Netflix has finally admitted to what we all knew.

With the streaming wars kicking off in just a few weeks, Netflix faces serious competition for the first time since it started streaming more than a decade ago.

And that competition from the impending launches of Disney+ and Apple TV+, along with several others from major media brands like HBO and NBC, could have a negative impact on Netflix’s subscriber growth.

Netflix disclosed these issues after its mixed earnings report Wednesday that showed a beat on earnings, but a miss on subscribers. The company also predicted it will add fewer subscribers in the fourth quarter of this year than it did a year ago.

And the reasons are obvious:

Price increases cause people to unsubscribe

In January of this year, Netflix raised prices, with its most popular HD streaming plan going from $10.99 per month to $12.99 per month. In its letter to shareholders, Netflix said the price increase was partially to blame for the subscriber miss.

“Since our U.S. price increase earlier this year, retention has not yet fully returned on a sustained basis to pre-price-change levels, which has led to slower U.S. membership growth,” the letter said.

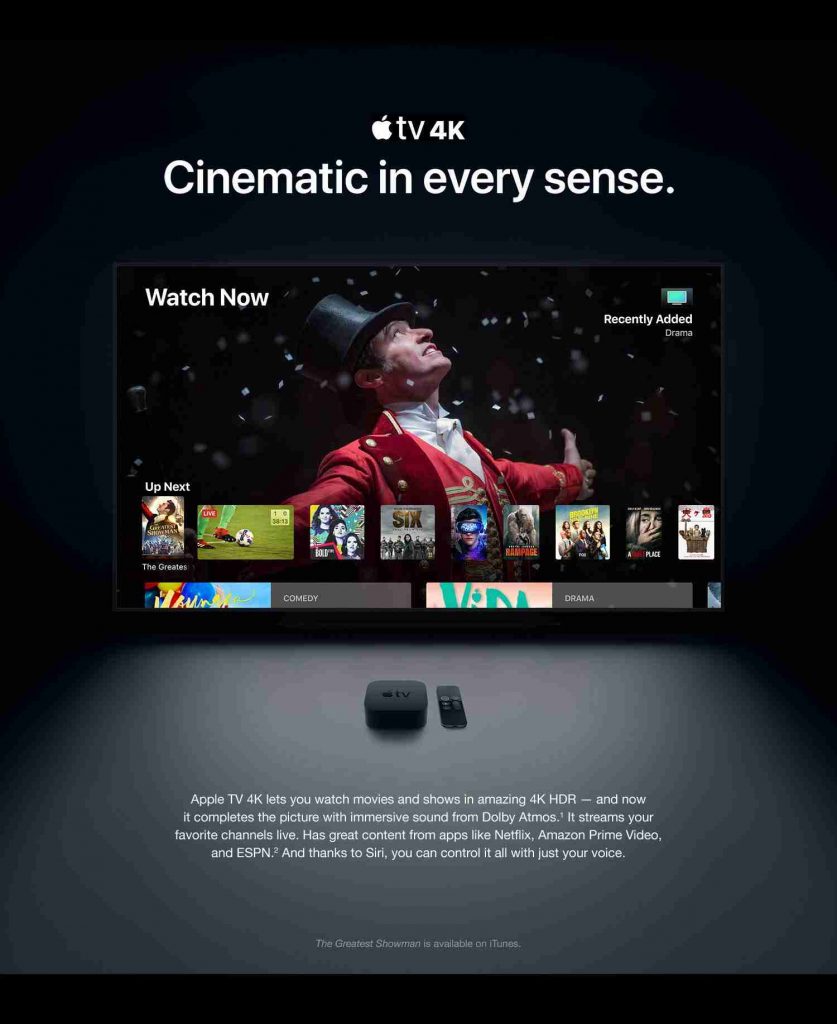

The price increases come as Disney+ and Apple+ plan to offer their services for far cheaper than Netflix. Disney+, which includes a massive library of Disney, Marvel and Pixar shows and movies, will cost USD$6.99 per month. Apple TV+, which will only have a handful of shows at launch, will cost USD$4.99 per month. (Apple TV+ will also be free for a year if you buy a new Apple gadget like the iPhone 11.)

Competition from new streamers could hurt subscriber growth.

Netflix said in its shareholder letter that the “noisy” launch of new streaming service may cause “some modest headwind to our near-term growth.”

Apple TV+ launches on Nov. 1. Disney+ launches on Nov. 12. And in the following months we’ll have the launches of Peacock from NBC and HBO Max from AT&T’s WarnerMedia.

The result: Netflix is projecting 7.6 million global net adds for the quarter, compared with 8.8 million in the same quarter one year earlier. On the company’s earnings call, CEO Reed Hastings said he hopes to blow away those muted expectations, but the fact that the company is warning slower growth could be on the horizon is an admission that the fears around competition are very real.

So, what’s Netflix’s plan to fight back against these new threats?

Content. Content. And more content.

Netflix continues to reinvest billions back into programming, and has a host of new movies and shows launching over the next few months, including the buzzy Martin Scorsese flick “The Irishman” and the fantasy epic TV show “The Witcher.”

On the earnings call Wednesday, Netflix’s top execs said it will keep up its strategy to produce shows people love, and do it on a regular basis so as not to lose subscribers in the quarters when there’s nothing good to watch. (Which is what we saw when Netflix lost subscribers in the second quarter.)

But there was another interesting nugget on the call about the content strategy. Netflix’s content boss, Ted Sarandos, brought up how popular franchises play into streaming. Disney+ will launch with popular and proven franchises ranging from Mickey Mouse to “Star Wars” to “The Simpsons.” Disney will have 70+ years worth of great franchises ready to watch when the service launches. But Netflix has to build its own franchises from scratch.

Sarandos appeared to see that as a strength.

“I think that is every bit as valuable as drafting off a bunch of different franchises and waiting for them to burn out,” Sarandos said of Netflix building its own franchises during the earnings call Wednesday.

But that’s also Netflix’s content problem in a nutshell.

So far, it hasn’t proven it can build a Disney-caliber franchise. “Stranger Things” perhaps comes the closest, but it’s not enough to keep Netflix subscribers sucked in year-round and in between seasons. Meanwhile, Netflix will lose some of its most popular third-party franchises like “The Office” and “Friends” to its rivals.

In short, Netflix admitted this week that it might be too expensive and lacking in enough engaging stuff to watch in order to keep subscribers growing at the levels it needs to. The pressure is on.

source: http://www.cnbc.com

MARKETING Magazine is not responsible for the content of external sites.