There had been heavy discussions and indications that MCMC is going to fund a Television Audience Measurement system in Malaysia, a very rare instance for a Government, Regulatory Body to get involved.

Instead of handing over all the levers to a Government/Regulatory Body, which has its own demerits, the industry can seize this opportunity to build a clear and concise strategic road map that will provide them with control and clarity over the next decade.

Over the upcoming weeks, we will highlight key issues, challenges and elaborate on potential solutions. In this Part-1, let us look at the following:

Funding related challenges:

1) Across the globe, mature markets like US (led by ANA), UK (led by ISBA), under the WFA banner are fully funding initial phases of the Measurement Projects in their respective countries.

This indicates that MAA can occupy the high seat, rally the industry, call the shots and set the agenda, similar to global markets.

We are not implying that MAA should invest upfront, but explore creative funding solutions, which are plentifully available, and it can mandate that all players are seated around the table.

2) There was an old, global, thumb-rule of 60% funding from Broadcasters, 20% from Agencies (MSA) and another 20% from marketers (MAA) which had become irrelevant.

As the industry steadily move to streaming-first, OTT and digitally distributed ecosystems, the definition of ‘broadcaster’ is being scrapped and redefined to include aggregators, distributors, OEMs (like Samsung) and premium Content-creators, essentially anyone who commands a 1PD (First party-data) and transactional relationship.

Given all this, in the here and now world, we have to get (a) Global Digital platforms like Google, Meta, TikTok etc and (b) new OTT players like iQiYi, Viu, etc and (c) OEMs like Samsung, Huawei etc and (d) ISPs like Telekom/Unifi to actively participate, provide funding and contribute to the solution-stack.

3) The most critical and important component that the industry is yet to create is a JIC-body, with a company registration, with clearly defined rights and responsibilities, adhering to the rule of the land.

Without this body all vendor negotiations, representation to the Government, Regulatory Bodies will be disjoint, fractured and incoherent.

Almost every major advertising market, other than the US, has a well-established JIC-body to drive measurement solutions. Within the US, JIC-bodies for Outdoor medium (Geopath), Digital medium (IAB) are well established.

The JIC-body is an important and fundamental building block that owns the solution.

4) In the present world the vendors are negotiating differential prices to different players of the industry, on different T&Cs and on different time-periods, implying that all negotiating levers are with the Vendors.

As the industry builds the measurement road map, it needs to advise all its members on the time-period.

Given how rapidly and dramatically the viewing patterns and consumption are changing with growth of broadband, expansion of 5G, any long-term agreement will be detrimental to the industry members.

5) Under any circumstances, should the industry carefully protect its negotiating position and should not take a complete backseat and allow MCMC to negotiate on its behalf? This can be tricky as priorities change with each Government, each Minister and each Chairman. And in any case, it is definitely not a global best practice.

6) The UK is building an interesting levy model, where a certain percentage of the media-investment is set aside for funding ISBA-led measurement projects.

With most measurement projects indirectly funded by MAA, it is the most compelling opportunity and initiative for them to ensure equitable contribution and get all of the industry, including global digital platforms to contribute meaningfully and participate actively.

Strategic clarity:

Back in 2019, Mr Kirti Singh, Global Chief Analytics and Insights Officer, P&G wrote

“I submit that our Market Research industry has been experiencing what I’m calling an “Inverted Moore’s Law.

I’m sure you are familiar with the concept of Moore’s Law… generated by Gordon Moore, co-founder of Intel in 1965, and largely proven today, that computing power would double every two years while costs halved.

If you look at our industry, I’d argue that Moore’s Law has played out in the opposite direction…that quality decreased while costs have increased. This is unsustainable.”

1) How we approach the measurement requirement in the emerging, digitized, 1PD-obsessed world can unlock and free us from the draconian past.

Instead of defining it as a research problem, we should approach it as a DS/AI/ML (Data Science, Artificial Intelligence, Machine Learning) solution.

When the buy-side led by MAA insists on collaboration, it is most likely to get it.

2) With Singapore being the only country where the Government/Regulatory body is involved, its IMDA-led model is ill suited for the present-day campaign activation processes. It’s an outlier and should never be a benchmark.

Building an industry-led solution stack by the industry for the industry is always the preferred mode.

3) With DS/AI/ML exploding, there is significant opportunity for the industry to explore and build data-stacking solution with Nielsen (TV), Kantar (Astro Pa-TV Only), ComScore (Digital), YouGov, GFK.

Trying to create everything new, afresh and from ground-up consumes too much time, money & effort and also renders all the past, historical data useless.

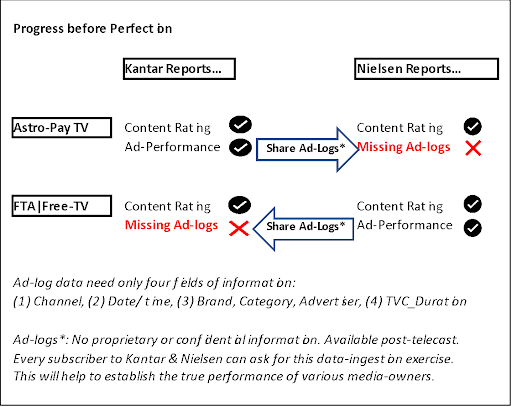

4) If both Kantar & Nielsen can publish “Content Viewership” data, there should be no barrier to publishing “Ad Viewership” data.

The industry has totally lost sight of this basic and fundamental possibility and once MAA/MSA gets to the bottom of this, it can be quickly resolved.

All of us need visible, tangible progress before lobbying MCMC for taxpayers hard earned money.

5) In the streaming-first, OTT-led, digitally distributed TV world, it is imperative that the industry secure written guarantees from Astro, Telekom/Unifi, MyTV, Global Digital Platforms (Google, Meta, TikTok etc), OTT players (iQiYi, Viu, TonTon), Retail-Media on sharing anonymized & aggregated data on monthly basis.

For eg., SKY in the UK, the largest Pay-TV service provider, regularly shares their package-level subscription numbers for valid modeling of the Universe Estimates.

6) With Retail-media and Connected-TV gaining ground rapidly, the industry can make provisions to get the respective, emerging players engaged in early discussions.

Rapid technology adoptions will accelerate, and it is never early to start engaging with this industry component.

In the next part, we will look at some of the technical issues, Governance issues, including Separation-of-service solutions.

These are truly challenging times and present an opportunity to lay a strong, robust foundation for the next decade.

The industry needs to walk this tight line carefully and avoid conflicts-of-interest, dependence on any single entity for end-to-end solutions and look to invest in modular, plug and play solutions with DS/AI/ML at the core.

About the writer:

Paddy alias Padmanabhan had been working in the marketing and advertising industry for the past 25+ years. Currently he is engaged in data and audience measurement projects in Malaysia as an Independent Consultant. He was part of the Team that launched Dell Computers, mother of all performance marketing in India and spent significant time working with GroupM, across countries in the region.

MARKETING Magazine is not responsible for the content of external sites.