Dentsu Aegis Network’s latest advertising spend forecast, based on data from 59 markets, predicts global growth will reach +3.6% in 2019, following growth of 4.3% in 2018, taking total investment to US$609.9 billion.

In Asia Pacific, there is a predicted +4.0% growth in 2019, following +5.3% in 2018, taking total investment to US$216 billion.

Geographically, Asia Pacific is the leading contributor to the global increase of US$20.9billion in 2019 compared to the previous year, contributing 39% of the global increase, closely followed by North America 34%.

Comparatively, Western Europe is forecast to contribute 14% to new ad dollars with Latin America at 11% and Central and Eastern Europe at 3%.

In Asia Pacific, forecasts have been revised downwards (-0.5%) from January following market softness at the beginning of the year particularly for TV, the lack of major events scheduled was also a contributory factor.

China continues to be the leading contributor to Asia Pacific and global ad spend and will continue to grow in 2019 by +5.4% to reach RMB 671 billion, a surprisingly healthy and stable growth rate, which remains on track despite the headwinds from trade tensions with the U.S.

The global forecast reflects softening growth across 9 of the top 13 advertising markets worldwide, with India and Brazil bucking the trend with accelerating growth in 2019.

Some markets saw downward revisions from January 2019 forecasts including Italy and Russia with both markets seeing GDP slow alongside ad spend.

Takaki Hibino, Executive Chairman, Dentsu Aegis Network Asia Pacific said, “Asia Pacific has long been the melting pot of digital and technology developments….though we have been facing a tougher economic environment, our ad spend forecast has shown that digital connectivity in APAC remains at its peak and consumer adoption rates have leapfrogged.”

Key market trends

- Australia: 2019 is expected to grow by 1.9% to AUD$16.6 billion, which is a modest increase in overall spend from 2018.

- Majority of the growth is expected to come from Digital and Video channels.

- China: the ad market continues to be a leading contributor to global ad spend and will continue to grow in 2019 by +5.4% to reach RMB 671 billion but at a lower growth rate than the +7.0% growth forecast in the January 2019 report. Digital is still the biggest driver of growth in total ad spend in China with the biggest share (63.6% in 2019) and growth rate.

- India: forecast double-digit 2019 growth of 11.4% to reach INR 696.9 billion (up from the 10.6% forecast in January and 10.8% growth in 2018) with the Cricket World Cup putting growth on the front foot. TV continues to be the leading media in 2019 and will contribute 39% share of total spend. Despite digital growth, TV continues to be dominant as it enjoys unmatched share of audiences. With 40% allocation of advertising spends, TV is forecast to expand in 2019 by 9.5% to reach INR 271.4 billion.

Global media trends

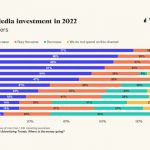

- Digital continues to power ad spend growth and is forecast to grow 11.5% in 2019 to reach US$249.7 billion and 41.8% of global share. Growth is steady into 2020 putting digital’s share of ad spend at nearly 45% by the end of the year.

- Mobile is the fastest growing platform within digital and is forecast to grow 21.4% in 2019. Powering this growth is the increasing consumption of video on mobile – from Instagram Stories, TikTok and Snapchat to YouTube and VOD – with online video in general set to grow 20.5% in 2019.

- TV ad-spend is forecast to shrink slightly in 2019 (-0.1%) with a return to modest growth in 2020 of 0.6%. Into 2020 growth will be driven by more dynamic TV opportunities and innovation as the penetration of smart TVs continues.

- The decline of traditional print has accelerated from our January 2019 forecasts (Newspapers -7.7% and Magazines -7.4%) as digital continues to dominate.

- Out of Home sees continued growth and an upwards revision from January to 4.3% in 2019 to reach 6.3% share. Growth is driven by innovations in DOOH.

MARKETING Magazine is not responsible for the content of external sites.