Disloyalty levels are on the rise among consumers in Malaysia, with just 9% of Malaysian consumers considering themselves to be committed loyalists when it comes to their favourite brands, according to a global consumer study conducted by global measurement company, Nielsen. This figure is in-line with the global average of 8%.

Nielsen’s Global Consumer Loyalty demonstrates that consumers are actively on the lookout for new grocery and household brands as the gamble of buying new products is de-risked by levers such as rising income levels in developing markets.

In Malaysia, a significant 44% of consumers say they love trying new things and nearly a further half (47%) – whilst preferring to stick with what they know – can be moved to experiment.

Consumers in Asia Pacific have the highest brand-switching propensity, with 47% willing to switch brands or try different products, closely followed by Africa and the Middle East (45%) and Latin America (42%). Consumers in North America and Europe are somewhat less likely to switch brands, at 36% and 33%, respectively.

Active explorers are adding more brands to their repertoire

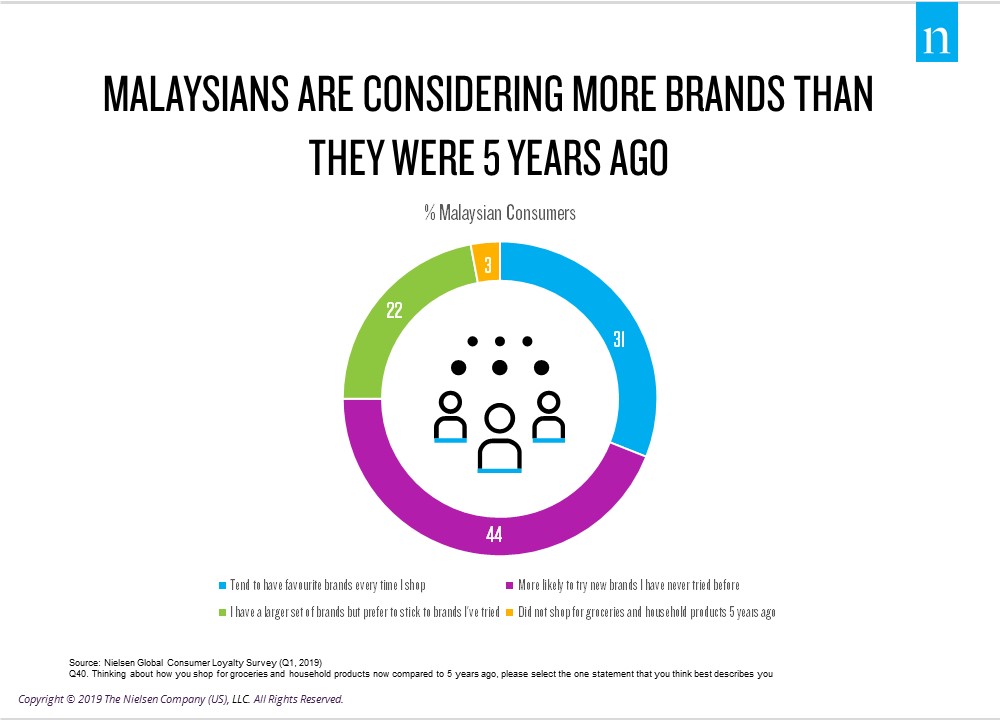

Malaysians are loosening their ties with familiar brands, with 44% consumers saying that they are now more likely to try brands that they’ve never tried before compared to five years ago.

Another 22% say that they now have a larger set of brands in their repertoire, but still prefer to stick to brand names they know. Only a third (31%) say that they still continue to buy their favourite brands every time they shop, as they did half a decade ago.

“Brand owners need to get accustomed to this new normal, where the overwhelming majority of consumers are actively or passively open to playing the field when it comes to brands,” says Luca De Nard, Managing Director of Nielsen Malaysia.

He attributes part of this it to the so-called “Amazon effect”, which has expanded consumers’ choice and enables price awareness more than ever before. However, he says there are multiple factors working in tandem to create disloyalty among consumers.

“There are Facebook groups in Malaysia, where consumers can hunt or even broker deals for new products at competitive prices. We also have trucks selling fresh meat, poultry and produce in neighbourhoods offering consumers convenience at prices that rival supermarkets. At the same time, traditional grocery retailers are trying to find ways to retain profitability levels in a world where home delivery is beginning to undermine margins.”

Malaysians prejudiced by price, while most Asia Pacific consumers seek superior quality

In Malaysia, monetary factors are the main influences for switching brands, with nearly half of Malaysians (49%) saying that they are always swayed if a product demonstrates value for money, while 47% will switch for price reductions or promotions. Only a third (35%) are influenced by the fact that a brand is well known and trusted.

At a regional level, Asia Pacific is the only region where value for money does not rank as the top factor influencing brand purchasing decisions; on average, 42% of consumers say enhanced or superior quality is their key consideration, while 40% are influenced by value for money.

However, value for money stands out as the key influencer of brand choice in Africa and the Middle East (44%), North America (38%), Latin America (37%) and Europe (35%).

De Nard says, “While Malaysian consumers may be enticed by a product’s price, they will also commit to brands that demonstrate superior quality.”

“Independent opinions and reviews are also influential in persuading a consumer to buy one product or brand over another, which is why brands should capitalize on the ability to generate personal dialogues with consumers through social media while also allowing prospects the opportunity to provide feedback.

“These efforts will go a long way in fostering consumer acquisition and retention.”

Malaysians: no loyalty for chocs & biscuits, but brand matters when it comes to personal care.

Competition is heating up across a number of categories in the marketplace as Malaysian consumers do take brands into consideration, but still switch across a various names. Chocolate & Biscuits (53%) and Fruit Juices (45%) top the list for categories where brand switching is more prevalent.

However, Malaysians are brand loyal when it comes to personal care products, with 46% saying they only choose from one or two shampoo & hair conditioner brands, and 45% choose from one or two skincare brands (body lotion, moisturizers, body wash).

MARKETING Magazine is not responsible for the content of external sites.

An afternoon of conversations we never had, with leaders most of you never met.

Discover what’s possible from those who made it possible. Plus a preview of The HAM Agency Rankings REPORT 2024.

Limited seats: [email protected]

BOOK SEATS NOW