After 25 years leading the local media and entertainment industry, Astro Malaysia Holdings Bhd is now on a new growth trajectory. We have heard of digital convergence and media convergence but it was only when I sat down for lunch with Henry last week that I grasped what Content Convergence was going to mean for all of us.

Henry Tan, Group CEO of Astro already made his mark on the global media scene way before he joined Astro, but this time the dynamics are different.

A global pandemic has thrown marketers off their footing in this new reset. We are at a point where the tide is turning in more ways than one.

“Our strength in local content has been proven by the fact that local and vernacular content accounted for over two-thirds of all audience viewing.”

During this ongoing crises, where trust deficits grow wider, Nielsen reports that TV recorded a 47% increase in viewership because of the higher credibility of news from this medium. During the peak of the first lockdown period in March, TV ratings surged to a high of 20.57 (4.6 million Malaysians) with average time spent per person increasing to 7:08 (from 5:36 hours).

For Astro, despite legacy issues and the never ending satellite versus streaming argument, it has stepped into a hybrid space where the best of both worlds is becoming a reality.

The fact that Astro has more than 200 channels is already a springboard into Over The Top (OTT) which is no longer an opportunity limited to legacy video or television brands.

Malaysian viewers have opted for streaming services – streaming twice as much online videos from services like Netflix in latest reports.

Incidentally, Astro GO ranks 2nd to Netflix in streaming and the third ranked player is a very far third.

Netflix has even bought content produced by Astro, which includes Astro First original drama series, Demon’s Path; Astro Shaw co-produced Malaysian Box Office hit Hantu Kak Limah and Polis Evo 2; as well as Jason’s Market Trails and Festive Foods, a heritage showcase of cultural festivals in Malaysia.

But Astro is not getting into the streaming wars.

Gaming the streaming players?

Astro’s strategy is to be the Super-Aggregator for Malaysian viewers.

With its 25-year track record in the market, Astro now becomes the partner of choice for streaming players to ride on.

Astro’s new independently-branded OTT “super content aggregator” app that will be launched this year will provide its content partners – like Warner Media LLC (which owns HBO, Cinemax, Warner TV and Cartoon Network), Disney and NBCUniversal – an alternative platform to sell their content in Malaysia.

In May and November 2019, Astro already collaborated with HBO and iQIYI (Chinese search engine giant Baidu Inc’s video streaming affiliate) to offer its subscribers preferential pricing for their OTT service.

Just as Astro has a dedicated iQIYI channel, some of Astro’s content is being shown on the iQIYI platform, a boon for local talent seeking exposure in the huge Chinese market.

“This year, we are building a new ecosystem so viewers can pivot into the era of streaming where viewers can pick and choose what and when they wish to view…”

Apart from adding more streaming services into their roster of offerings progressively, the launching of Astro’s very own OTT service this year is where the story is at.

“Our strength in local content has been proven by the fact that local and vernacular content accounted for over two-thirds of all audience viewing.”

