Media owners advertising revenues in Malaysia are increasing this year to reach MYR 6.1bn ($1.5bn). The economy will grow by +5.6% on a real GDP basis, following 2021’s +3.1% growth. While this is lower than prior expectations, brands spent anyway, especially on digital advertising formats. With 84% of the population now fully vaccinated, consumer behavior is returning to normal as well.

In this environment, linear advertising revenues are increasing by +6% to MYR 2.3bn ($545 million). Linear budgets remain at just 68% of their pre-COVID levels. Because linear ad spending will erode from here as consumers continue to shift to digital media formats, linear advertising revenues will never again approach their pre-COVID highs.

TV spending, which increased by +1%, are now 92% of their pre-COVID total. Finally, with the economy returning to normal and consumer spending increasing, cinema screens have re-opened. Recovering from the fallout due to closed operations, cinema is showing a substantial growth this year of +330%.

Finally, an increase in consumer behavior means that OOH spending will increase this year (+13%) and will continue to grow by +15% in 2023.

Digital advertising spending, on the other hand, will grow by +18% to reach 63% of total budgets. Digital advertising spending is being led by social media, which will increase by +25% and represents 47% of total digital budgets. By format, spending is led by mobile (+24%), display (+17%), and search (+14%). Digital advertising spending will continue to significantly outperform linear budgets, and by 2026, digital formats will represent 73% of total advertiser budgets.

Malaysia reopened its borders to all international visitors starting April 1st. This will provide a boost to the tourism, airlines, and hotel industries. In addition, Malaysian general elections, while not constitutionally required until mid-2023, have been rumored (a snap election) throughout the past few months. If there is a snap election that could also provide some incremental TV ad spending revenues.

In 2023, ad spending will grow by +6% to reach MYR 6.5bn ($1.6bn). GDP will continue to grow by +5%, and linear budgets will begin to decay in 2023 and beyond.

“Digital advertising is clearly the dominant media, projected at 63% of total advertising spends in 2022, and driven mainly by social media advertising. This will continue to grow in the coming years and is projected to represent 73% of total advertiser budgets by 2026,” said Fan Chen Yip, Chief Investment Officer of Mediabrands Malaysia. “In the linear advertising formats, it is very heartening to see that cinema is coming back in a big way, with an expected colossal growth of 330% for the year. OOH has similarly rebounded, spurred by the on-the-move culture of Malaysians, with a projected 13% growth. We are very optimistic about the OOH scene that has largely taken off due to new technological innovations within DOOH.”

“Programmatic and addressable technologies, and audience targeting in general, remains the growth engine of many digital formats. Hence the recent announcement of the availability of addressable TV advertising by Astro is equally exciting,” added Fan. “The digital-style targeting on TV is a first in the Southeast Asian region, and leverages Astro’s first-party data, providing a more impactful advertising experience for consumers. While still early days, we expect this innovation to help TV maintain its position as the mainstay amongst linear TV and may possibly stem the decline on TV advertising, as other TV operators catch on to this addressable technology.”

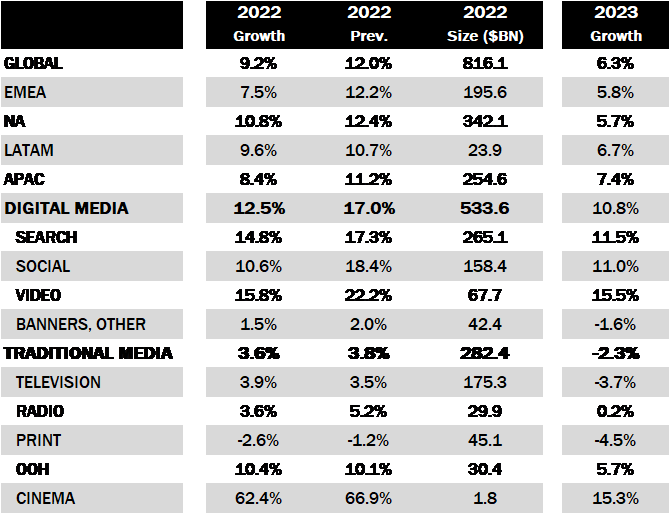

Vincent Létang, EVP, Global Market Research at MAGNA and author of the report, said, “Most of the headwinds facing the advertising market this year were expected: economic landing following a red hot 2021, continued supply issues generating inflation, and mounting privacy restrictions slowing down the growth of digital ad formats. On top of that, the war In Ukraine now exacerbates inflation and economic uncertainty. Nevertheless, MAGNA believes full-year advertising revenues will grow again in 2022, helped by a strong start to the year, on top of organic and cyclical drivers.”

“Organic growth factors (continued and broad-based ecommerce spending, digital marketing adoption), strong cyclical drivers (record political spending in the U.S., Winter Olympics and FIFA World Cup), and the strength of emerging or recovering industry verticals (Travel, Entertainment, Betting, Technology) will generate enough marketing demand to offset headwinds and keep the advertising economy growing in full-year 2022,” added Vincent.

“While some markets continued to bear the effect of mixed Covid impacts through-out 2021, the APAC region advertising revenues have continued to rise to +35% above pre-COVID spending levels. Not surprisingly this has been largely driven by digital advertising, as digital consumption is even further integrated into consumer day-to-day lives. APAC consumption is already more significantly skewed towards Ecommerce than it is in western markets. Giants like Alibaba, JD.com, Rakuten, and Pinduoduo, have grown to the point where shopping online is just as large as shopping in person, vs. ecommerce sales at an average market share of 20% of total retail sales in the West,” commented Leigh Terry, CEO Mediabrands APAC.

MARKETING Magazine is not responsible for the content of external sites.

After 20 years of evolving technology, shifting market trends, and adapting to changing consumer behaviour, the media landscape has nearly reached saturation.

We’ve optimised to the fullest, providing advertisers with abundant choices across technology, platforms, data-driven marketing, CTV, OTT, DOOH, influencer marketing, retail, etc.

Media specialists have diversified, but with more options comes the challenge of maintaining income growth. The industry is expanding, but revenue isn’t keeping pace.

Now, we’re at a TURNING POINT: time to explore and harness new sustainable revenue streams. While GroupM forecasts a 7.8% global ad revenue growth in 2024, challenges like antitrust regulation, AI and copyright issues, and platform bans persist.

Collaboration is key: partnerships that thrive on synergy, shared values, and aligned goals are becoming increasingly essential.

Hence, the Malaysian Media Conference, in its 20th year, has assembled the partners and players under one roof on October 25 for a day of learning, sharing, and exploring.

REGISTER NOW