The Media Specialists Association (MSA) of Malaysia, in collaboration with the Malaysian Advertisers Association (MAA) and the Malaysian Digital Association (MDA), announced the Malaysian Digital ADEX Reports for the first half of 2025 (1H 2025). The Q1 and Q2 reports track digital advertising expenditure across major formats and industry categories, offering a comprehensive snapshot of Malaysia’s digital advertising performance for the year to date.

Covering the period from January to June 2025, the reports draw on data from 21 participating media agencies, representing about 60 percent of Malaysia’s total digital ad spend. Figures for the third and fourth quarters will be published in subsequent updates by MSA, completing the full-year overview.

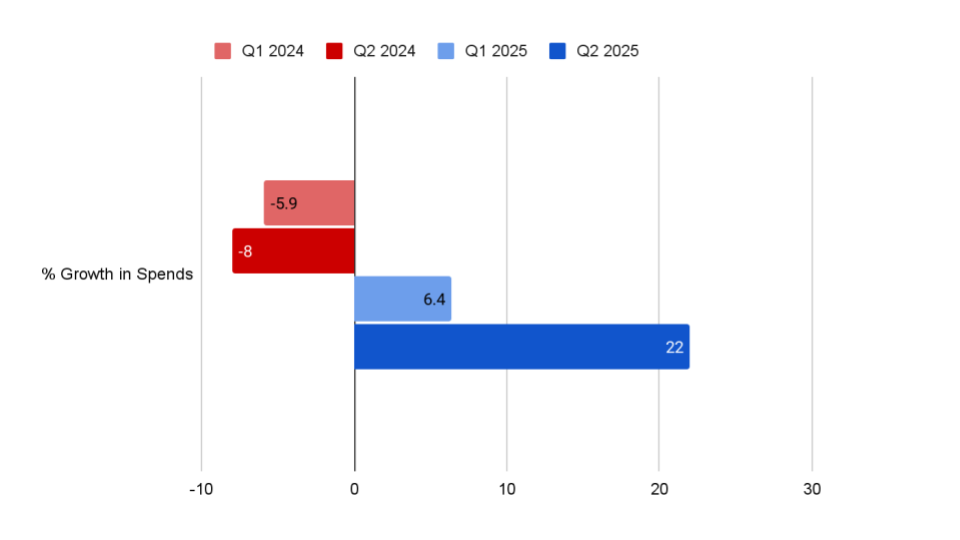

Malaysia’s digital advertising market showed strong momentum in the first half of 2025, continuing the recovery that began late last year. The reports recorded a 6.4% rise in Q1 and a further 22% surge in Q2, bringing the total reported digital adex to RM343 million and RM661 million respectively. Combined, these figures mark one of the most robust first-half performances since the initiative began tracking digital spend in 2017.

The upward trend points to renewed advertiser confidence and steady growth in consumer activity across digital platforms, following a period of cautious spending in 2024.

Jessica Lim, Pillar Lead for Research and Measurement, MAA, said: “After a cautious year in 2024, we’re now seeing a genuine resurgence in digital advertising confidence. Brands are re-energising their campaigns, experimenting with creative formats, and doubling down on measurable results. This rebound signals not just recovery, but renewed belief in the strength of Malaysia’s digital economy.”

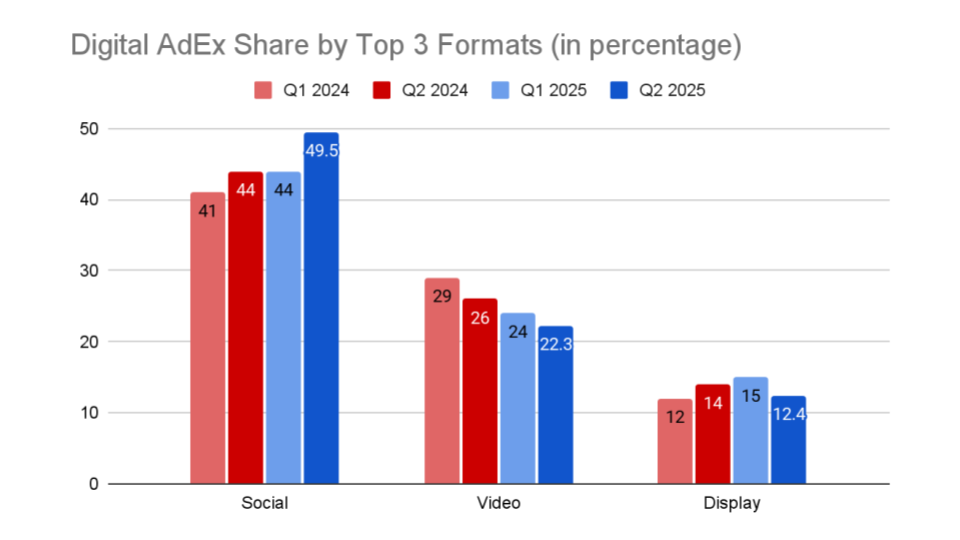

Alongside this overall rebound, shifts in media format preferences reveal how advertisers are fine-tuning their digital mix to match changing consumer behaviour. Social platforms continued to dominate Malaysia’s digital advertising spend, rising from 41% to 44% in Q1 year-on-year and from 44% to nearly 50% in Q2 year on year. The steady rise underscores advertisers’ growing focus on social engagement and community-driven content as key drivers of digital visibility.