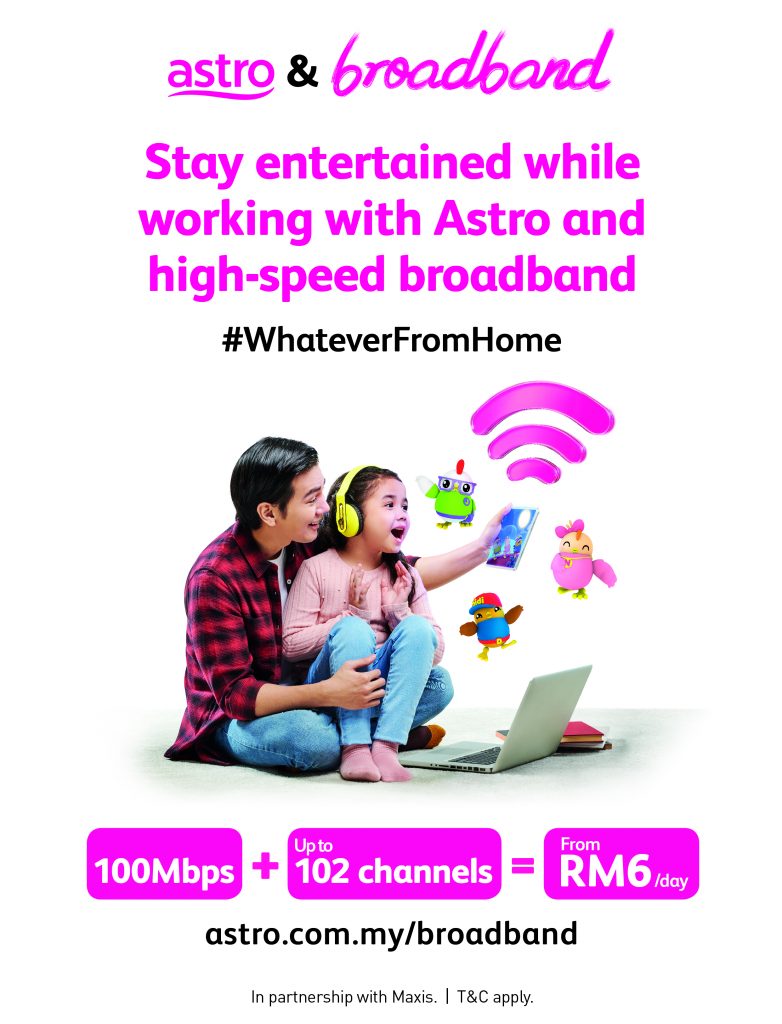

Admittedly, Astro being a legacy service provider is unable to switch over overnight because it is a technological leap. But the race has begun. An in-house broadband service may also be in the works.

Similarly, old TV-viewing habits are slow to change for a majority of Astro’s 5.7 million subscribers that make up 74% of Malaysian households.

Regardless, Astro is coming up to speed as its Content Convergence strategy is pervasive, traversing mass audiences to micro-communities and groups.

Readers can check out Astro’s latest Dream Makers TVC series here.

“This year, we are building a new ecosystem so viewers can pivot into the era of streaming where they can pick and choose what and when they wish to view instead of scheduled programming currently offered.”

All for One, One for All

Audiences are tired of navigating between multiple services to find what they are looking for. Astro hopes to address the issue of subscription fatigue by allowing users group multiple subscriptions under a single umbrella with one account, login, payment preference, etc.

The new ecosystem will offer a single gateway access to an array of content they now access separately through various apps and incorporates Search for seamless navigation under a singular and better bundled price offering. Much like a Video Streaming Search Engine within the same realm.

This model will appeal to the “cord-nevers”, viewers who have never paid for a cable or satellite subscription, who are unforgiving unless their choice of content is on their platform of choice 24/7.

One sexy app is what they want. And if you go by what most marketers believe, what millennials want, millennials get!

“Cord-cutters” or those disenchanted with linear pay-TV broadcasting will also find the new Astro coming full circle to meet their needs.

… The challenge will be in the finer details of contractual arrangements with content providers…

Hence, Astro is not joining the streaming wars but embracing all the combatants into their fold, offering them win-win partnerships, allowing them to scale their numbers through Astro’s footprint of more than 74% of Malaysian households.

The new realisation is that streaming services are complementary rather than cannibalistic to Astro’s business. Time to streamline streaming services.

Addressable Advertising

The new super aggregation journey seems almost like a rebirth for sorts. But it is clear that the TV business is on the verge of being taken over by super aggregators with pay-tv in pole position to lead and SVODs (Subscription Video on Demand) holding the rest of the power.

Super aggregation is a logical progression for Astro as their history has always been one of securing affiliate relationships with content providers. The challenge will be in the finer details of contractual arrangements with content providers.

Estimates suggest that at the top of the list of global SVOD syndicators are Netflix, Amazon and Disney+ and will comprise 67% of global SVOD subs, outside of China, by 2025.

Astro is also positioned to blend linear services with the best of SVOD services.

Plus no-one can deliver Live, linear TV with the massive scale of broadcast like Astro.

A single, integrated platform for encoding, storage, delivery, personalization, and data unification. This means advertisers may finally get addressable TV advertising, programmatic TV or the ability to show different ads to different households while they are watching the same program.

Ah, the media equivalent of heaven!

A peek into this future is evident with Astro’s Ultra Box which also offers cloud-based video recording and access to 60,000 video-on-demand content. Talk about a sexy interface…

MARKETING Magazine is not responsible for the content of external sites.