By a Founding Member of The Extra-not-ordinary Club

But I won’t cry for yesterday

There’s an ordinary world

Somehow I have to find

And as I try to make my way

To the ordinary world

I will learn to survive.

Sorry Duran Duran, wrong song for the year 2020. What we need now is to thrive in this new world of social distancing, work-from-home-till-you-lose-your-wits-state and economic slowdown. This new normal as we know it, has seen a marked shift in behaviour from how we get our meals, shop for our essentials and attend meetings to acquiring new skills. Heck, even the word extraordinary itself has a new-found twist as a hashtag.

As we were looking for that one hashtag that would encapsulate our new CIMB e Credit Card; our agency, Geometry Global had come back with #ExtraNotOrdinary, which for obvious reasons stood out among the rest. The first reaction was why not just say extraordinary? My curiosity got me Google-ing and looking up the hashtag. Then it dawned on me that in fact, extraordinary is an oxymoron because if you break the word apart, extra-ordinary would literally mean more ordinary than the norm!

It was a tussle between #ExtraNotOrdinary and #MakeItEpic. And if I could, I would ask you readers to cast your votes here just to prove a point but I am going to go out on a limb that the winner would be #ExtraNotOrdinary because really, who wants to be ordinary? Certainly, not marketers! Well, so that’s the story with this #ExtraNotOrdinary hashtag, which essentially embodies our entire positioning and proposition of our brand new card named CIMB e Credit Card or e in short.

The story of e though gets even more intriguing because we got to be able to live up to that attribute and own it. What we knew from the start was that e wasn’t going to be just another ecommerce or digital card. In fact, e was designed to be the quintessential companion to one’s universe of e ─ from e-payments to everyday essentials and all the epic stuff in between for almost everything, everywhere both online and offline.

A super hero born out of prayers from deal grabbers, e came to take us into the but of course, an extra-not-ordinary world of rewards so that you and I can extract the most value from our new way of life. e also spots an ethereal look to exemplify the whole epic experience.

eDay which falls on every 10th of the month is the day where e cardholders rejoice as they get to earn 12X Bonus Points for every RM1 spend plus enjoy exceptional deals such as RM1 for RM50 vouchers with a minimum spend of RM50 on Shopee, Lazada and Taobao! But e won’t lie, there is obviously a cap for these things and I will let you explore more on our site so that you get check out other crazy deals okay, especially that other RM1 deal for your second handcrafted Coffee Bean beverage. e’s earth-loving nature also brings you exclusive deals with Poptron.co, a new unique lifestyle ecommerce site that houses more than 100 homegrown artisanal as well as social enterprises that are eco-friendly and socially conscious! Cardholders can also choose to donate their bonus points to support sustainability-driven organisations on our programme.

All these eDay rewards apply to offline contactless payments at the store too so you can take advantage of this day to spoil yourself or someone a bit more since you are actually going to get 10X Bonus Points for almost every spend or 12X when you make any purchases with our featured partners! And yes, this includes overseas spend, online and offline too!

Are you excited yet ’cause I barely started!

What about other days I hear you ask? Well, there’s 5X Bonus Points on your other daily online spend without being limited by any ecommerce platforms. It also applies to e-wallet spend specifically Grab (not just GrabPay), Touch ‘n Go e-Wallet, BOOST, BigPay and Setel. Pro tip for you: you would want to time your reloads on eDAY to get maximum rewards! And in case you haven’t noticed, most banks no longer reward you points for your e-wallet payments.

That’s not all – e rewards you for your recurring scheduled online bill payments too. This includes your telco, WiFi bills, utility bills and online media bills!

