By The Malketeer

X’s Advertising Revenue Plummeted from US$4.5bn in 2022 to Just US$2.2bn in 2023

In what industry analysts are calling a self-inflicted wound of historic proportions, X (formerly Twitter) appears to be leaving billions in potential advertising revenue on the table, even as its social media rivals enjoy unprecedented growth.

A comprehensive new analysis reveals the true cost of Elon Musk’s controversial leadership style and its impact on the platform’s advertising business.

The Great Advertising Exodus

The numbers paint a stark picture.

X’s advertising revenue plummeted from US$4.5bn in 2022 to just US$2.2bn in 2023—a staggering 46.4% year-on-year decline.

As the platform struggles to maintain its advertising base, forecasts suggest earnings will further deteriorate to US$2bn in 2024, with 2025 threatening to push revenues below the US$2bn mark for the first time in over a decade.

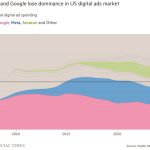

A Tale of Two Markets

While X grapples with this dramatic decline, its competitors are thriving in what has become a boom period for social media advertising.

Instagram saw ad spend surge by 29.4% in 2023, while both Snapchat and Pinterest are projected to achieve double-digit growth in 2024, at 13.8% and 18.1% respectively.

Counting the Cost

The true scale of X’s missed opportunity becomes clear when analysing potential revenues against market trends.

Had the platform maintained its pre-acquisition growth trajectory relative to the wider social media market, X could be earning more than double its current advertising revenue.

WARC Media’s analysis suggests the platform could miss out on US$3.2bn in 2024 alone, following a US$2.7bn shortfall in 2023—totaling a remarkable US$5.9bn in potential lost revenue.

“Falling from a position as one of the top 20 media owners worldwide, X’s advertising business has eroded significantly since Q4 2022,” notes James McDonald, WARC’s Director of Data, Intelligence and Forecasting.

Brand Safety Blues

At the heart of this decline lies a fundamental disconnect between Musk’s vision for X and advertisers’ brand safety requirements.

Major brands including Coca-Cola, Unilever, and Mondelez International pulled their spending following Musk’s acquisition, concerned about his plans for minimal content moderation in his “global town square.”

Rather than address these concerns, X’s leadership has taken an increasingly confrontational stance.

Musk’s notorious “go f*** yourself” message to departing advertisers in November 2023 exemplified this approach, while the platform’s lawsuit against the World Federation of Advertisers marked a dramatic escalation in tensions.

A Crisis of Confidence

Recent research from Kantar suggests X’s problems run deeper than a simple advertiser boycott.

The platform faces a growing consensus among marketers that it simply cannot deliver on campaign objectives.

A mere 4% of marketers now consider ads on X to be brand safe, while 26% plan to reduce their spending on the platform in 2025—the highest planned reduction for any major advertising platform.

Platform Faces Existential Challenge

As X heads toward 2025 with forecasts suggesting continued decline, the platform faces an existential challenge.

Without a significant shift in approach to brand safety and advertiser relations, the gulf between X’s actual and potential advertising revenue may continue to widen, leaving billions more in unrealised opportunities on the table.

The question now isn’t just whether X can stem its advertising losses, but whether it even wants to.

As Jane Ostler, EVP Thought Leadership at Kantar, observes, X must overcome significant hurdles in both trustworthiness and innovation to win back advertiser confidence—a challenge that seems increasingly difficult given the platform’s current trajectory.

MARKETING Magazine is not responsible for the content of external sites.

An afternoon of conversations we never had, with leaders most of you never met.

Discover what’s possible from those who made it possible. Plus a preview of The HAM Agency Rankings REPORT 2024.

Limited seats: [email protected]

BOOK SEATS NOW