“Programmatic Out-Of-Home – Promise or Curse?” was first published in MARKETING WEEKENDER Issue 338

By Ron Graham

As markets emerge from the constraints of Covid the out of home media sector is rapidly recovering lost ground. The growth numbers are impressive albeit from a diminished base driven by Digital Out-Of-Home (DOOH) which is attracting attention of PE funds and stakeholders betting on digital OOH growth.

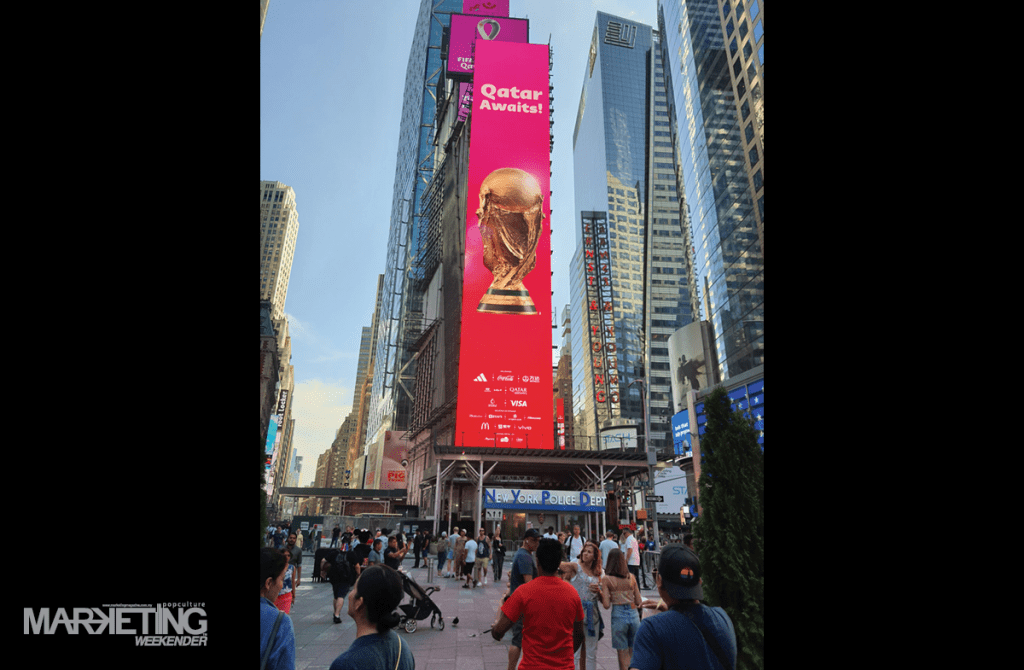

At the end of 2019, OOH had witnessed more than ten consecutive years of growth due to fundamental factors such as digitisation, improved measurement, rich location data plus a realisation that as a mass reach medium, OOH is a perfect partner to Online, Mobile and Social. Case after case showed us how OOH amplified digital media and provided a real-world on-ramp to the online world.

Furthermore, Digital OOH was showing its strengths for targeted and contextual advertising able to engage and activate audiences. One more benefit was the ability to measure attribution with dataset cross-overs from the physical world and the online world, leveraging on location, geofencing and retargeting.

There is an almost frenzied expectation about DOOH growth and the main driver is automation whereby the cumbersome nature of OOH media planning, buying, deployment, verification and reporting is benefitting from systems and tools which automate the exchange of information between the buyers and sellers of OOH and DOOH media. With the right data, media buyers can buy DOOH the way they buy other digital media, programmatically.

Programmatic Digital Out of Home or pDOOH, is happening especially in markets where there is an established ‘currency’ for audience measurement and where the media formats have scale and uniformity. Here in Malaysia pDOOH is small but growing quickly with local and international Programmatic platform providers.

The promise of pDOOH is the ability to be included in the world of online media, which in many markets, accounts for more than half of all media spends so this represents incremental revenue for out of home media providers.

Supply-side platforms (SSP) and Demand-side platforms (DSP) aim to connect sellers and buyers – programmatically. The prevailing situation in Asia however is that many media operators do not have SSP systems. As the DSP folks try to get the buying information, they realise a break in the chain. The major DSP providers are also offering a SSP solution, (often free in return for access to the media operators’ inventory data), oblivious to the potential conflict

Programmatic providers also promise that CPM’s for pDOOH must be higher than a media owner’s existing CPM thereby booking unsold inventory, at a premium price from new sourced budgets. If this is true, then media owners should grab pDOOH with both hands… but have we really considered if DSP’s will deliver these advantages? And what does it mean in practical terms for the media operators?

