Last weekend was a long one.

But I never imagined I’d be rummaging around for good interest rates with my savings.

Of late, bank interest rates have been on a painful low, so I decided to see where I could get more bang (bank) for my buck. I don’t have the hundreds of thousands like most in my industry, as many years ago a cheat cleaned out all my EPF savings.

Lost story short: I was hoodwinked into losing a mountain of money in my business.

I also don’t play in the stock market; because for me it is a form of gambling. So, for me, it’s just my savings and whatever I can earn from an FD or two that keep me on the straight and narrow.

So with air of cynical cautiousness, I started my research looking around what the banks were peddling.

With two brutal fact-checkers in tow, my wife and my mother-in-law, we spent a few hours on the hunt and then compared notes.

But only after sifting through the highly visible information overload by eager beaver banks. The internet cookies were also relentless, with their pop-ups, while I should add nobody makes better cookies than my wife.

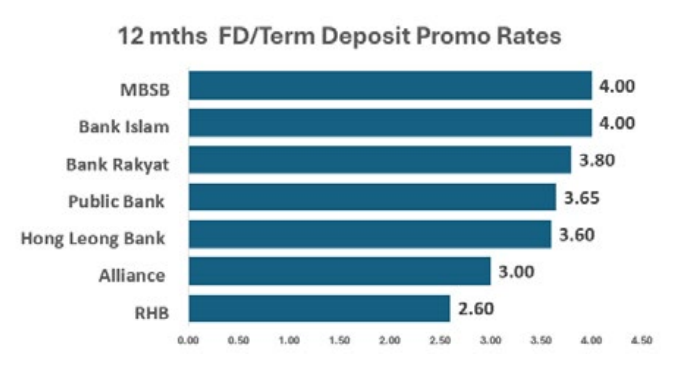

Take the 12-month rates, for instance.

MBSB and Bank Islam stand tall at a robust 4.00% p.a, offering a haven for those yearning for a safe, yet rewarding termdeposits.

Bank Rakyat follows closely at 3.80% p.a, while Public Bank and Hong Leong Bank present competitive figures at 3.65% p.a and 3.60% p.a respectively.

Alliance and RHB, though not leading the pack, still provide notable returns at 3.00% p.a and 2.60% p.a respectively.

If you are an existing RHB customers you enjoy 3.7% p.a. but that’s not exactly like-forlike. Maybank and CIMB choose to focus on other products, such as Term Investment Accounts and FD, and Current Account and Savings Account (CASA) mix – that’s why they are not here.

Between MBSB Bank and Bank Islam, both are good options. But you can guess where I put my money.

Given the fact that everything else is comparable, I chose MBSB for their convenient locations.

STOP PRESS: This almost cost me dearly if not for my wife’s 2020 vision. The offer ends this month—on 31st July, 2024!

Article taken from Marketing Weekender Issue 411.

MARKETING Magazine is not responsible for the content of external sites.