Global advertising spend is set to rise by 7.1% to USD$660bn this year, buoyed by 13.2% growth in internet investment. But traditional media, combined, are expected to record 1.5% growth to USD$324.2bn – the first rise since 2011 – finds WARC, the international marketing intelligence service.

The traditional media total is expected to be boosted by a return to growth for TV; here spend is set to rise 2.5% to USD$192.6bn, helped in no small part by the US presidential election campaigns and the Summer Olympic Games in Tokyo. But advertising revenue for the ‘duopoly’ (Alphabet and Facebook) is forecast to reach USD$231.9bn in 2020, having topped the TV total for the first time in 2019.

Alphabet’s ad income is forecast to rise 10.5% to USD$149.0bn worldwide, equivalent to 23 cents in every ad dollar. A full 72.4% – USD$107.8bn – will come from Alphabet’s core Google search platform – this gives Google a 77.0% share of the global search market.

YouTube is expected to earn a further $18.5bn for Alphabet in 2020, a 22.1% rise from 2019 and equivalent to 29.0% of all online video adspend worldwide.

Facebook’s ad revenue is projected to rise 19.0% to USD$82.9bn; much of this growth is organic though the social network will benefit from the US presidential campaigns this year.

Amazon’s ad income is set to rise 21.4% to $17.1bn, Twitter’s 9.2% to $3.3bn and Snap’s 34.1% to $2.3bn. All will contribute to an overall rise of 13.2% in internet ad investment this year, to a total of $335.4bn – over half (50.9%) of the global total for the first time.

James McDonald, Managing Editor, WARC Data, and author of the research, says: “Internet ad growth has been far stronger than the state of the global economy would suggest, rising seven times faster on average since 2015. But, regulation aside, online platforms are bound by the law of large numbers, and revenue growth is easing for key players like Alphabet and Facebook.

“We are yet to amend our forecasts in light of the COVID-19 situation, as we would expect – if the crisis is contained – displaced spend to be reallocated later in the year. Advertising’s relationship with GDP is strong, but a slowdown in economic output as a result of the virus will not necessarily translate into reduced advertising investment. If events such as the Tokyo Olympics and UEFA Euro 2020 tournament are postponed or cancelled, however, we would expect a notable impact.”

All product categories are expected to see growth in 2020

Adspend is set to rise across all of the 19 product categories monitored by WARC. The financial services sector is expected to lead growth, with a forecast rise 11.8% to $53.4bn in 2020. A full 53.9% of spend is directed towards online formats; banks in particular are looking to build brand resonance with youth demographics (increasingly via social media).

At the other end of the scale, a rise of 2.6% in the retail sector is soft compared to the global rate of 7.1% but would still represent the strongest growth since 2013, lifting market value to $65bn.

Consumer packaged goods (CPG) sectors such as soft drinks (+6.5% to $17.3bn) and food (+4.9% to $28.1bn) are expected to grow just behind the global rate this year, alcoholic drinks (+6.9% to $9.7bn) and automotive (6.8% to $57.2bn) are roughly par.

Trends by platform

Alphabet: Alphabet’s advertising revenue – across Google Search, YouTube, and Google Network Members (third parties that host Google ads) – is forecast to rise 10.5% to $149.0bn this year – 22.6% of global advertising spend (up from 21.9% in 2019). This is before the deduction of traffic acquisition costs (TAC), which amounted to $30.1bn in 2019.

YouTube: Advertisers are forecast to spend $18.5bn on YouTube this year, a rise of 22.1% from $15.2bn in 2019. This gives YouTube a 29.0% share of all online video advertising spend, and a 2.8% share of total adspend.

Google: By far the largest service in Alphabet’s portfolio, Google’s ad income is expected to rise 9.9% to $107.8bn this year – 77.0% of global search spend and 16.3% of all adspend.

Facebook: Advertisers are expected to spend $82.9bn across Facebook, Messenger, WhatsApp and Instagram this year, a rise of 19.0% from 2019. This gives Facebook a 12.6% share of global advertising investment.

Amazon: Amazon is forecast to record double-digit ad revenue growth again this year, with income amounting to $17.1bn, a 21.4% rise from 2019. This gives Amazon a 2.6% share of global advertising spend.

Snapchat: Ad investment in Snapchat is forecast to rise 34.1% to $2.3bn in 2020, 2.2% of all social and messaging spend and just 0.3% of total adspend.

