Media owners advertising revenues in Malaysia are increasing by +9% to reach MYR 8.3 billion ($1.9 billion). In 2024, total advertising revenues will reach MYR 8.8 billion ($2.0 billion), a +6% growth. The economy is further increasing this year by +4.5% on a real GDP basis. Economic inflation in Malaysia is increasing by +2.9% with +3.1% growth expectations in 2024. With consumer behavior now back to normal, real GDP will grow by an additional +4.5% in 2024.

In this environment, linear advertising revenues are increasing by +2% to MYR 2.3 billion ($532 million). Linear budgets remain at just 71% of their pre-COVID levels. Because linear ad spending will continue its erosion as consumers continue to shift to digital media formats, linear advertising revenues will never again approach their pre-COVID highs. TV spending, which is growing by +2%, are now 87% of their pre-COVID total. Recovering from the fallout due to closed operations throughout COVID, cinema is continuing its recovery by a significant +21% this year. Finally, an increase in consumer behavior is further increasing OOH spending this year (+7%) however will decline by -5% in 2024.

Digital advertising spending is growing by +13%, following +19% in 2022, to reach 72% of total budgets. Digital advertising spending is being led by mobile devices, which is increasing by +16% and represents 78% of total digital budgets. By format, spending is driven by social media (+15%), search advertising (+12%), and video advertising (+11%). Digital advertising spending will continue to significantly outperform linear budgets, and by 2027, digital formats will represent 82% of total advertiser budgets.

In 2024, ad spending will grow by +6% to reach MYR 8.8 billion ($2.0 billion). Digital advertising will continue to grow by +11%, and linear budgets will decline by -6% and will continue its decay through 2027. Within digital media, growth will be led by Video (+14%), Social (+12%), and Search (+10%). Mobile advertising will continue to increase in presence by +14% and will represent 80% of total digital spending. On the other hand, both Television (-6%) and Print (-10%) will see declines in 2024.

APAC HIGHLIGHTS

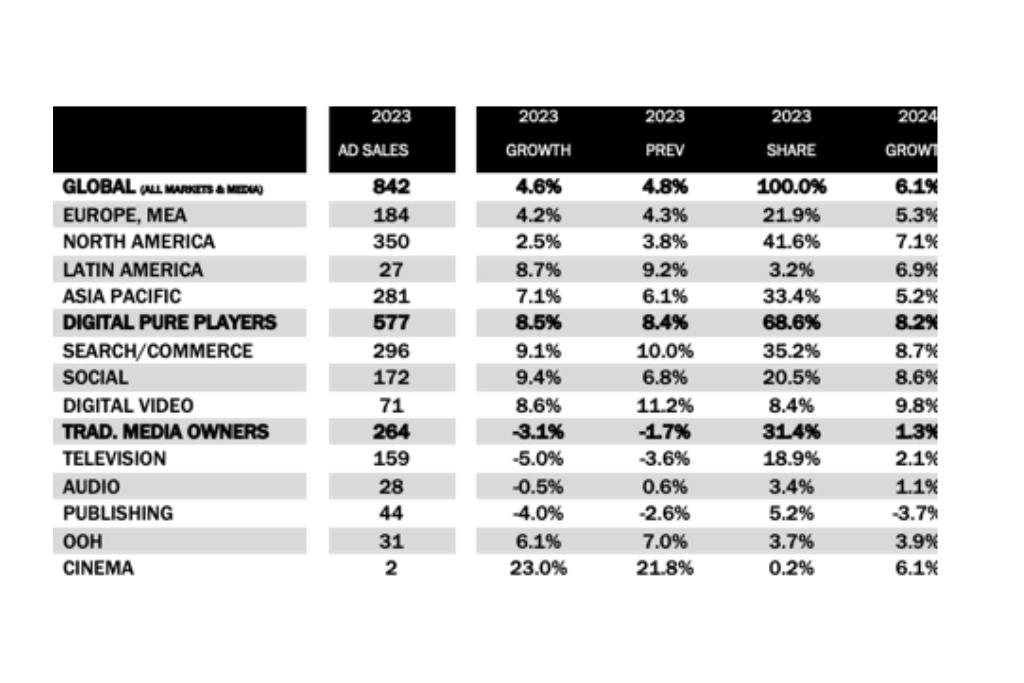

- The summer update of MAGNA’s “Global Ad Forecast” predicts media owners advertising revenues will reach $842 billion this year, +4.6% growth vs. 2022 ($805bn).

