The Malaysian Digital Association (MDA), the apex representative body for online publishers, advertising agencies and digital service providers in Malaysia, released a report on “Covid-19 lockdown: Malaysians go online for work, food and TV”, which is produced by SimilarWeb.

The MDA recently appointed SimilarWeb as its measurement partner for Market Insight. The report provides an overview about how the nation has adapted online to the Movement Control Order (MCO) implemented to break the chain of Covid-19 infection.

As the number of Covid-19 infections in the country rose through February and March, so did Malaysians’ expectations of measures to restrict movement as had occurred in China and Italy. A partial two-week lockdown that began on midnight March 18 and scheduled to end on 31 March has now been pushed another two weeks and will end on 14 April 2020.

With households hunkered down at home, desktop and mobile web traffic showed a mass migration to online services for news, conference calls, grocery shopping and delivery, and entertainment during the third week of March.

In this study by the MDA and its Market Intelligence partner SimilarWeb, we compared the sequential year-on-year (YoY) growth rates to study the change in traffic for key online services. We used sequential YoY to control for noise such as bounce and users switching in and out of sites.

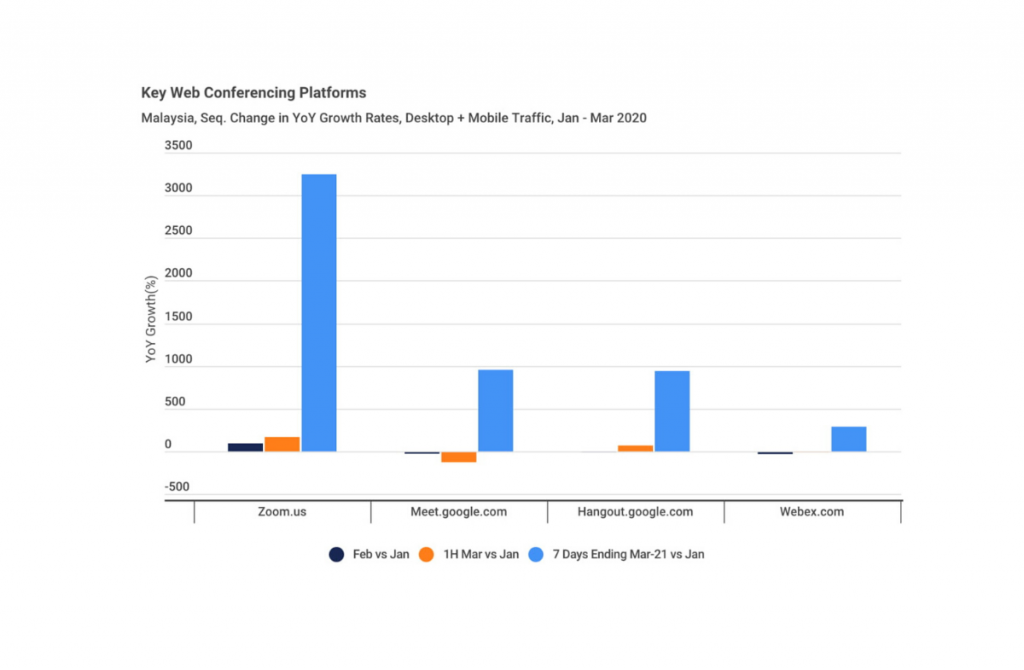

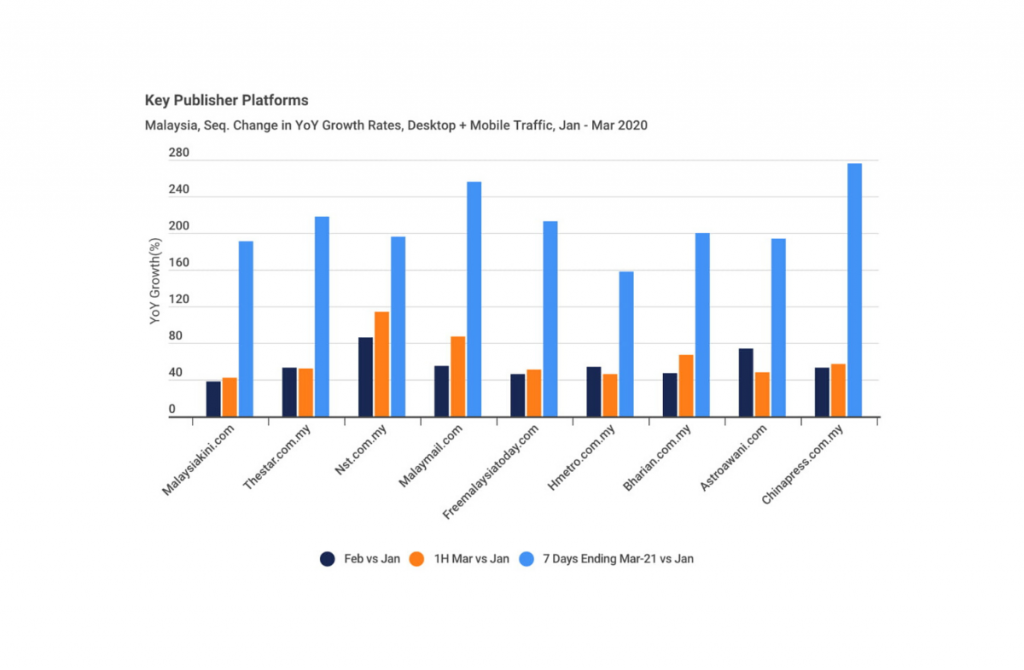

Using January as a base, the report compares YoY change for February, the first half of March (1H) and a rolling 7-day period (15 to 21 March) to chart the growth in traffic.

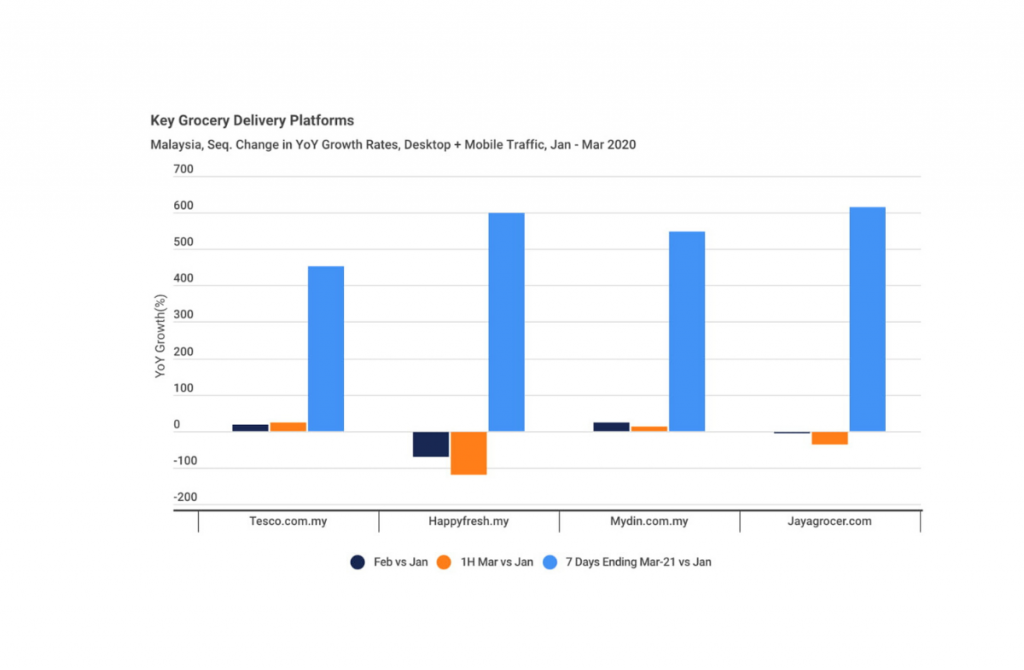

Key grocery delivery players saw traffic growth rates surge during the third week of March, compared to traffic in the first two weeks of March as well as February. The online stores of supermarket chain Jaya Grocer (jayagrocer.com) and grocery delivery service HappyFresh (happyfresh.my) saw the biggest jumps in sequential traffic in the third week of March, with activity up by 600%, compared to the first two weeks of the month.

Traffic to hypermarket chain Mydin (mydin.com.my) grew more than 540% in sequential traffic, while that to Tesco (tesco.com.my) rose by more than 450%.

