In a world where its getting harder to reach customers, ‘advanced television’ is poised to change all of this.

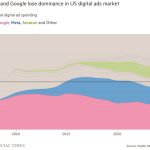

All of this will ultimately point towards digital advertising revenue, and Amazon is set to join Google and Facebook in turning the marketplace into a triopoly.

While Google and Facebook may have a 57.7% market share as of 2018, Amazon’s wealth of consumer data will make it a force to be reckoned with, and the stage could be set for all three companies to corner the scene.

Advertising in television will soon be heavily customized, and these online ads will be tailored using the consumers’ viewing habits, purchases and location data.

Philadelphia advertising agency, Harmelin Media, highlighted advanced advertising on TV as on the key standout trends at an event recently.

“Consumer data is now being matched with viewership data to follow your audience wherever they live,” Harmelin Media’s Dan Cox, vice-president and head of planning, said.

In the U.S., cable and satellite providers such as Comcast and DISH network are showing highly personalized advertising that is based on its customer profiles.

From the choice of pets they have, credit card data, GPS phone location data and other tracking data; it’s all being factored in to determine what kind of advertising will appeal to them.

Currently, advanced TV advertising is only 3% of the United States’ US$70bil (RM291.86bil) in total ad spending per year, but it’s expected to grow exponentially.

While audio marketing is also changing with extra emphasis being shown on advertising in online music services, mobile phones are becoming the most valuable source of consumer data.

According to Garry Herbert, associate media director at Harmelin, phones are revealing a lot of data regarding purchasing behavior and this is making an impact on digital advertising.

One such example is that digital billboards with the help of pin pointing phone locations has made the whole enterprise very efficient.

Advertising dollars spent on digital billboards reached US$8bil (RM33.35bil) in 2018, up 5% from the prior year, said Alison Bolognese, media director at Harmelin.

Interestingly, voice search is also predicted to be a high growth advertising channel.

In America, there are 118.5 million active smart speakers, and Amazon owns 65% of the smart speaker share.

Sources: The Philadelphia Inquirer and The Star Malaysia

MARKETING Magazine is not responsible for the content of external sites.

An afternoon of conversations we never had, with leaders most of you never met.

Discover what’s possible from those who made it possible. Plus a preview of The HAM Agency Rankings REPORT 2024.

Limited seats: [email protected]

BOOK SEATS NOW