- This 2023 growth forecast is just 0.2 percentage points below MAGNA’s previous forecast (Dec. 2022: +4.8%) as the deterioration of economic conditions and marketing spending in most Western markets is mitigated by stronger-than-expected growth in some markets (China, Spain), industry verticals (Retail) and media types (Retail, Social).

- Several industry verticals show counter-cyclical patterns in their marketing dynamic. Some are expected to grow strongly, in line with business recovery (Automotive, Travel), some are not necessarily expected (Retail) to grow. CPG/FMCG product categories are ramping up their spending with Search and Retail Media Networks, partly at the expense of traditional branding media, but mostly by reallocating trade marketing budgets, thus bringing new money in the advertising ecosystem.

- Traditional media companies and branding formats (Television, Audio, Publishing, OOH, Cinema) are most exposed in this uncertain business climate, as some brands reduce marketing budget or prioritize performance-based digital ad formats. Global ad revenues across traditional categories in aggregate will thus shrink by -3% to $264 billion.

- Global television advertising revenues will shrink by -5% this year to $159 billion while Publishing ad sales will drop -4% to $44bn. Audio Media ad revenues will be stable (-0.5% to $28bn). The only traditional media categories to grow will be Out-of-Home, up +5% to reach $31 billion (catching up with pre-COVID market size), cinema (up 23% to $2 billion).

- Meanwhile, digital pure-play advertising sales will grow by +8.5% to reach $577 billion dollars i.e., 69% of total ad sales, driven by organic growth factors (ecommerce, retail media, media consumption shifts, stabilization in the data landscape). Search/commerce formats remain the largest ad formats, approaching the $300bn milestone (+9.1% to $296 billion). Social media formats re-accelerate by +9.4% to $172 billion, while short-form pure-play video advertising grows by +8.6% to $71 billion.

- Retail Media Networks are expected to generate $121 billion in advertising sales this year (+12%), most of it in the form of product search and ecommerce sponsorship. The bulk of these ad sales will come from ecommerce pure players, but traditional retailers are developing their media capabilities and their advertising sales will grow by +24% to reach $21 billion.

