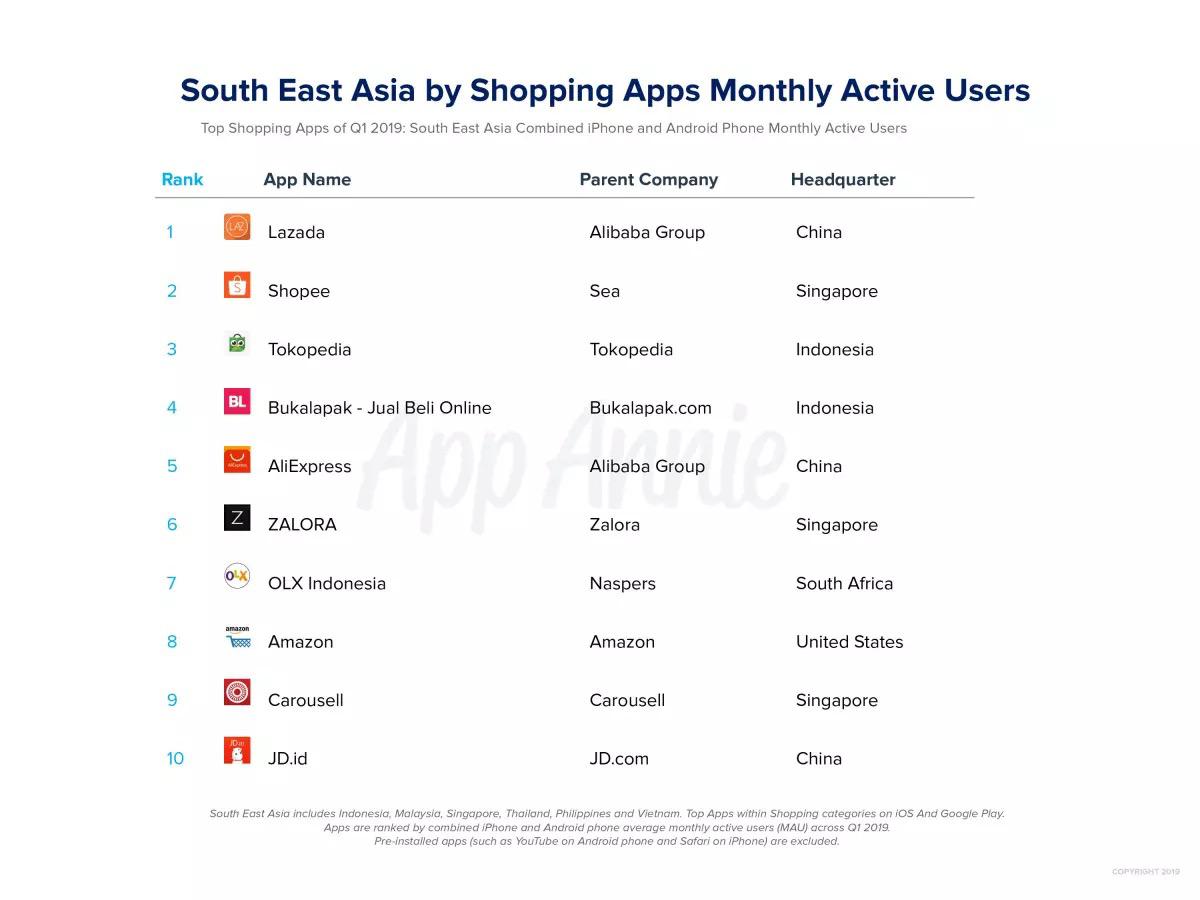

Lazada is leading the way in ecommerce in Southeast Asia in terms of monthly active users, with Shopee trailing not far behind.

The Map of E-commerce market study by online shopping aggregator iPrice Group and app analytics company App Annie found that Lazada had the most number of monthly active users as of Q1 2019 in the Southeast Asian region.

It placed first in the Philippines, Malaysia, Thailand, and Singapore in that regard. The Alibaba-backed company also snagged top positions in Indonesia and Vietnam, placing fourth and second, respectively.

Shopee, on the other hand, showed steady growth as it ranked first in Vietnam and second in Indonesia, Thailand, the Philippines, and Malaysia.

It also became the most visited ecommerce platform in Southeast Asia during the quarter, with combined website and app traffic increasing by 5% over the previous quarter to 184.4 million visits.AD.

Lazada previously held the title in Q4 2018, but was beat out amid a 12% decline in total average visits to 179.9 million. Helping Shopee’s rise is its prominence in Indonesia, which accounted for about 40% of its total visits.

Tokopedia, Indonesia’s top platform of choice, was the third most visited ecommerce platform in Southeast Asia for the quarter. It remains a prominent competitor as it holds the biggest market share in the region’s most populated country.

Meanwhile, Indonesia’s Bukalapak and Vietnam’s Tiki placed fourth and fifth, respectively, as most visited platforms during the quarter despite operating in only one market.

A report by Google and Temasek stated that ecommerce has been “the most dynamic sector” of Southeast Asia’s online economy, growing four times since 2015. It is expected to garner more than US$100 billion in gross merchandise value by 2025.

Google and Temasek’s report also showed that three companies accounted for much of ecommerce’s rise in the region: Lazada, Shopee, and Tokopedia.

source: http://www.techinasia.com

MARKETING Magazine is not responsible for the content of external sites.