Omnicom has announced a dramatic overhaul of its global operations, with more than 4,000 jobs to be cut and a number of storied advertising agencies being folded into its main networks following its acquisition of Interpublic Group.

The restructuring follows Omnicom’s recently completed takeover of IPG in a deal valued between US$9 billion and US$13.5 billion depending on the accounting lens. The merged company will become the largest advertising agency holding group globally in revenue terms surpassing long-standing industry leaders.

Which Agencies Are Being Retired — And Where They Go

Under the new plan, several venerable agency brands will cease to exist as independent entities…

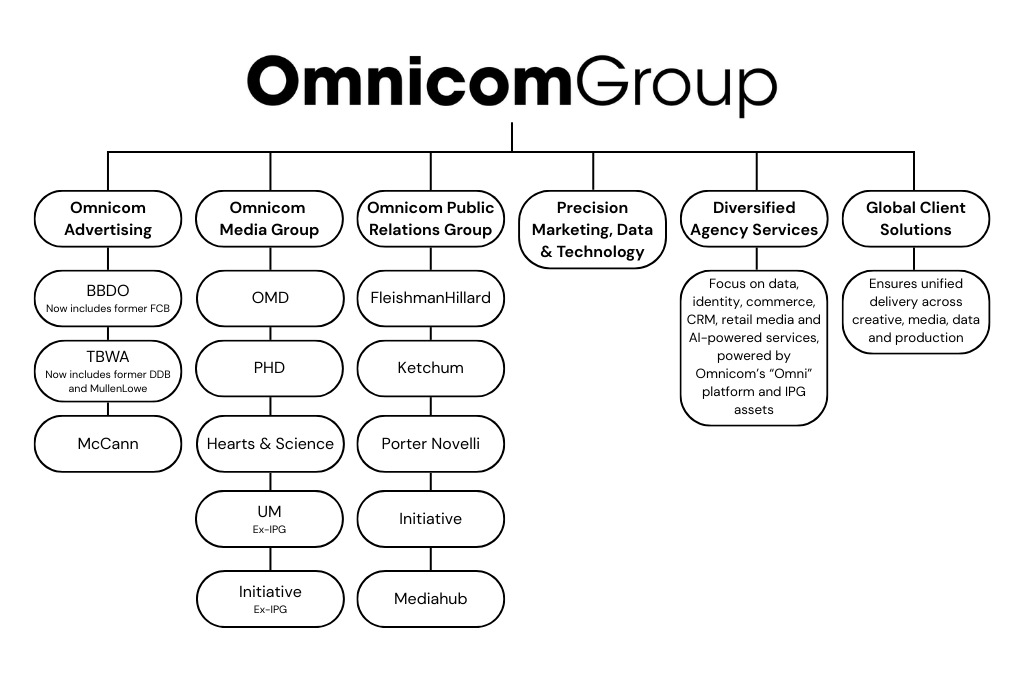

The creative-services wing of the new combined entity, now called Omnicom Advertising, will be anchored by just three global agency networks: BBDO, TBWA and McCann Worldgroup.

Meanwhile, the media operations side has also been reorganized: all of IPG’s media units (including those under IPG Mediabrands) will be merged into a unified group under Omnicom Media Group.

What Kind of Jobs Are Being Cut and Why

According to public statements by Omnicom CEO John Wren, the 4,000-plus job reductions will mostly affect administrative roles, with some leadership positions also among those eliminated.

This is not entirely new: both firms have already carried out significant layoffs in 2024–2025, including around 3,000 at Omnicom and about 3,200 at IPG earlier this year.

Omnicom says this step is necessary to achieve the US$750 million in annual cost synergies promised to investors when the merger was first proposed. The company expects actual cost savings to exceed that initial estimate.

Executives describe the consolidation as a strategic move to avoid redundancy, flatten management layers and build a more efficient, scalable platform.

The Industry Trend — And What This Means for Advertising

This shake-up at Omnicom comes at a time of major structural change for the broader advertising industry. Rising competition from tech giants like Meta Platforms and Google who offer advertisers self-serve ad tools plus the growing use of generative artificial intelligence in creative and media workflows, have squeezed traditional agency margins.

By combining creative, media, data, tech and production capabilities under a single umbrella — and equipping the business with its AI-powered intelligence platform (Omni, integrated with data unit Acxiom) — Omnicom aims to future-proof itself against these competitive forces.

In its public remarks, Wren emphasized that the deal marks a “defining moment” for the company and the industry. With the merger complete, Omnicom now offers clients broad global reach, unified media-buying firepower, and AI-driven creative and commerce capabilities.

Still, many in the industry view this as a wake-up call: the consolidation underscores how surviving agencies will now need to adapt to remain relevant in a world where brand marketing increasingly demands speed, scale and data-driven performance.

What’s Next: What to Watch Out For

For now, Omnicom is betting big that scale + technology + unified operations will offer a competitive edge. The next few months will reveal whether this gamble and the resulting disruption pays off.

Share Post:

Haven’t subscribed to our Telegram channel yet? Don’t miss out on the hottest updates in marketing & advertising!