Meltwater, a global leader in social and media intelligence and data analytics, has today released its “State of Social Media 2023” report, revealing Facebook remains the dominant social media platform for APAC marketers, closely followed by LinkedIn and Instagram.

Despite TikTok being named the fastest growing social media channel, it seems it is yet to be leveraged by marketers at the same rate as those well-established platforms.

The report, which includes findings from over 1,700 global marketing and communications professionals, found that the majority of organisations are using at least four of the most common social media platforms within their strategy, with 77% planning to maintain or increase social budgets in 2023, and 60% saying that the current economic development has led to social media being perceived as more important by their organisation.

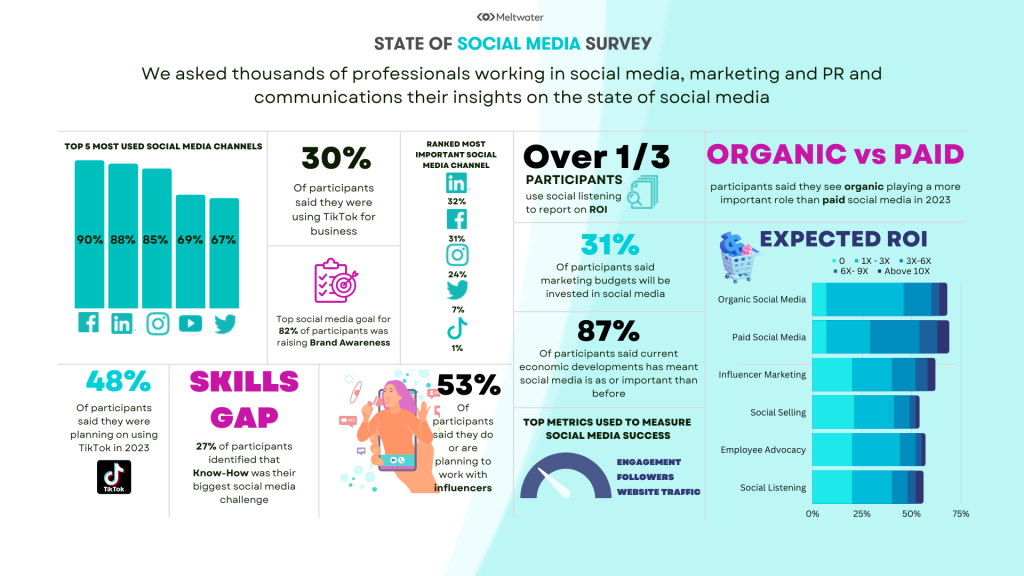

Five of the most used social media channels in APAC are a long way ahead of the rest: Facebook (87%), LinkedIn (81%), Instagram (81%), YouTube (67%) and Twitter (50%). But TikTok, in sixth place (29%), is rapidly growing (globally 30% vs 16% in 2021), with nearly half (41%) of organisations across APAC planning on introducing it to their marketing mix in 2023.

Branding remains the primary reason for using social media, with the majority of marketers (79%) using social to “raise brand awareness” and (71%) to “increase brand engagement”.

This was followed by acquiring new customers (53%) and increasing web traffic (46%), with only 36% using social to directly increase sales, and only 19% to increase customer satisfaction.

Measuring social media marketing performance also continues to be a top challenge for marketers, with over half (56%) of APAC marketers stating that “measuring the impact/ROI of social media” was the biggest social media marketing challenge, with 40% struggling to “prove the value of social media”.

This was also reflected by ‘revenue generated’ being the lowest used metric by marketers (21%), suggesting marketers are still finding it challenging to directly link social spend to the bottom line.

Whilst different social media channels are used for different purposes and require a number of measurement metrics, the top three social media metrics for APAC marketers are social media engagement (82%), web traffic (64%) and social media followers (63%).

Social listening is also on the rise with 42% currently running a social listening program, and another 15% planning to do so in 2023 – with the goal to gain a better understanding of audiences and target groups (64%).

“As we are moving into a cookie-less future, facing tighter data and privacy regulation and increased fragmentation, the integration of social media listening and customer data will be critical for marketers to reach the right audience and provide a personalised customer experience”, said Ross Candido, VP ANZ and South-East Asia Meltwater.

Whilst influencer marketing has been growing steadily, the report found less than half of marketers (39%) currently use influencers, and a further 16% are planning to do so.

Most APAC marketers (72%) also see organic social playing a more important role in driving business and marketing strategy in 2023, and 60% see paid social playing a more important role.

77% plan to maintain or increase social budgets in 2023, with 60% saying that the current economic development has led to social media being perceived as more important by their organisation.

“It’s clear that successful marketers are embracing a strategic mix of social media strategies. Social media has established its place in the marketing and communications mix.

There’s been a lot of talk about organic being dead or phased out, but based on the survey findings, the importance of both paid and organic social media is set to increase in 2023 and the current economic situation has played a role in this development.

As paid opportunities evolve and Facebook owned channels become more integrated, this will have an impact on how people are using the platforms in the future,” said Ross Candido.

To explore further, the full report can be found here.

MARKETING Magazine is not responsible for the content of external sites.