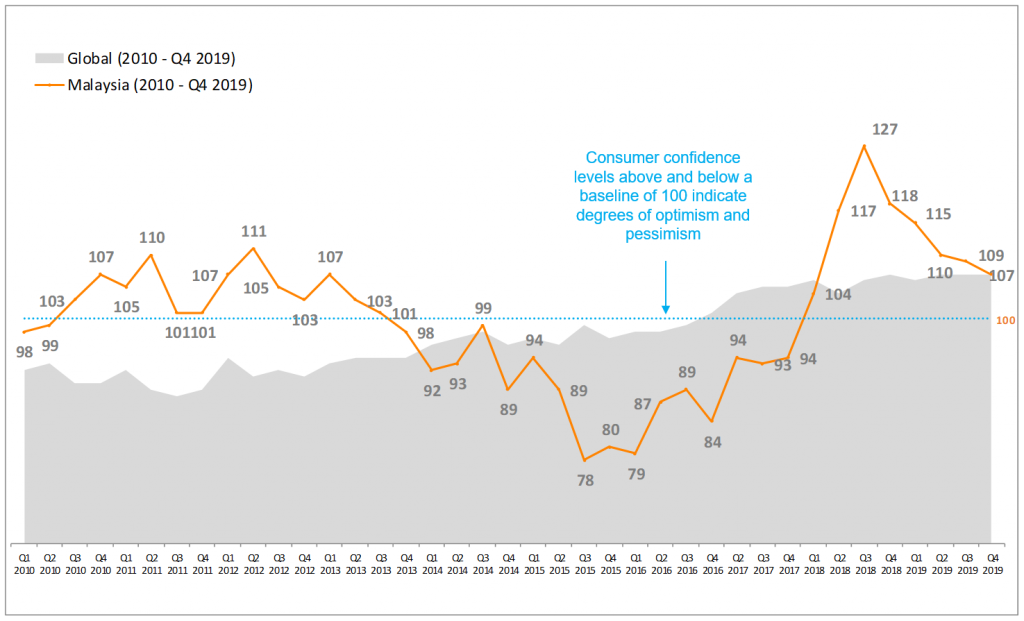

Malaysian consumers remained largely optimistic in Q4 2019, based on an index score of 107 points on The Conference Board Global Consumer Confidence Index, produced in collaboration with Nielsen. This is slightly down from the 109 points posted in Q3 2019, and a drop from 118 points in the same quarter of the previous year.

Q4 2019)

The CCI is driven by three indicators, which are consumers’ perception on local job prospects, personal finances and intentions/readiness to spend. In Q4 2019:

• 61% of Malaysians believed the state of their personal finances in the next 12 months will be excellent or good (vs. 62% in Q3 2019, 70% in Q4 2018)

• 60% had a positive view on job prospects in the next 12 months (vs. 68% in Q3 2019 and 71% in Q4 2018)

• 46% said “now is the time to buy the things they want and need” (vs. 44% in Q3 2019 and 53% in Q4 2018)

“This is the 5th consecutive quarter of decline since the all-time high index score in Q3 2018, which was recorded just after the 14 th General Election,” remarked Luca De Nard, Managing Director of Nielsen Malaysia.

“Since then, we have seen the score steadily decline to a level that is more realistic and sustainable in the long run. Barring any major economic or socio-political event that can adversely affect consumers’ outlook, confidence levels should remain in the positive in the coming months.”

Recessionary sentiment reduced slightly, but Malaysians still cautious spenders

In Q4 2019, 70% of Malaysians believed that the country is currently in a recession – down slightly from 73% posted in the previous quarter; of these, 37% were optimistic about an economic recovery in the next 12 months (which is higher than 34% in Q3 2019).

