Achieving subscriber scale remains important in the long run, but many streaming players in Southeast Asia have pivoted their focus to finding the right balance between expanding customer bases and generating higher average revenue per user amid mounting pressure to maintain healthy profit margins.

“Revenue growth and cost optimization are among the key themes shaping growth strategies for many of the top streaming operators in Southeast Asia in 2024,” says Kym Nator, analyst at S&P Global Market Intelligence.

Total subscriptions for paid over-the-top video streaming services in Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam are projected to exceed the 50 million mark, potentially translating to a market value of about $1.90 billion at the end of 2024.

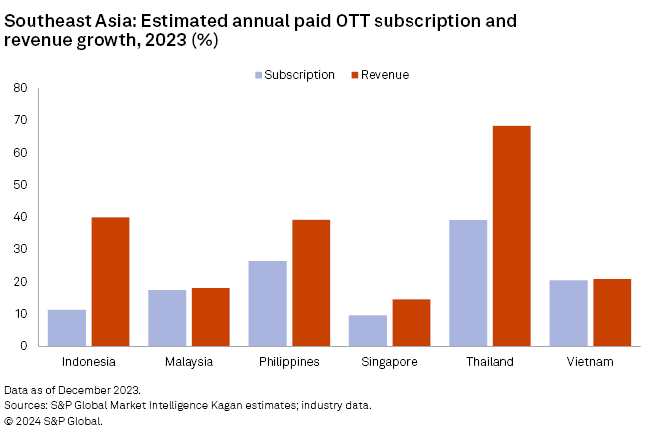

Estimated annual revenue growth for subscription streaming services in Southeast Asia rose at a faster rate of 38% to $1.53 billion compared to 21% for total paid subscriptions, which stood at 44 million by year-end 2023.

Many streaming platforms in Southeast Asia recalibrated their pricing strategies to extract more value from new and existing subscribers. Subscriptions to streaming services have generally remained affordable in the region, providing enough room for services like Disney and Netflix to raise or introduce new fees in some major markets.

Advertising and partnerships with local third-party operators and content producers will continue to play critical roles in powering growth for streaming services in the emerging region.

Paid ad-supported streaming tiers might not gain much traction in Southeast Asia in 2024 as most consumers in the region continue to embrace the freemium model championed by local and regional platforms. Global services are more likely to continue relying on mobile-only plans as the cheaper alternative to encourage untapped price-sensitive consumers to sample their platforms.

MARKETING Magazine is not responsible for the content of external sites.