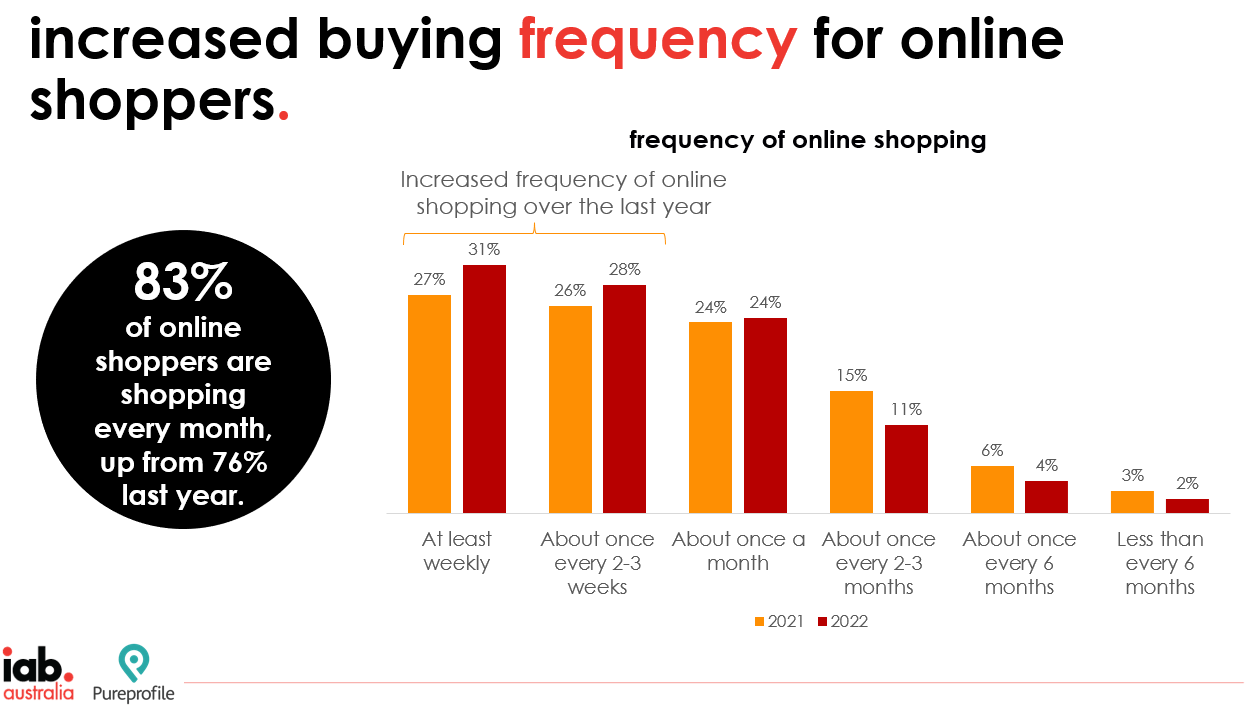

SYDNEY, AUSTRALIA: The Australian Ecommerce Report 2022 released today by IAB Australia and Pureprofile (ASX: PPL) has found that while shoppers have been able to get back into physical stores, regular online purchasing for both groceries and retail products have increased since last year with 83% of online shoppers buying every month.

Convenience was named as the number one reason for purchasing online by 77% of respondents, while value for money was identified as the most compelling feature for online brand purchases by 84% of respondents. Fast shipping declined as a driver of purchases.

The Australian Ecommerce Report 2022 found that seamless omnichannel shopping experiences that deliver convenience and value for money will present the biggest opportunity for brands this year as shoppers return instore. However, it also issued a warning to retail marketers to assess their marketing strategies more regularly into 2023 to ensure they can adjust activities to respond to economic changes, navigate the continuing influence of covid, optimise shoppers omnichannel experiences and bolster confidence among hesitant shoppers.