12 months (Q3 2019 vs. Q4 2019)

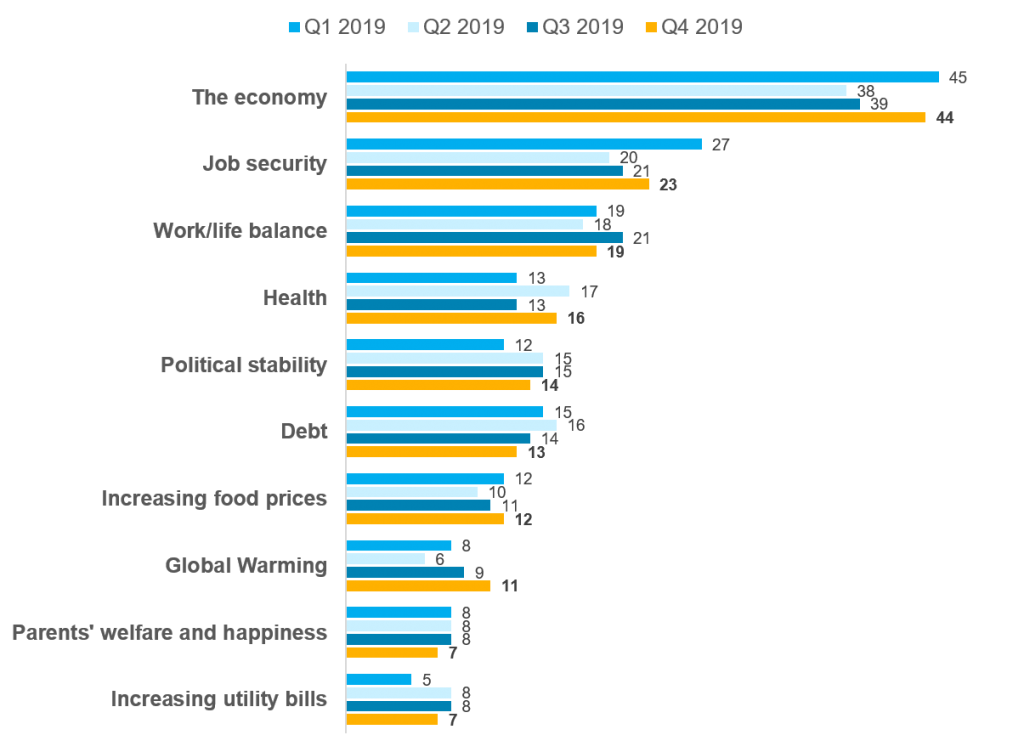

But while recessionary sentiment reduced, more Malaysians cited the economy as their top concern compared to the previous quarter (44% compared to 39% in Q3 2019). Other top concerns included job security (23%), work-life balance (19%), health (16%) and political stability (14%).

Reflecting their increased concerns on the economy, Malaysians continued to be cautious with their finances, with a majority of consumers saying that they have adjusted their spending habits to save on household expenses (85% in Q4 2019 vs 82% in Q3 2019).

When asked what actions they are taking to save on household expenses, 57% said they will spend less on new clothes (vs 49% in Q3 2019), 50% will cut down on out-of-home entertainment (vs 47% in Q3 2019), while 47% will switch to cheaper grocery brands (vs 44% in Q3 2019).

“Given that consumers are slightly apprehensive about spending, brands and retailers should strive to showcase value for money and appeal to Malaysians’ love for promotions. Those who do this successfully will be able to win over consumers in the current climate,” said De Nard.

2019 – Q4 2019) [%]

A majority of South East Asians are optimistic, but not Thais and Singaporeans

Consumers in the Philippines (133 points, 2 nd place), Vietnam (125 points, 3rd place) and Indonesia (123 points, 4 thplace) ranked among the 10 most confident in the world in Q4 2019. At 107 points, Malaysia fell just outside the top 10 most optimistic countries, placing 11 th on the index.

The situation is not the same in Thailand and Singapore, however, where consumer confidence scores are below the baseline of 100, which points to overall pessimism. While Singapore consumers, generally, have not been positive about the future for the past couple of years, this is the first quarter that Thailand’s score has fallen below 100 points on the index.

“Thailand’s confidence scores have been steadily declining over the past five quarters, due to events such as the drought and haze, as well as uncertainty surrounding the general election in the first quarter of last year,” commented De Nard.

“Learning from this, the Malaysian government and private sector should be prepared to address extraordinary events such as the COVID-19 outbreak happening now, which will certainly impact consumer confidence and the overall economy if not contained.”

MARKETING Magazine is not responsible for the content of external sites.