Video remained the second-largest format, though its share moderated to 24% in Q1 and 22.3% in Q2 of 2025 respectively, while Display fluctuated between 12–15% as brands balanced broad-reach awareness with performance-driven optimisation across programmatic and direct buys.

“Social remains the heartbeat of digital engagement in Malaysia. We’re seeing brands tap into mini dramas, short-form video, creator partnerships, and conversational formats that meet audiences where they are — scrolling, interacting, and sharing in real time. As social commerce accelerates, these numbers are expected to rise even further, reshaping how brands move consumers through the marketing funnel. At the same time, display and video continue to play essential supporting roles, showing that a balanced, full-funnel digital mix still matters for reach and brand strength,” Lim added.

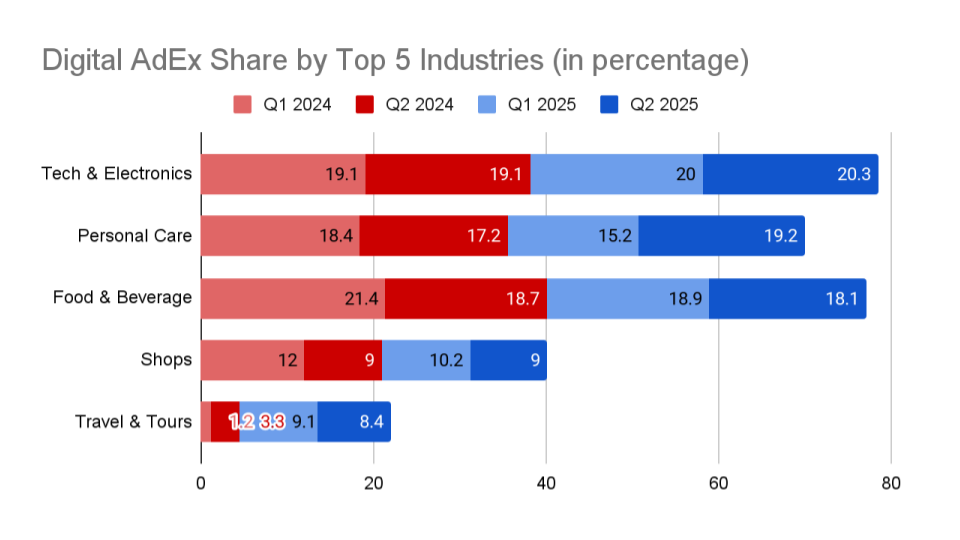

Across sectors, the report shows a reshuffling of Malaysia’s top digital spenders in the first half of 2025. Tech & Electronics retained its lead as the largest digital spending category, rising from about 19% to 20% year on year, while Personal Care showed mixed performance — softening in Q1 but rebounding to nearly 19% in Q2. Food & Beverage remained among the top three despite a modest decline from 21% in Q1 2024 to 18–19% in 2025.

The standout performer, however, was Travel & Tours — climbing from just 1% in Q1 2024 to nearly 9% by Q1 2025, signalling renewed momentum in tourism, hospitality, and experience-based advertising.

“The rise of travel and lifestyle categories tells a clear story — Malaysians are back to exploring, connecting, and spending on experiences. Advertisers are responding with campaigns that speak to optimism, mobility, and emotional reconnection,” said Lim.

Claudian Navin Stanislaus, President of MAA, added: “What matters most here isn’t that the numbers are up; it’s that we’re seeing a healthier balance between progress and perspective, between the tools and the people behind them. The growth across categories suggests Malaysia’s advertising industry isn’t just reacting to change… it is choosing to move forward with intent, not just intensity.

“Each data point is a reminder that people and partnerships drive this industry. Proof that marketers, agencies and creators are moving faster, sitting closer and working harder to make brands actually matter. In the end, it is collaboration and accountability, not accolades, that will move the industry forward.”

The full Q1 and Q2 reports are now available for download via the newly relaunched MAA website, which has been refreshed to make industry insights more accessible to members and the wider marketing community. Beyond hosting the AdEx findings, the website will also be serving as a hub for thought leadership, best-practice resources, and updates on MAA’s ongoing industry initiatives.

For more information on the association’s initiatives, visit malaysiaadvertisers.com.my.

Share Post:

Haven’t subscribed to our Telegram channel yet? Don’t miss out on the hottest updates in marketing & advertising!