By Vadivel Rajhamanickam Padmanabhan (Padi)

The digital advertising size in Malaysia is estimated to be in the range of RM 2.3 Bn to as high as RM 6.2 Bn, depending on which Report you choose to trust.

The spread is too large and calls for pertinent questions to the industry.

While different listed companies use different numbers for strategic reasons, we looked at two published sources: [1] e-Conomy Report from Google, Temasek, Bain & Company.

These are being published since 2017 and provide some form of continuity and [2] MSA (the association representing Media-agencies) which started reporting around 2018 onwards.

There is a vast and stark difference in the estimates published by these two sources. As expected, the definitions and assumptions used by these two sources are different.

We will provide simple comparison and implications for the industry.

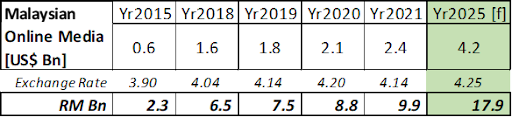

The e-Conomy SEA Reports are published annually by Google, Temasek and Bain & Company around October of each year. The main service-areas covered are (1) Transport and Food, (2) e-Commerce, (3) Online Travel and (4) Online Media. Within this Online Media, they had aggregated (a) Gaming, (b) Subscriptions (Video and Music service) and (c) Online Advertising.

As expected, Online Advertising which includes Search, Social, Display, Video represents the major component under Online Media.

Exhibit: 1

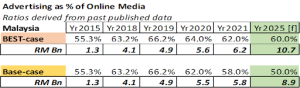

The e-Conomy SEA Report had provided the dispersion by Gaming, Subscription and Advertising for the years 2015, 2018 and 2019 at an aggregated level for the SEA markets.

For reasons unknown, they had stopped publishing those numbers for 2020 and 2021. Using those past ratios one can estimate the Online Advertising size for Malaysia. As a thumb rule, the Digital Advertising accounts for 60% of all Online Media.

Exhibit: 1a

Broadly speaking, the e-Conomy SEA Report indicates that the Digital Advertising size in Malaysia was around RM 6.0Bn in 2021.

It had not provided any breakdown by formats and products such as Search, Social, Video and Display. Nonetheless, the number is significantly large than generally assumed by the industry. At RM6.0B, it is almost three times the size of traditional advertising (TV+ Radio+ Print+ OOH).

While there is clearly a vested reason for Google to boost and boast about the Online Advertising size, it will also be attracting a lot of internal pressures to deliver against those numbers and growth rates.

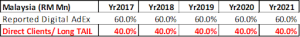

Now, let us review the other Report published by MSA (Media Specialist Association), which is composed of practitioners. These are being published quarterly from Q32019 and have provided annual numbers from 2017.

MSA had worked on a major assumption that around 20-odd agencies account for 60% of all Digital Advertising in Malaysia.

They had not provided a reliable and verifiable source for that assumption. Because this 60%-contribution is cast in stone for all the analysis, they tend to suppress the overall size of digital advertising, under-represent the contribution from SMEs, the paid-Search is disproportionately under-reported and the size of social media may be distorted and the power of video-format is not captured fully.

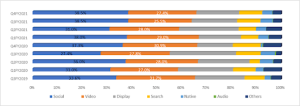

Exhibit: 2

Around 65% of all Digital Media bought by agencies under MSA are in the combined social-media and video formats.

For reasons unknown, MSA does not provide the break-up for video-format within social-media, which for all practical purposes is dominated by Meta/FB/IG.

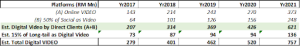

Exhibit: 2a

If we assume that the video-format within social-media is around 50%, then Video accounts for 45% of Digital Advertising bought by the “Agency/Direct Clients” in Malaysia and is approaching RM750 Mn this year.

Exhibit: 2b

This reported RM600+ Mn is significant, when we consider the size of traditional, Linear-TV ad dollars. We need the industry leaders to provide clear and concise estimation on the Total Video advertising as managed and processed by the Direct Clients/ Top Agencies.

The industry can then have a good handle on the dynamics, including campaign-measurement metrics and also on trading practices.

It is important for the broadcasters and premium publishers to stand their ground, fortify their strategic advantages, revisit their work-flow processes, invest in digitization and review their inventory-pricing policies.

There is a big role that Regulatory Body, MCMC can play by engaging the industry to understand the investment trends.

If the ad dollars are flowing away from traditional, linear-TV then it needs to revisit its plan for TV Audience measurement and get clear commitments from the large global, digital platforms and emerging streamers to participate in the study.

If the Online-video advertising is as big as the traditional, linear-TV in 2021 and is walloping at a much faster rate, and coupled with the imminent launch of 5G, which is expected to further drive adoption of streaming and digital-consumption, then it is best that the industry revisits their priorities around measurement projects.

Another major development led by WFA in the US and UK, where the advertisers are funding the Cross-media Measurement initiatives and have committed to make the design and methodology open-sourced.

Big opportunity for the new MAA Leadership to be seated at top of table, open their purses to invest their fair share of costs and demand the elusive global digital platforms to actively participate in the MCMC initiative.

About the writer:

Paddy alias Padmanabhan had been working in the marketing and advertising industry for the past 25+ years. Currently he is engaged in data and audience measurement projects in Malaysia as an Independent Consultant. Prior to that he was VP-Group Integration at Astro, a DTH operator. Having worked across India, Malaysia and Singapore, he brings deep and wide marketing and advertising experience. He had spent significant time working with GroupM, across countries with its agencies and in challenging roles with leading CPGs like Unilever, P&G, Danone etc.

MARKETING Magazine is not responsible for the content of external sites.