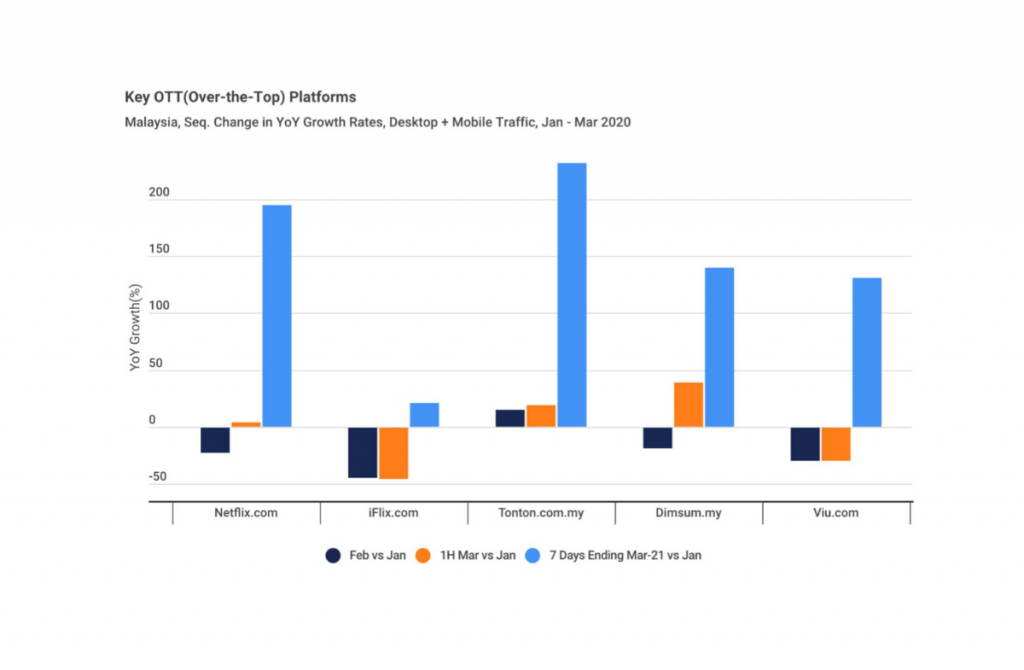

Demand for entertainment also swung up with streaming video consumption rising as curbs on movement kept people indoors. Netflix (netflix.com), as expected, gained 195% in sequential traffic in March on a rolling 7-day basis. Visits to homegrown video streaming service Tonton (tonton.com.my) jumped 232% in sequential traffic in the third week of March, while those to local subscription service dimsum (dimsum.my) and Asian drama streaming service Viu (viu.com) increased 140%.

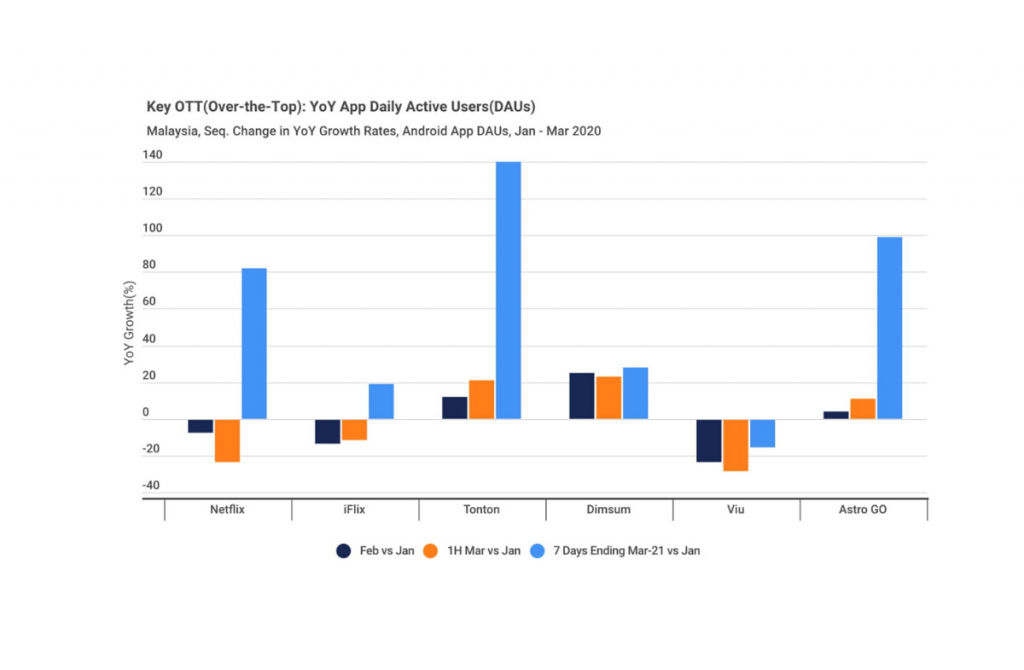

OTT mobile app DAU growth is also trending up. Astro Go, Netflix and Tonton grew more than 80% in sequential DAUs in the third week of March.

While businesses and offices closed their doors for the lockdown, workers continued to toil at home, with discussions shifting to WhatsApp and other messaging apps. Data on key web conferencing platforms show meetings migrated to the cloud through video and audio calls.

The volume on Google’s Meet and Hangouts (meet.google.com and hangout.google.com) surged ~950% in sequential traffic in March on a rolling 7-day period, while rival Zoom (zoom.us) saw a phenomenal burst of traffic, growing in excess of 3,180% compared to the sequential traffic in 1H March.

Hungry for news and information, Malaysians flocked to online media outlets, with sequential traffic surging between 190% and 250% during the rolling 7-day period in the third week of March for eight key publisher platforms, and 276% for a ninth, China Press (chinapress.com.my), compared to 1H March.

MARKETING Magazine is not responsible for the content of external sites.

An afternoon of conversations we never had, with leaders most of you never met.

Discover what’s possible from those who made it possible. Plus a preview of The HAM Agency Rankings REPORT 2024.

Limited seats: [email protected]

BOOK SEATS NOW