This mass switch to online commerce has ushered in a new shopper-brand and shopper-retailer relationship – Retail 5.0.

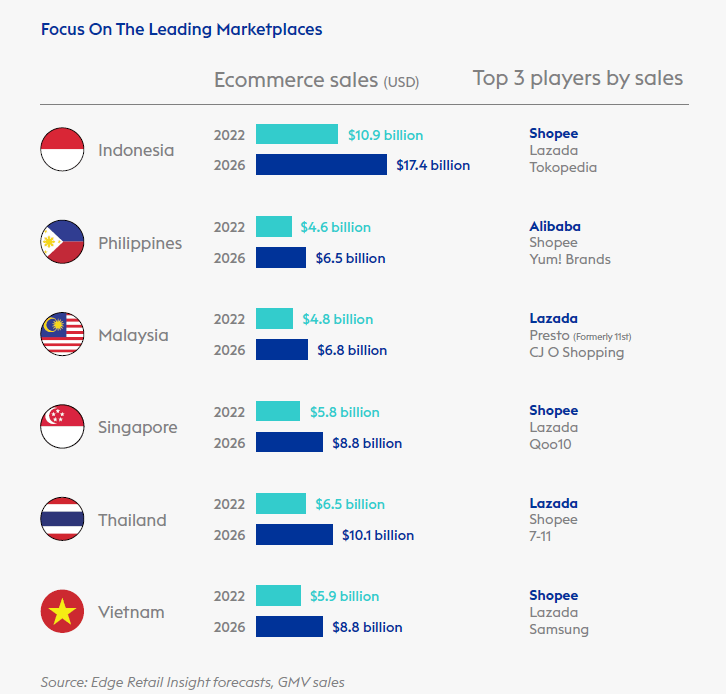

Online shoppers in Indonesia, the region’s largest online commerce market, are expected to spend $9 billion in 2022, up from $1.7 billion in 2016. By 2026, ecommerce will be worth $17.4 billion in Indonesia. Ecommerce in the Philippines, Vietnam, Thailand and Malaysia is also growing at that pace.

A whitepaper released today by Ascential Digital Commerce highlights the rapid growth of ecommerce sales across Southeast Asia (SEA) and explores the opportunities and challenges consumer brands face as ecommerce becomes the number one driver of retail strategy in the region.

Navigate Retail 5.0 in Southeast Asia lays out how consumer brands in the region can thrive in a new era of shopping – what the paper’s authors describe as Retail 5.0.

But, the requirements to succeed online are very different to the physical store. The paper suggests that optimizing digital retail platform growth can only be accessed by adopting a fundamentally different set of capabilities, skills and in many cases, wholesale organizational change.

The whitepaper projects ecommerce sales in the region to grow nearly 18% to reach US$38.2 billion by the end of 2022, up from US$31.9 billion in 2021. By 2026, ecommerce sales are projected to reach US$57.8 billion.

This comes after bumper ecommerce growth in 2020 of US$27.4 billion and shows how pandemic shopping behaviour has changed retail for good.

Indonesia, one of SEA’s largest online commerce markets, is expected to add $9 billion in ecommerce sales in 2022, while the Philippines, Vietnam, Thailand and Malaysia are also key markets to watch.

One of the key takeaways in the whitepaper for brands is to focus on resources and investment on mass personalization to reach and retain digital-first shoppers, who use smart devices, such as laptops and mobiles, to discover, select, purchase and engage.

But the whitepaper cautions against consumer brands from jumping on the bandwagon and crowding the mass personalization space.

Understanding the strategic priorities and unique growth levers of the fastest growing digital retail platforms, such as Alibaba-owned Lazada, Grab, and Sea Group’s Shopee, in order to succeed.

“Southeast Asia is brimming with opportunities for retail operators. In this evolving Retail 5.0 landscape, retail operators must constantly reevaluate their investments and innovation strategies to stay relevant, grow, and effectively tap into the largest ecommerce marketplaces,” said Jill Meng, Customer Success Director, APAC, Ascential Digital Commerce.

“Consumers are dictating and shaping the retail sector, informing brands about their preferences via social media or conversations. Consumer brands that can analyze, adapt and adopt solutions quickly to the new shopping environment will win these dollars,” said Xian Wang, Vice President, Retail Insights, Edge by Ascential.

“With shifting consumer behaviours, ecommerce and fast delivery are now considered table stakes. Consumers expect much more from their online experience. They want to try new products frequently, have personalized experiences, seamless customer journeys, and interactive engagement,” said Saad Ahmed, Managing Director, Regional Head of Merchants & Commercial, Grab.

Key recommendation to win marketplace shoppers:

- Identify how your shoppers are searching for your brand and products online and understand their purchase journey

- Get full oversight of your and your category’s performance, sales and share online and on the marketplaces you are selling through to inform effective business decisions

- Understand the marketplace dynamics and their capabilities to focus investment in the right places

On the product side, consumer brands must ensure a highly flexible product innovation and distribution model where sufficient stock is immediately available for rapid distribution globally. This is crucial especially as businesses can lose up to 22% of weekly sales every day a product is out of stock, according to data from Edge by Ascential.

Methodology

The whitepaper drew inputs from Ascential Digital Commerce’s data, as well as third-party industry data to present trends.

It also references our STEIP framework, which is the lens through which we make 5-year retail projections, and Ascential’s Generational Retail Development Framework from 2016 plotting where the global retail industry was on its digital transformation journey. This research manifested in our Generation Retail Development Framework (GRDF). Ascential uses STEIP to view how our future might unfold in the world of retail.

The GRDF is based on Ascential’s analysis of more than 500 global consumer brands.

MARKETING Magazine is not responsible for the content of external sites.