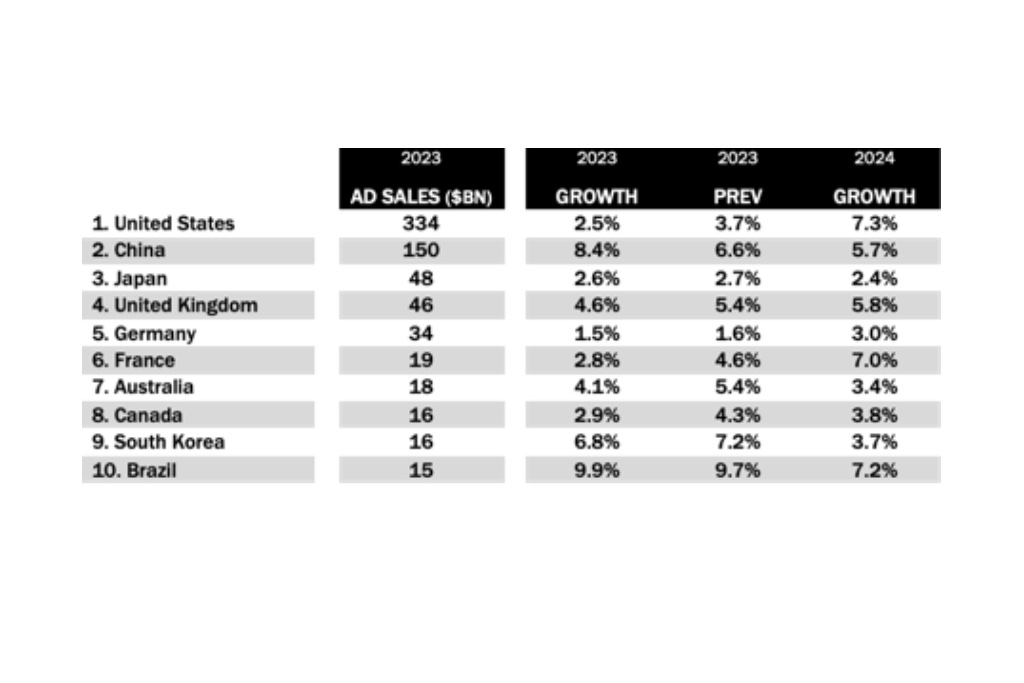

- The strongest ad growth rate this year will come once again from India (+12.3% to $12.6bn); India is the 11th largest market. The Chinese ad market is set to recover faster than previously expected (+8.4%). At the other end of the spectrum, most Western European markets will stagnate this year: Germany, France, Italy all below +3% growth all-media, and negative for traditional media owners.

- In APAC, digital advertising is powering total market growth. By format, this year’s growth comes from social (+12%) and video (+11%), with search also growing by +9% (but already representing a huge 47% of total digital budgets).

- In 2024, economic stabilization and the return of major cyclical events will re-accelerate ad spend: +6.1% to $892 billion globally. Traditional media owners’ ad revenues will recover by +1% while digital pure players ad sales will increase by +8%.

Fan Chen Yip, Chief Investment Officer of Mediabrands Malaysia commented:

Digital advertising continues to drive ad spend growth in Malaysia, ahead of all formats, signalling a further push towards digital mediums as consumers, especially Millenials and Gen Zs, increasingly seek connection and immersion in digital spaces. For 2023, advertising revenues are forecasted to reach RM8.3billion, with digital comprising 72% of this total.

Drilling deeper into these digital spends, mobile is forecasted to take a significant portion of digital ad spends at 78%, indicating the mobile-first consumer behaviour of Malaysians that is continually growing. Forecasting further into the future, digital is anticipated to garner 82% of total media budgets by 2027, indicating room for significant digital innovation across media platforms.

Leigh Terry, CEO Mediabrands APAC commented:

“The Asia Pacific advertising economy will show strong growth of +7% this year, higher than the global average, and powered by growth markets like India (+12%) and Pakistan (+11%). Digital advertising in APAC has slowed significantly in 2022 and 2023 vs. the pre-2022 trend, but remains resilient and continues to lead all formats for advertising revenue growth.

Many of the headwinds that slowed Chinese digital advertising revenue growth in 2022 (zero-COVID policy, continued government regulation headwinds, etc.) are lessening in 2023 and this will allow big digital publishers to continue to grow.”

Vincent Létang, EVP, Global Market Research at MAGNA and author of the report, said:

“Advertising spending slowed down to a halt in the first quarter of 2023 (+1.5% globally, flat in most Western markets) due to economic uncertainty and the lack of cyclical drivers. There are, however, some drivers mitigating the impact of economic slowdown: Ecommerce and Retail Media bringing more marketing dollars into digital advertising formats, and the counter-cyclical dynamic of some large industry verticals (Retail, Auto, Travel).

On balance, MAGNA expects the global marketplace to keep growing this year, as it managed to do during the brutal COVID recession of 2020. But of course – like in 2020 – traditional media formats and mature markets will struggle this year.

Innovation keeps the market moving, however: traditional media owners are developing cross-platform capabilities and brand-safe addressable solutions that are increasingly attractive to brands, and now account for 19% of their advertising revenues.”

KEY FIGURES

TABLE 1: GLOBAL ADVERTISING MARKET

TABLE 2: TOP MARKETS

ABOUT THE RESEARCH

The MAGNA market research is media centric. It estimates net media owners advertising revenues based on an analysis of financial reports and data from local trade organizations; other ad market studies are based on tracking ad insertions or consolidating agency billings.

The MAGNA approach provides the most accurate and comprehensive picture of the market as it captures total net media owners’ ad revenues coming from national consumer brands’ spending as well as small, local, “direct” advertisers. Forecasts are based on economic outlook and market shares dynamic.

The full Ad Forecast report (80 pages) and dataset contains more granular media breakdowns and forecasts to 2027, for 70 markets.

Next Global Forecast: December 2023

MARKETING Magazine is not responsible for the content of external sites.