%) and Hermes (10%).

Luxury is driving growth in the premiumisation of the personal care category too, with high-end personal care brands (Clinique, Estée Lauder, Garnier, Lancôme, L’Oréal, Shiseido) up 14% collectively, while mass personal care brands (Colgate, Crest, Dove, Gillette, Head & Shoulders, Nivea, Olay, Oral-B, Pantene) are down 4%.

Retail is the second fastest growing category (25%), and the strategies of the highest performers – including Amazon, Home Depot, Walmart, Costco, Ikea, Lowe’s and Aldi – indicate that if brands move with changing consumer needs and behaviours to deliver high quality experiences they can still win in a challenging retail landscape.

Of course, not all brands are growing in value. After Tencent, the biggest losers are GE (-32%), Baidu (-22%) and DHL (-19%), with other value-declining brands including Zara (-16%), Marlboro (-12%), IBM (-11%), Samsung (-6%) and Gillette (-8%).

Not one car brand increased its value in 2019, with BMW and Mercedes-Benz both down 9% and Toyota down 3%, while Ford and Honda drop out of the ranking completely. Meanwhile, with a brand valuation of USD$9bn, Tesla is close to entering the ranking for the first time.

source:/www.marketingweek.com

MARKETING Magazine is not responsible for the content of external sites.

After 20 years of evolving technology, shifting market trends, and adapting to changing consumer behaviour, the media landscape has nearly reached saturation.

We’ve optimised to the fullest, providing advertisers with abundant choices across technology, platforms, data-driven marketing, CTV, OTT, DOOH, influencer marketing, retail, etc.

Media specialists have diversified, but with more options comes the challenge of maintaining income growth. The industry is expanding, but revenue isn’t keeping pace.

Now, we’re at a TURNING POINT: time to explore and harness new sustainable revenue streams. While GroupM forecasts a 7.8% global ad revenue growth in 2024, challenges like antitrust regulation, AI and copyright issues, and platform bans persist.

Collaboration is key: partnerships that thrive on synergy, shared values, and aligned goals are becoming increasingly essential.

Hence, the Malaysian Media Conference, in its 20th year, has assembled the partners and players under one roof on October 25 for a day of learning, sharing, and exploring.

REGISTER NOW