While the media agency-funded ad spend market dropped 10.6% in March, the 18th consecutive month of decline, newspaper bookings soared by 30.2% in response to COVID-19, according to the latest Standard Media Index (SMI) figures.

Newspaper bookings were the strongest of any medium for the month, but the true extent of COVID-19’s impact on ad spend and brand budgets is yet to be seen, with SMI AUNZ managing director Jane Ractliffe predicting an April decline of 30%.

This is in line with SMI’s mid-April forecast, with future pacing data collected with a week of trading to go showing the local value of April ad spend sits at 57% (and 59.7% in New Zealand) of that achieved in April last year.

“Those figures suggest that in both the Australian and New Zealand media markets we should see declines in media agency bookings of about 30% in April, although the final results won’t be known until we collect more data in just over a week’s time,” Ractliffe explained.

SMI said it also has good visibility into the May market, with 28% of local bookings guaranteed (and 31% in New Zealand).

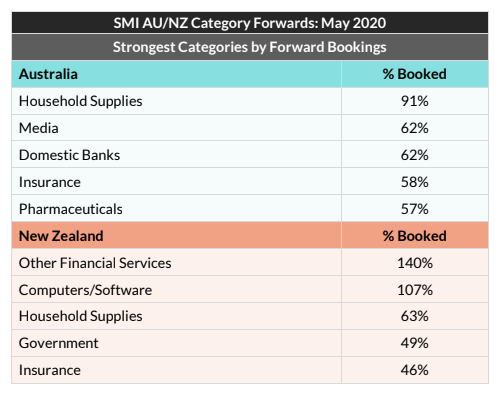

“And we can see many product categories are already showing bullish levels of media investment in May, suggesting the market looks set to improve on the April results,” Ractliffe added.

“In Australia, advertisers in the Household Supplies category have already guaranteed 91% of last year’s total investment for May and in NZ ad spend from the Other Financial Services category is already 40% above that recorded in May 2019.”

March demand – down 10.6% – was lower than usual due to a lack of digital bookings later in the month, which SMI said would have decreased the decline to single digits.

Cinema dropped 40.8% due to required closures, magazines were down 21.1%, and outdoor was back just 8.9% despite lockdowns forcing people to stay inside.

If the month’s figures were normalised to account for last year’s high level of political party and union bookings in the lead up to the federal election, decline would sit at 9.3%.

In New Zealand, meanwhile, demand grew 1.1% in March – it’s third consecutive month of growth. Newspaper bookings jumped by 35.7%, the highest March ad spend in the market for newspapers since 2017.

Ractliffe said the results indicated New Zealand is in a stronger financial position than Australia, growing 4% in the financial year versus dropping 6.6%.

“This context is important as going forward we can see future confirmed bookings in NZ are already slightly above that evident in Australia, and that stands to reason as confidence in the NZ media market has been at a far higher level for the past nine months,” she noted.

This month, SMI also launched three new retail sub-categories to bring the total of retail-specific categories to nine: supermarkets/ convenience stores, alcohol retailers, and shopping malls/ operators.

SMI is also working on new breakdowns for domestic banks, with six sub-categories to be released in May: brand/ sponsorship, consumer banking, business banking, institutional banking, home loans, and savings/ deposits.

The categories add additional insights for media agencies, on top of SMI’s new features including a newsletter and COVID-19 ad spend updates. Ractliffe said this service will continue over the coming months, in addition to its usual fortnightly releases, because navigating this time with data is crucial.

“It’s never been more important to have the facts about how advertising demand is tracking and we want to ensure all our media and advertiser stakeholders continue to have an accurate view of the market on which to make important decisions in this unprecedented time,” she said.

source: https://mumbrella.com.au/

MARKETING Magazine is not responsible for the content of external sites.