4 major trends that will boost online grocery shopping

The Tetra Pak Index was released yesterday by the world’s leading food processing and packaging solutions company.

The report focused on the rise of online grocery shopping and its unique challenges and how smart packaging plays a role in creating new business.

Malaysia is one of the leading e-commerce markets in South East Asia, with an impressive *88% growth rate in the online channel for FMCG sales. The online channel captured 1.5% of FMCG sales in Malaysia in 2017, one of the highest shares in South East Asia.

With the number of mobile internet users in Malaysia projected to increase by 5% over the next few years, reaching more than 21 million users, the online sales segment is expected to grow in tandem with this trend.

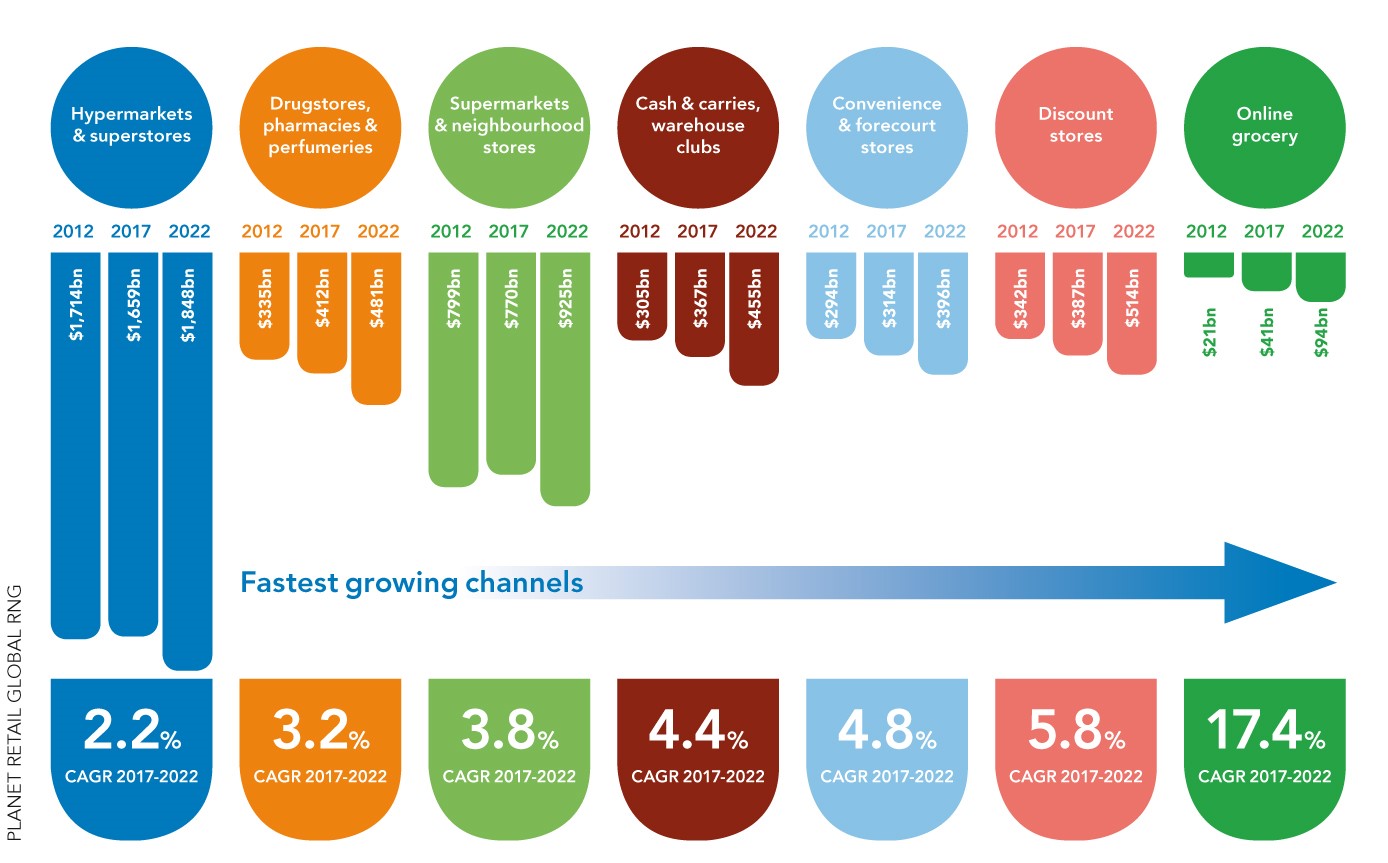

According to John Jose, Marketing Director, Tetra Pak Malaysia, Singapore and Philippines, “Tetra Pak Index forecasts that the online grocery segment will grow by 17% worldwide from 2017-2022.

At the same time traditional grocery outlets, such as supermarkets and convenience stores, will continue to play a major role in the market, but with a much slower growth rate of only 2-5%.

The main reason for this difference is that consumers now look for the most convenient channels which let them make purchases anytime and anywhere by using their smartphones.

In Malaysia, the online channel is expected to grow significantly in the food category within 3 years, doubling its market share as of today and paving the way for the rapid rise of the online grocery segment.”

According to Kantar Worldpanel Malaysia group director Cynthia Su the online channel in the FMCG industry is growing strongly in emerging markets and Malaysia is among the fastest growing markets.

Currently, the FMCG online channel in Malaysia is dominated by baby and beauty products.

However, the food category has been charting a notable upward trend with one out of every three online shopper purchasing food items, and this rise is expected to continue, shares Cynthia.

The Tetra Pak Index 2018 highlights four major trends for brands to consider in terms of product development to keep up with these challenges:

Convenience

This would be the main thing that online consumers look for a time crunched shoppers want to make their lives easier.

Key opportunities include easy-to-use products which are convenient to consume, keep and transport.

Sustainability is also important to consumers as these days people want to know where raw materials are sourced from and how products are recycled.

Personalisation

Personalisation is key to customising the shopping experience. Getting consumers to purchase items online without first seeing and trying them in person creates a challenge which can be addressed through high-quality attractive packaging.

Great packaging not only helps to stimulate trial purchases, but also give the fun unboxing experience which may lead to further purchases.

Technology & performance

Packaging tracking systems, will become a critical factor in boosting efficiency in online grocery logistics.

This is crucial, because logistics becomes increasingly complex as consumers shift towards buying more frequently but in smaller amounts. The use of robotics, AI and data processing are all parts of the solution which is aimed at transforming the supply chain.

Smart packaging

Another important element in the online grocery space is Smart Packaging which uses codes to communicate with consumers. Radio Frequency Identification (RFID) or QR (Quick Response) codes can be read by small scanners or mobile phones.

“Smart packaging features allow brands to connect and provide positive consumer experience which is a key factor in online grocery shopping.

“Sharing important information such as production materials, nutrition facts, current promotions and environmental initiatives is only one example of how smart packaging can be used. It opens up all kinds of possibilities for strategic communications and creating a sustainable relationship with consumers in the future,” adds John Jose.

MARKETING Magazine is not responsible for the content of external sites.

An afternoon of conversations we never had, with leaders most of you never met.

Discover what’s possible from those who made it possible. Plus a preview of The HAM Agency Rankings REPORT 2024.

Limited seats: [email protected]

BOOK SEATS NOW