To be fair to the uninitiated, OTT (Over The Top) refers to content provided via internet connection. With the Movement Control Order (MCO) in place, more viewers are choosing OTT as their preferred choice of consuming long form content.

OTT has had the biggest impact in the Video on Demand (VOD) space. A PwC’s report in May 2018 said OTT VOD revenue is projected to increase by 80% to 90% between 2016 to 2021 in Southeast Asia. PWC estimated that Asia Pacific will overtake North America as the world’s biggest region in OTT revenue in 2021.

Increasingly the empowered consumers want to exert greater control over how and where they consume the media. Consumers are looking for avenues to enjoy media experiences that uniquely tailored to their own personal preferences and context.

During the MCO, Malaysian integrated media players have seen an increase in download of their app services, with Astro GO taking the lead at 70% growth or a total of 265K new users in the first 18 days of MCO. Correspondingly, Dimsum, Tonton and PlayTv has also shown double digit increase in downloads during this period.

In Daily Active Users (DAU): Astro GO and Tonton have both garnered stronger DAU growth rate of 30% and 6% respectively. In Astro GO’s case, it achieved 1.2mil in total daily active users during MCO period.

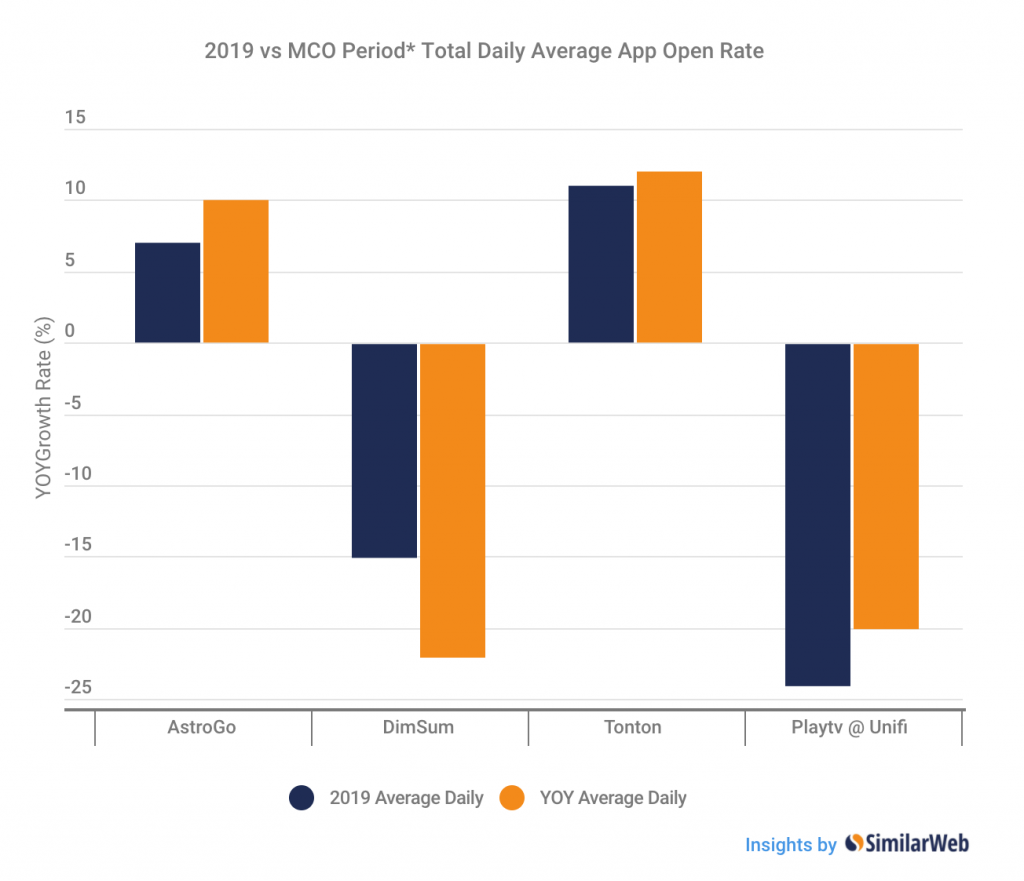

Relatively, App Open Rate has a similar pattern as DAU with Astro GO and Tonton on the slight increase 6-10% trend. They both maintain a rather stable open rate before and during the MCO.

As seen in the graph below, all OTT websites’ total traffic (desktop & mobile web) have shown growth led by Tonton and Astro GO. The latter has seen a spike in its website traffic by two folds compared to last year.

Overall, most local OTT providers have shown growth rate for total page views, except for Dimsum. The incremental of 35-55% has shown the indicative that viewers are consuming more content on their device during MCO.

*MCO Period: 18 March 2020 – 4 Apr 2020

2019 Average Daily: Total 2019 Average Daily vs 18 March – 2020 Average Daily

YOY Average Daily: 18 March – 4 Apr 2019 vs 18 March – 4 Apr 2020 Average Daily Count

App Download represents the number of daily downloads of the analyzed app over a set period of time.

Daily Active User represents the number of unique users who use the analyzed app on a daily basis, in the analyzed country and timeframe, each user needs to be active in the app for at least 10 minutes.

Open Rate represents the percentage of the total Android devices who have installed the app, and use the analyzed app on a daily basis, in the analyzed country and timeframe.

All data quoted above are provided by *SimilarWeb.

*About SimilarWeb:

As the most trusted platform for measuring online behavior, millions of people rely on SimilarWeb insights daily as the ground truth for their knowledge of the digital world. We empower anyone — from the curious individual to the enterprise business leader — to make smarter decisions by understanding why things happen across the digital ecosystem.

MARKETING Magazine is not responsible for the content of external sites.