The Report, which is based on research conducted with 1,000 Australian online shoppers examining the consumer attitudes, behaviours and influences driving ecommerce in Australia, identified clothing, shoes, and fashion as the most popular online purchases in the last year at 74%, up slightly from 72% in 2021. The largest online shopping growth area was the purchase of groceries, increasing from 54% in 2021 to 64% in 2022.

30 – 39-year-olds were identified as more likely than any other age group to purchase a range of different products online, while 18 – 29-year-olds were most likely to purchase jewellery, handbags, and accessories online; and 40 – 49-year-old were interested in electronics, technology, and mobile phone purchases online.

Two thirds of online shoppers were reported as saying cost of living pressures mean they don’t have as much to spend on less essential retail shopping this year, while 65% reported the potential for further interest rate rises means they are more cautious about spending, particularly young families.

Those currently experiencing cost of living pressures are more attracted to online shopping for price comparisons and for finding specific products. They are more likely to be looking for value in programs such as store loyalty cards.

The research explored consumer engagement with retail media channels, with 58% of online shoppers regularly reading retailer content. However, it also reinforced that retailers need to be clear and transparent about their usage of shopper data provided via their transactions, with 55% of online shoppers somewhat or very concerned.

A further 11% of online shoppers note that their level of concern depends on how much they trust the retailer they are providing data to. Most online shoppers do understand that their data is used for targeting advertising and marketing, however 24% don’t know whether retailers share their data with other companies.

Online search remained as the key to discovering brands when shopping online, however word of mouth has strengthened as a source of inspiration. 59% of 18-29’s use social media for product inspiration, while 30-39’s rely more heavily on friends and family or shopping events and over 50’s were most heavily influenced by online search and emails from retailers.

Gai Le Roy, CEO of IAB Australia commented, “Since the onset of COVID in 2020, consumer online habits have changed, and retailers have made investments in digital transformation which has resulted in a huge growth in ecommerce expenditure. This growth has continued into 2022 but with the expectation of future economic downturn, retailers will need to service customers who have embraced the convenience of home delivery as well as click and collect but are increasingly price sensitive.”

Martin Filz, CEO of Pureprofile commented, “After a challenging period where retailers were forced to pivot to online and many flourished, those retailers now find themselves at an interesting juncture – needing to maintain their growth while also being aware of the economic environment. Through this year it will be especially important for retailers to keep close to their consumers and examine changing sentiment swiftly.”

Other research findings include:

- 47% of online shoppers have purchased from a direct (to consumer) brand, while 31% have purchased multiple direct brands. Direct brand shoppers tend to be younger and more frequent online shoppers and they maintain strong customer loyalty with 64% of online shoppers purchasing from their favourite direct brand on multiple occasions and 61% reporting they would rarely or never buy their favourite direct brand product from a different business. 39% of direct brand shoppers are subscribed to a product delivery service.

- 48% of online shoppers are aware of shoppable advertising, with 21% of 18-29’s and 25% of 30-39’s having made an online purchase this way.

- While value for money stands out as the most compelling feature of brands purchased online, hygiene factors such as being simple to buy and having quick and easy returns are also important.

- Digital touch points which also provide rich behavioural data for retail marketers are dominating retailer communications. 58% of online shoppers often read content produced by retailers, with websites and emails topping the list, while physical catalogues and free reading magazines have both declined year on year.

- Rewards programs continue to thrive with nine in ten shoppers signed up to at least one shopper reward program. 40% of those signed up to rewards program have four or more cards (down from 45% in 2021).

- Nearly half of online shopper’s report that purchasing from ethical brands is important to them, while 29% of shoppers said that if they trust a brand, they will buy without looking at the price. Community connections built during COVID being maintained, with the Report finding 47% of respondents indicated they are now more likely to buy from companies they feel behaved well during the COVID crisis and 48% buying more things from online from local retailers.

The full report is available online for IAB Australia members.

MARKETING Magazine is not responsible for the content of external sites.