Twitter: Twitter’s ad income is expected to ease into single digits, with a total of $3.3bn representative of a 9.2% rise in 2020.

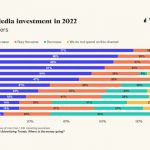

Trends by media and format

TV: Spend is forecast to rise 2.5% to $192.6bn, 29.2% of all global spend this year. This only partially reverses a 4.4% dip in 2019. A third of the global TV total is transacted in the US – where, TV spend is set to rise 4.0% to $62.9bn. Just over $4bn will come from presidential campaigns.

Out of home: Spend across billboards, transport and retail/point of sale (PoS) locations is forecast to rise 5.9% to $43.5bn this year, the sixth consecutive year of growth. The sector is benefitting from the increasing penetration of digital sites in advanced markets.

Radio: Advertiser investment in radio is forecast to rise 1.8% to $32.8bn, recouping losses from a 1.3% dip in 2019.

Print: Spend is set to fall by $3.2bn, or 5.8% in 2020, but this is half the rate of decline recorded in 2019. Digital revenue now accounts for over a third of total ad income for publishers worldwide, though this share is closer to a half at the New York Times.

Social media: Spend is forecast rise 19.5% to $102.4bn this year, 15.5% of global advertising spend. Facebook (including Messenger, Instagram and WhatsApp) is expected to draw 80.9% of this investment, or $82.9bn, though this share is down from 81.2% in 2019. Just over 42% – $35bn – of Facebook’s ad revenue will come from the US this year.

Online video: Spend is forecast to rise 21.4% to $63.7bn this year, equivalent to 9.7% of global advertising spend. YouTube is expected to account for three in ten cents.

Search: Spend is forecast to rise 12.7% to $140.1bn in 2020, 21.2% of global adspend. Google is set to draw 77.0% of the market, down from 79.0% in 2019.

Trends by region

North America: Total market growth forecast at 8.4% this year – to $250.3bn – following a 4.5% rise in 2019. The US ad market is expected to grow 8.8% to $238.2bn, while Canada is projected to grow 1.9% to $12.2bn

Asia-Pacific: Advertising spend is expected to rise 7.5% to $205.0bn in 2020, with China (+9.7% to $98.5bn), Japan (+3.2% to $40.2bn), Australia (+2.4% to $13.3%) and India (+15.6% to $11.2bn) all set to record annual growth.

Europe: European adspend is forecast to rise 6.9% to $158.7bn this year, with France leading key market growth at +10.0% (to $18.2bn). The UK (+3.2% to $31.3bn), Germany (+1.3% to $24.9bn), Italy (+2.7% to $10.5bn) and Russia (7.6% to $10.5bn) will continue to see rising investment.

Latin America: The region is heavily susceptible to the strength of the US dollar, which resulted in an 1.1% decline in adspend last year. A further fall, of 2.5%, is forecast this year, with Brazil recording a 4.3% dip to $14.3bn.

Middle East: Spend is expected to fall 1.7% to $12.0bn in 2020, following on from a 3.7% fall in 2019.

Africa: Spend is expected to rise 5.6% to $6.9bn this year, reversing a 1.5% dip in 2019.

Other new key media intelligence on WARC Data across regions

Global:

Consumers: Ad blocking rises to all-time high of 764m people

Brands & Advertisers: Food, drink and automotive brands see lowest email CTR

Media & Tech:E-sports investment to reach $800m this year

Americas:

Consumers:One-quarter of Americans now own a smart speaker

Consumers:Netflix subscriptions in Latin America top 30 million

Media & Tech: NFL, NBA and MLB to draw $4bn from sponsors in 2020

Asia Pacific

Brands & Advertisers: Southeast Asian brands most active on WhatsApp

Media & Tech: OTT to halve APAC pay TV growth by 2024

Media & Tech: Sponsorship investment for Tokyo Olympics to triple

Europe, Middle East and Africa

Consumers: 26% of 18-24 year olds use TikTok in the UK.

Brands & Advertisers: Less than half of marketers use consumer data systematically.

Consumers: Connected TV use in Portugal flatlines for second year.

MARKETING Magazine is not responsible for the content of external sites.

An afternoon of conversations we never had, with leaders most of you never met.

Discover what’s possible from those who made it possible. Plus a preview of The HAM Agency Rankings REPORT 2024.

Limited seats: [email protected]

BOOK SEATS NOW