Flexible access to digital out of home screens assumes highly targeted DOOH media at places and times of most value, such as peak-hour commutes, Mon-Fri which tends to leave odd shaped gaps in the loop at off-peak times. Can those peak times really command a price premium to offset vacant spaces which cannot sell? Anxiety to get scale of supplier data is resulting in DSP’s offering private market place deals (PMP) for standard play loop time slots. This early practice could also create benchmark CPM expectations that may be hard to adjust when more flexible trades happen and price premiums are proposed.

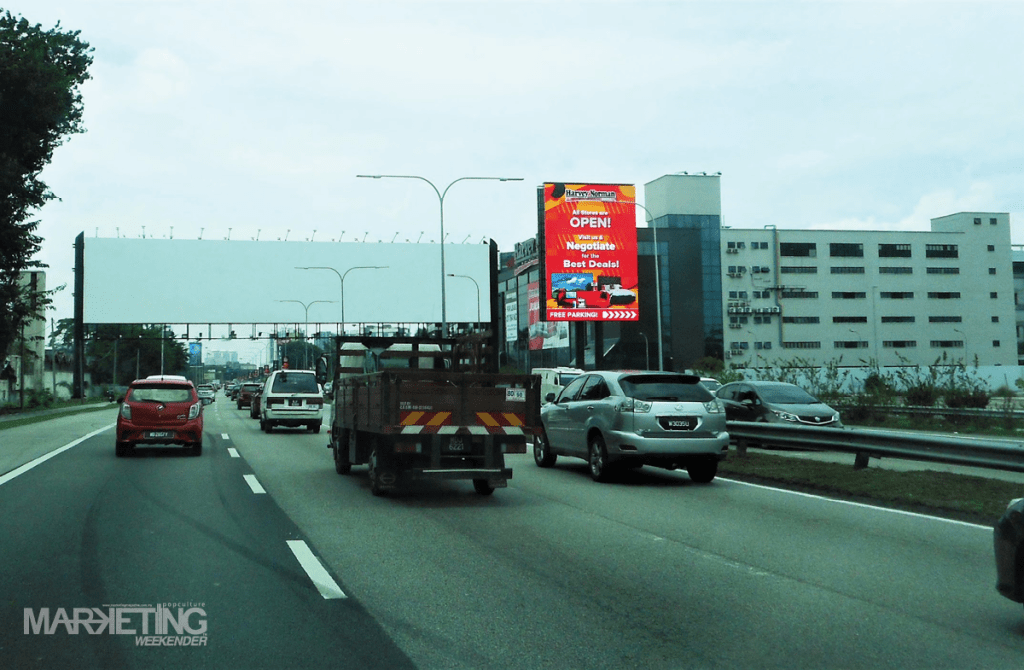

CPM or impressions-based trading, essentially requires a common approach to audience measurement, to determine the impressions delivered as a basis for CPM calculations. Malaysia does not have a common adopted source of audience measurement for OOH and DOOH media. The contingency relies on traffic data; (vehicle counts for roadside media and footfall traffic for indoor environments such as malls or rail stations). This is quite acceptable but traffic data must come from reliable sources, only for direction of viewability, modified for vehicle occupancy.

Traffic data is often used as a proxy for one-to-many exposure, sometimes referred to as impressions multiplier. This is a blunt solution which fails to account for wide variations of size, format, dwell time and environments.

CPM cannot stand alone, without an adjustment for quality, impact and effect. A 200 sq mtr billboard has more impact than a 50 sq mtr. Digital OOH screens have added effect over static posters. Play loops of 2-minutes offer frequent exposures versus those with longer loops.

DOOH media operators must retain the opportunity to differentiate their products on quality, visibility, impact and effect. Media buyers need scale of access to supply for comparative assessment and to optimise their media investment choices. Brands are already concerned over lost value in the chain of platforms and services between their dollars spent and the net media value delivered and they risk lower ROI with pDOOH.

Advocates claim that Programmatic DOOH is an evolving process which will get better and we should carry on to test-and-learn. This is not good enough when there are clear issues which devalue the medium but can be addressed.

Ron has experience in both media owner and media buying sides of the business and can draw on vast knowledge to contribute at multiple levels in the OOH industry, with advertisers, agencies, media owners, technology providers, property owners, Government agencies and institutions. With focus on strategy, business development and best practice, from an independent and objective standpoint, Ron’s aim is to address the challenges facing OOH media business, identify what is next, what is possible and provide actionable plans for achievable results.

MARKETING Magazine is not responsible for the content of external sites.