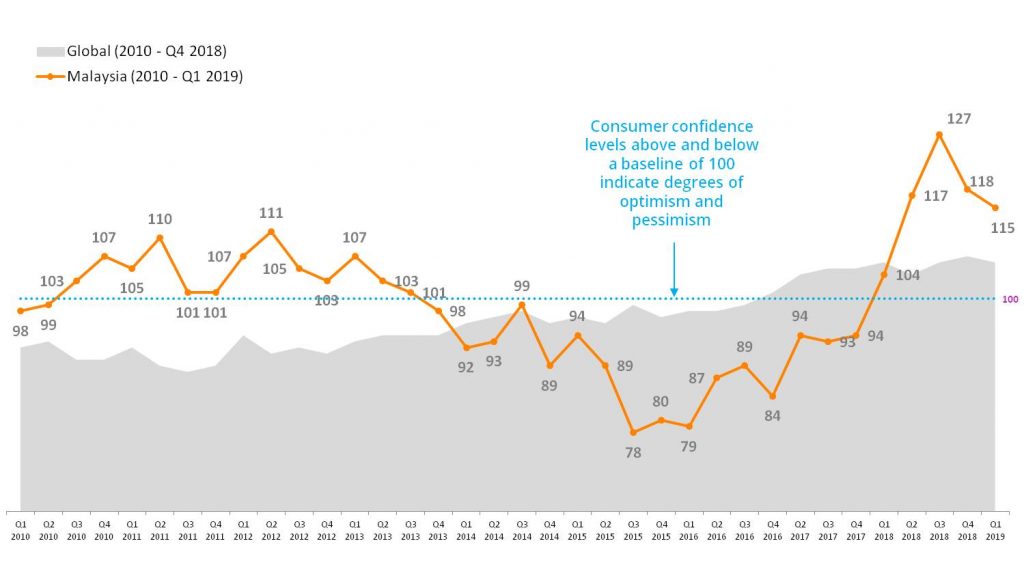

Malaysia has been placed number six globally on the Consumer Confidence Index (CCI), with an index score of 115 points in Q1 2019, largely in-line with last quarter’s score (118 points).

The country posted the fourth highest y-o-y gain among the 64 countries measured, up 11 points vs. Q1 2018, according to The Conference Board Global Consumer Confidence Survey, which is produced in collaboration with Nielsen.

The CCI is driven by 3 indicators, which are consumers’ perception on local job prospects, personal finances and intentions/readiness to spend.

While perception on personal finances and job prospects are in-line with the previous quarter, there is a significant decrease in readiness/intent to spend:

• 71% of Malaysians believe the state of their personal finances in the next 12 months will be excellent or good (vs. 70% in Q4 2018, 63% in Q1 2018)

• 70% have a positive view on job prospects in the next 12 months (vs. 71% in Q4 2018 and 56% in Q1 2018)

• 48% say “now is the time to buy the things they want and need” (vs. 53% in Q4 2018 and 42% in Q1 2018)

“This is the fifth consecutive quarter of consumer optimism for Malaysia, and consumers appear largely positive about the country’s prospects in 2019,” says Luca De Nard, Managing Director of Nielsen Malaysia.

“But consumer confidence may not always translate into spending, as a majority of consumers are conservative about spending at this point in time. As such, brands who are able to demonstrate value for money are more likely to appeal to the cautious consumer.”

While consumers are positive on the state of their personal finances and job prospects, two in three continue to believe that the country is in a recession (69%, in-line with Q4 2018).

Of this, 45% are positive that the economy will recover in the next 12 months (in-line with 44% in Q4 2018).

As such, it should come as no surprise close of half of consumers rank the economy as their top concern (45%, versus 37% in the past quarter). This is followed by job security (27%) and work-life balance (19%).

“Perception on the larger economy is shaped by more than just how an individual feels about his or her own financial situation. It can be driven by conversations in the public sphere, the influence of family and friends, and also speculation about global economic trends,” notes De Nard.

“In Malaysia, it is clear that perception of the economy does not correlate to actual economic performance. For example, we experienced consecutive quarters of low inflation, a consistently low unemployment rate of 3.5% and GDP growth of 4.7% in Q4 2018, all which contributed to healthy

total FMCG growth of 4.9% in 2018.

“Yet, in Q1 2019, there has been a significant rise in concerns

about the economy compared to the previous quarter, showing that messages surrounding the country’s strong economy is not at the forefront of consumers’ minds.”

Malaysian’s are prudent spenders. Given consumers’ cautious optimism, they are naturally more prudent when it comes to spending.

Indeed, close to 9 in 10 Malaysians (88%) say that they have adjusted their spending habits to save on household expenses.

Some of the actions they have taken to control their expenses include spending less on new clothes.

(54% versus 52% in Q4 2018), saving on gas and electricity (49% compared to 40% in the previous quarter), cutting down on out-of-home entertainment (48% compared to 50% in Q4 2018) and switching to cheaper grocery brands (43% compared to 41% in Q4 2018).

“The bottom line is that Malaysians have always been financially prudent,” commented De Nard. “We know from our Shopper Trends study that a majority of consumers are price sensitive and nearly half actively seek out in-store promotions.

“Brands who want to win the consumer share of wallet would

do well to keep these behaviours in mind.”

When it comes to spending their spare cash, more than half of consumers put it towards their savings, 44% pay off their debts, credit cards and loans, while just over a third spend on holidays or vacations.

Source: The Conference Board Global Consumer Confidence Survey

MARKETING Magazine is not responsible for the content of external sites.