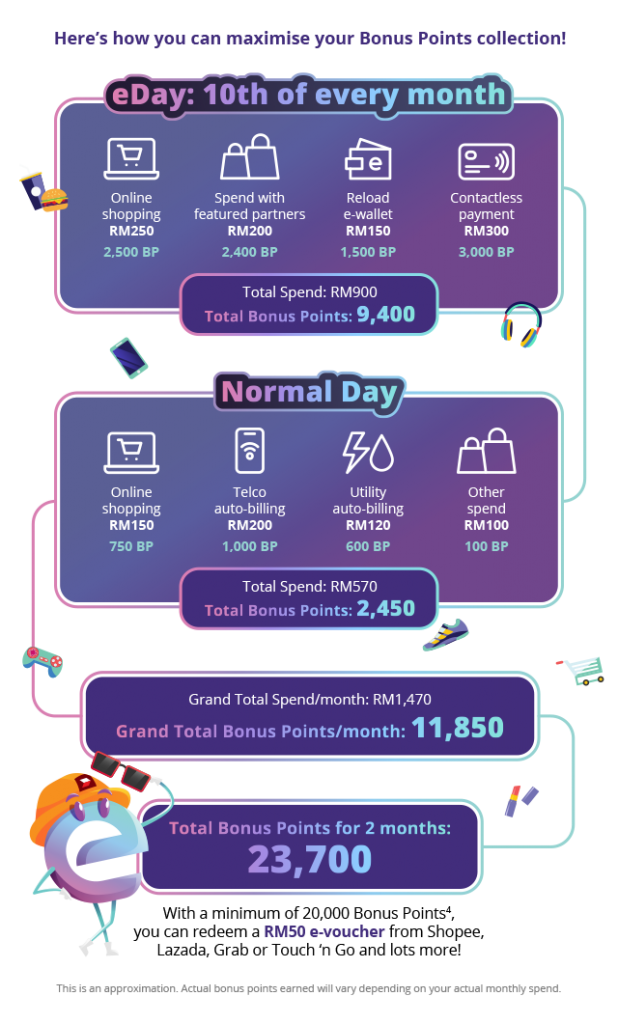

So by now you are probably wondering what’s the point with these points? Well, this is really the icing on the cake – CIMB Bank has in fact the best bank bonus point to cash conversion value at 400 to RM1. Let us do the math for you, if you spend about RM1,500 a month, you can in fact easily chalk up about 12,000 as illustrated below or more depending on how you time your spend and where. Now, that works out to 1.25% in terms of cash back on a regular day and 2-3% cash back on eDay there with no minimum spend so that you don’t feel pressured to spend more than you really need to.

Image via CIMB website

The point to this is the whole easy redemption experience so that you can really enjoy your rewards. No complicated form-filling as we have online redemption through CIMB Clicks and our Member Rewards site plus our awesome Pay With Points acceptance at over 9,000 merchants nationwide including Jaya Grocer, Isetan, IKEA, Harvey Norman, MPH and many more! With Pay With Points outlets, your points are as good as cash and you can also check your points and top up within your credit limit at the cashier by entering your card PIN.

And when you hit 20,000 points, which you can easily attain by spending wisely, you get to conveniently redeem a myriad of RM50 e-vouchers from major ecommerce sites and e-wallets mentioned above!

As they say all good things must come to an end. In the case of e, there is a monthly cap of 20,000 bonus point rewards, equivalent to RM50. Further, direct airline bookings are not eligible for bonus points. However, you can still earn points on flights purchased through online travel aggregators. Also excluded from bonus points rewards are insurance premiums and instalment payments which are common among banks, as well as spend in member countries of the European Union.

There’s no annual fee the first year. Subsequent annual fee waiver of RM100 will be accorded with a total spend of RM12,000 a year and can be combined with the supplementary cardholder’s spend. The abovementioned spend categories though excluded for bonus point rewards, will still count towards the spend requirement for annual fee waiver.

So what’s your verdict? Is it extraordinary or extra-not-ordinary?

CONTEST

The first 3 readers who correctly guess the sentence with the most number of words beginning with e in the above. Winners will receive but of course an #ExtraNotOrdinary Vibe Box worth RM150. Please text us your answers using this link ( https://wa.link/m41q9z ) stating#ExtraNotOrdinary , name and contact number.

Meanwhile, here’s an invitation to join the #ExtraNotOrdinary club at www.cimb.com.my/ecard or follow the hashtag on Instagram for more extra-not-ordinary vibes.

——————————————————————————————————————————————————

Time to shine with your MERDEKA TVCs: voted annually by readers who are marketing communications professionals for top 20 ranking. The top 10 TVCs will enjoy industry-wide fame, and if they run on Astro get extra airtime free! Enter now: https://forms.gle/y9LGYDZZPrNrcESy5

MARKETING Magazine is not responsible for the content of external sites.

An afternoon of conversations we never had, with leaders most of you never met.

Discover what’s possible from those who made it possible. Plus a preview of The HAM Agency Rankings REPORT 2024.

Limited seats: [email protected]

BOOK SEATS NOW